Costco and 2,000 Other Companies | Pricing Lessons with Evan Grubb

Evan Grubb has been with Price Intelligently... then ProfitWell... then Paddle for 7 years and counting (and yes, he's been there for all the name changes and acquisitions). He's been keeping track of monetization trends all along. You can check out his newsletter here if he inspires you in this podcast (and if he didn't, let me know).

Talk To Evan Yourself

Evan is going to be hosting a talk on January 30th all about Pricing your A.I. product. This isn't fluffy chat about something that's all hype, we have real data that Evan and his co-host, Jack Cove, will dive into. Sign up here and don't miss out.

Just Give Me the 10,000 Foot View

- Evan Grubb's Career and Role at Paddle: Insights into his journey in the pricing and SaaS industry... and why The Eagles are the greatest American rock band

- Effective SaaS Pricing Strategies: Exploration of successful pricing models and approaches in the SaaS sector.

- Costco's Business Model: Detailed analysis of Costco’s subscription model and its effectiveness.

- Application of Costco’s Model to SaaS: How lessons from Costco can be applied to SaaS businesses.

- Trends and Tactics in Pricing: Grubb shares his perspective on current trends and effective tactics in SaaS pricing strategy.

But Let's Go Deeper

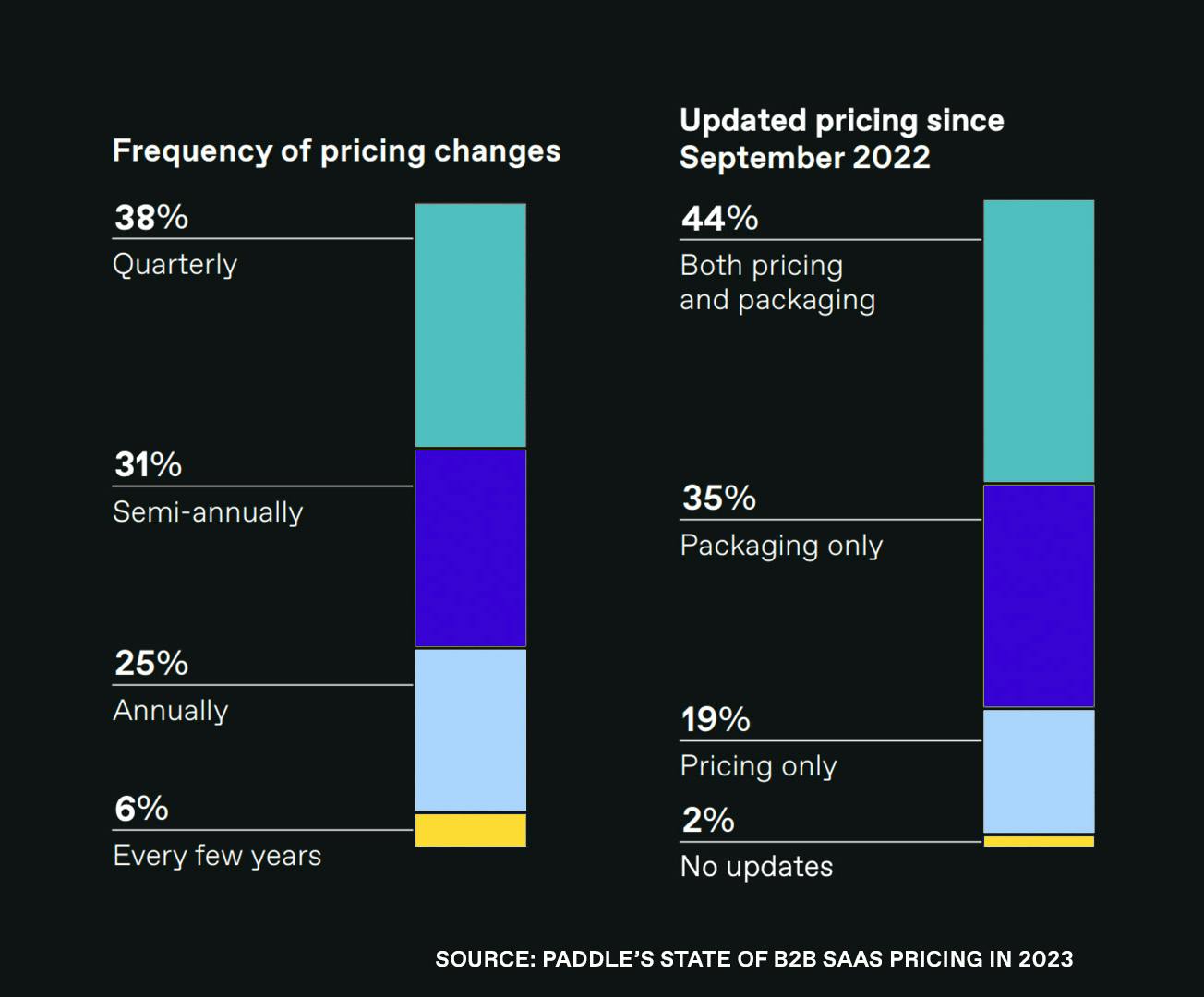

In 2023, the state of B2B SaaS pricing evolved. A recent study we conducted revealed that businesses are updating their prices more frequently. In the last year, 63% of respondents updated pricing. However, the approach to these changes often lacks a strategic foundation. This is where value-based pricing becomes crucial. Make sure you get the report here.

Why Value-Based Pricing is Key

Value-based pricing is not just about adjusting prices; it's about aligning them with the perceived value of the product or service in the eyes of the customer. This approach considers factors like customer benefits, differentiation from competitors, and willingness to pay. By focusing on value, companies can price their products more effectively, ensuring that the price reflects the utility and satisfaction derived by the customer.

The Incorrect Approach in Price Changes

Despite the increased frequency of price changes, many companies still rely on cost-plus or competitive-based pricing models. These methods overlook the customer's perspective on value, leading to pricing that may not resonate with market demand or customer expectations.

Implementing Value-Based Pricing in SaaS

For SaaS companies, implementing value-based pricing involves several key steps:

- Customer Research: Understand what customers value most in your product.

- Segmentation: Tailor pricing to different customer segments based on their specific needs and value perceptions.

- Flexibility: Be prepared to adjust prices as market conditions and customer preferences change.

- Communication: Clearly communicate the value provided to justify the pricing.

Learning from Costco's Add-On Strategy

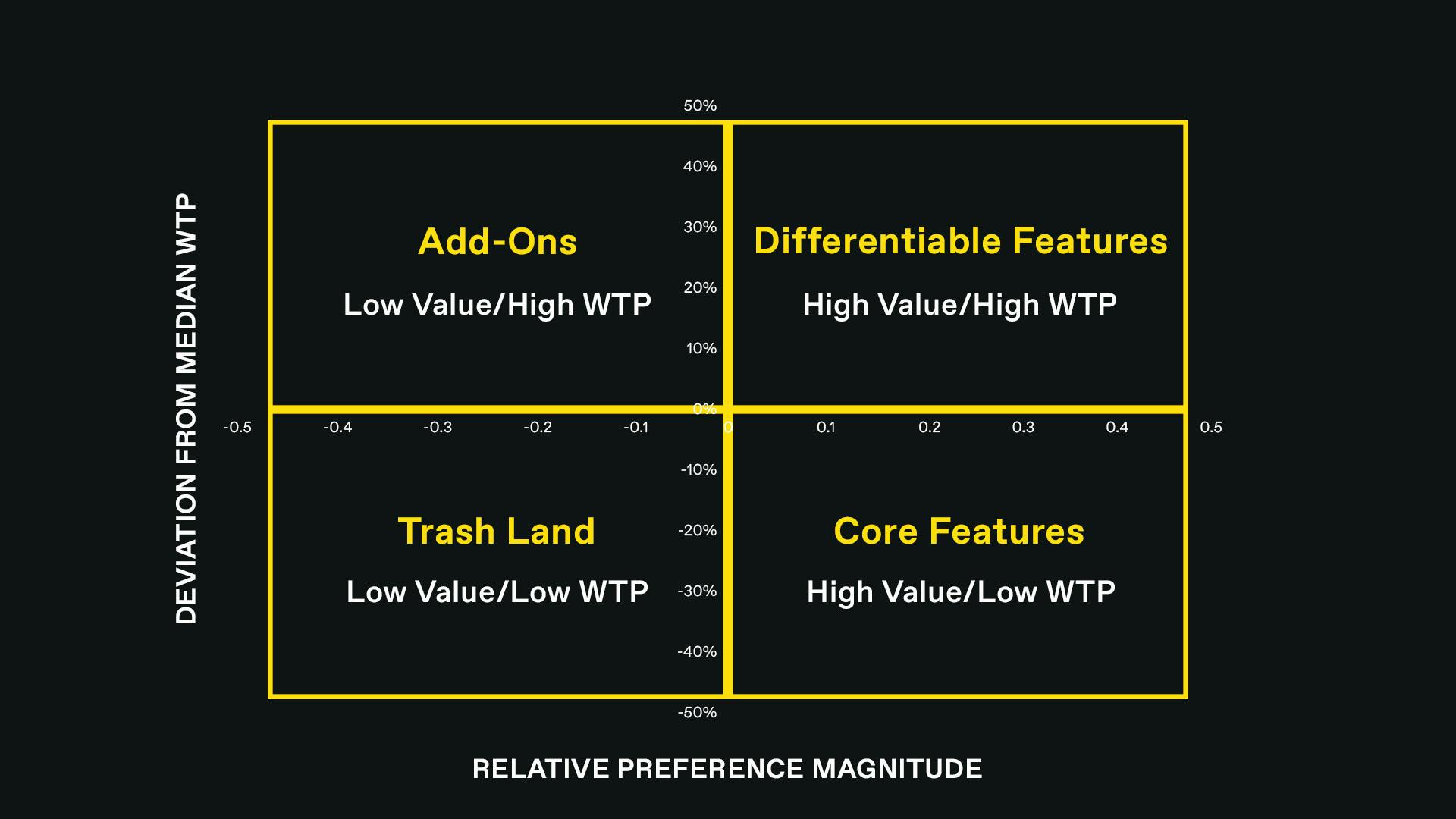

Add-ons are a massive value-add (literally). Costco's approach to pricing, particularly its add-on strategy, offers intriguing lessons for SaaS companies. Costco successfully uses add-ons (like its $1.50 Hot Dog and Soda) to enhance the customer experience and increase perceived value, encouraging customers to spend more based on the additional benefits received. This strategy can be adapted in the SaaS industry to increase both customer satisfaction and revenue. An add-on is typically something with low relative preference and high willingness to pay. In other words, it's an item that not a lot of your customer base might want but those who do would pay a lot for it. An example here is Costco's Gas... plus it also brings folks in the door.

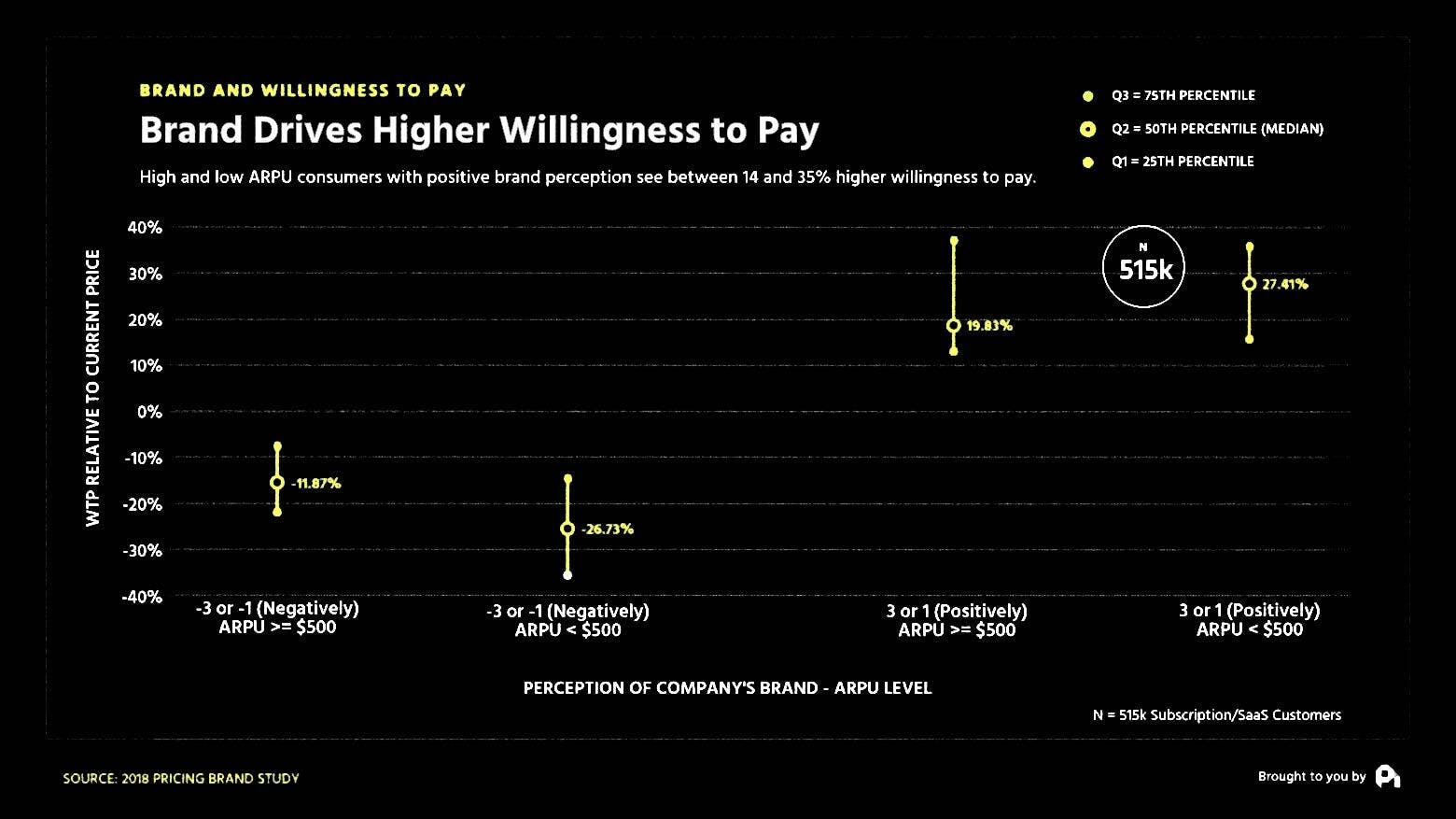

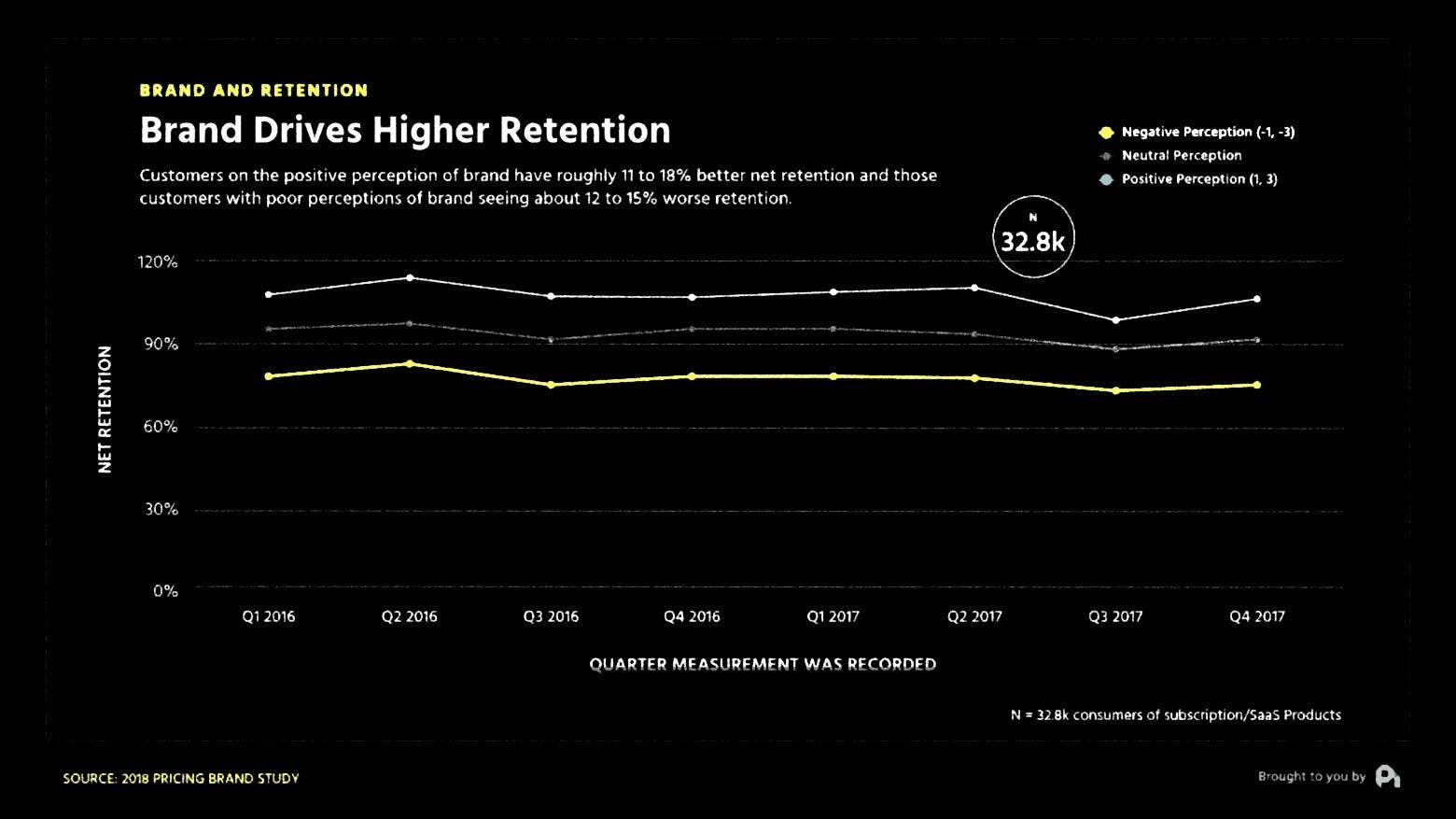

Brand Boosts Willingness to Pay and Retention

A positive association with a brand can significantly boost willingness to pay and retention by creating a strong emotional connection with customers. This positive brand perception builds trust and loyalty, leading customers to perceive higher value in the brand's products or services. As a result, they are more willing to pay premium prices. Moreover, a strong brand relationship enhances customer retention, as customers are more likely to remain loyal to a brand they trust and associate positively with, even in the face of competition or price changes. This loyalty translates into sustained revenue and long-term business success.

Next up, check out why Costco's famous Hot Dog Deal will never change.

00:00:00:02 - 00:00:25:04

Ben Hillman

Evan Grubb has been fixing SaaS pricing for nearly ten years, speaking to over 2000 companies and counting, He quite literally spends his days talking monetization with everyone from your B2C darling to B2B behemoths. To top it off, he helped author the state of B2B SaaS pricing in 2023. Although folks are definitely getting better about when they change their prices, there's still a massive knowledge gap on the best method to do so.

00:00:25:07 - 00:00:28:17

Ben Hillman

Who better than Evan to talk us through it? Plus, we talk about the.

00:00:28:17 - 00:00:29:07

Ben Hillman

Sneaky.

00:00:29:07 - 00:00:54:01

Ben Hillman

Subscription company. You've got to learn how Costco. While they may seem like you're run of the mill legacy box store it, they functionally pioneered the subscription model for over 40 years, slinging toilet paper, groceries, dollar, 50 hot dogs and everything in between. We get into the details of what makes Costco's business model such a massive revenue driver, including over $4 billion of subscription revenue alone last year.

00:00:54:03 - 00:01:17:18

Ben Hillman

If you want to improve your monetization strategy, you're going to have to listen to what Evan Grubb has to say from Padel. My name is Ben Hillman and let's protect the hustle. So before we get into the episode, we've just got a quick word from our sponsor, us. More specifically, the Price Intelligently team. They're hosting a discussion about pricing featuring today's guest, Evan Grubb.

00:01:17:20 - 00:01:35:23

Ben Hillman

He's going to be joined by Jack Cove and the two of them are going to dive deep into pricing your AI product in 2024. The discussion will be on January 30th at 12 p.m. Eastern. As you'll hear in the episode, Evan is brilliant when it comes to this sort of stuff and he and Jack back up their anecdotes with some really solid evidence.

00:01:35:23 - 00:01:54:01

Ben Hillman

If I say so myself, you'll get a bunch of valuable insights like how to understand the value your AI tool or product adds to your customer. How this will likely lead to a more complex pricing structure and getting started with that, as well as best in class strategies that we have seen and worked with. Make it easy on yourself and sign up with a link in the description.

00:01:54:03 - 00:01:55:20

Ben Hillman

And now let's get to the episode.

00:01:55:22 - 00:02:01:11

Evan Grubb

My name is Evan Grubb. I'm an account executive and I sell the price intelligently. Service here at Paddle.

00:02:01:11 - 00:02:05:23

Ben Hillman

Give me the Evan Grub background. How did you get here? How long have you been doing this? And like, why?

00:02:06:00 - 00:02:27:03

Evan Grubb

I've been with now paddle formerly price intelligently, as you know, Ben for about seven years. My first job out of college. So I went to school in Boston at Emmanuel College, down the street from you. And I met Peter, one of the co-founders, and I was essentially evaluating, going to get my MBA and some other gigs and had a really interesting chat with him.

00:02:27:03 - 00:02:46:04

Evan Grubb

And he basically said, like, you can go get your MBA or you can come work for this startup and you can learn probably a lot about business in doing so. So I did that. We were we're pretty small. As you know, Ben, we we bootstrapped this thing for a long time and the challenges that we were solving for for companies were like really interesting, right?

00:02:46:05 - 00:03:06:18

Evan Grubb

We were slinging software in a transactional way. I wasn't cold calling a ton of people every day. I was solving these real business problems with regard to pricing and packaging and go to market motions for what is now, we know is like a booming sector, this asking subscription industry. But at the time it was it was still kind of in the infancy.

00:03:06:19 - 00:03:22:20

Evan Grubb

I started doing that. I've basically been on that team for about seven years. The core mission of helping SaaS companies better monetize their products has remained the same. But like the way that we've got to market and the way we've evolved, the team has changed, so it's remained pretty sweet over the past seven years.

00:03:22:20 - 00:03:42:12

Ben Hillman

And why continue to do this? I know you have a background in music. I saw you one of your like looks like in college. Maybe you're like, Blink music. You're working there. Yeah, that's like, I know that's a side passion of yours. You once told me that the Eagles are the most consistent American rock band of all time, and that has truly stuck with me for so long.

00:03:42:14 - 00:03:44:09

Ben Hillman

Well, like, did you want to back that up at all?

00:03:44:09 - 00:04:07:11

Evan Grubb

Let's go on a little tangent. I think it's a shorter list than people realize of great American rock bands. I think it's Eagles number one. Not necessarily my favorite. I'm just saying, like great bands, like it's Eagles number one and probably Beach Boys. Number two, maybe Nirvana, number three. But the point is like we actually don't have that many great American rock bands.

00:04:07:11 - 00:04:25:10

Evan Grubb

And it's kind of ironic. But anyway, that was it's interesting you remember that because you and I have we've definitely jammed out a little bit over the years. Yeah. So I work for a music studio and I was in college that also sold like high end audio equipment. So it's like really nice speakers and amps and cables and things.

00:04:25:12 - 00:04:45:01

Evan Grubb

And that's when I realized like I probably could sell a little bit, but it had to be a product that I was passionate about and could fully wrap my head around. I think my my dumb brain can't fully understand the inner workings of high end audio, and so I was really, really bad at it. But I learned a lot and I had that team there.

00:04:45:01 - 00:04:45:21

Evan Grubb

It was awesome to me.

00:04:46:02 - 00:04:48:19

Ben Hillman

And you still do you still play guitar on the side?

00:04:49:00 - 00:04:57:13

Evan Grubb

Yeah, I still play guitar. Still play some drums. Wish I was better at piano. I never really cracked the code on that one. But yeah, guitar is kind of the go to for me nicely.

00:04:57:13 - 00:05:26:06

Ben Hillman

Nice man. Yeah, that's good to have that. I definitely understand the, you know, having that offer on the side is something that you, you know, maybe could pursue if you wanted to like, I don't know, monetize your hobby, but it's good to have that sort of side thing that you can do to unwind. And when you're just to not think about pricing and packaging and all that, like 24 seven, you know, as we've talked about over the past seven years, I've known you, you've kind of rose rose through the ranks from like BBR to account executive.

00:05:26:10 - 00:05:39:19

Ben Hillman

You've been doing this for so long, like seven years, you know, closer to ten than five. What has been the through line that sort of kept you interested in this and gets you excited to keep going?

00:05:39:19 - 00:06:03:02

Evan Grubb

I it's a really interesting space. Like the subscription model is one of the greatest business models of all time. And then you stack on top of that like software where margins are super high. And so you're it's this emergence of a lot of factors that make for a really exciting space and pricing sort of touches all of those dynamics, right?

00:06:03:02 - 00:06:23:17

Evan Grubb

So my job is basically helping software companies that are already doing really, really well, just like sort of get to the next level. And so a lot of folks think that that's changing the price point or it's moving up or down market, but there's a ton within that umbrella, right? So it's like, are we targeting the right types of buyer personas?

00:06:23:19 - 00:06:40:06

Evan Grubb

Are we charging on the right value metrics? Do we have the right model right now? It's like usage pricing. Should it be pay as you go? It should be this kind of hybrid model. And so the questions change. And so you're right, like I've been doing this for a long time, but it's like it's never the same. Every company is a little bit different.

00:06:40:06 - 00:06:49:04

Evan Grubb

The goals change, the markets change. Like this year is different than it was last year. So it does feel fresh, even though I've been doing it for a while.

00:06:49:06 - 00:06:52:19

Ben Hillman

How many companies do you think you've talked to over the years, if you can ballpark that?

00:06:52:23 - 00:06:56:09

Evan Grubb

I think we we looked it up and it was like 2000 or something.

00:06:56:09 - 00:07:09:16

Ben Hillman

You talked to. That's a lot. Yeah, That's unreal. What are like the the common objections to focus on like, well, we don't want to change. Like, we don't want to mess with our pricing. Like, is that, is that a common thing that you've heard over the years?

00:07:09:16 - 00:07:30:19

Evan Grubb

There's a couple like why folks just don't want to make pricing changes. I mean yeah, yeah. It's usually like it's been working. So if it's not broken, we don't want to fix it. There's the we're looking at our competitors and so we know if folks are buying our competitors, then then we should have a pretty good read on what they care about.

00:07:30:21 - 00:07:48:06

Evan Grubb

But I don't know. Everybody's a little bit different. Like sometimes it's like, we have a we have a new board member and they worked for you know, they worked in this industry for 20 years. And so we're going to go with in their direction, it's actually a little more political or involving guesswork than you might imagine.

00:07:48:09 - 00:07:57:13

Ben Hillman

Before we move on, though, I wanted to know, how frequently do you think you talk to folks about pricing? Like is that just like that's literally your job every single day? You're talking to folks about pricing.

00:07:57:15 - 00:08:01:17

Evan Grubb

I talk to folks about pricing every day. Yeah, multiple times a day.

00:08:01:19 - 00:08:09:06

Ben Hillman

You have to not like you just know what people are thinking about and what sort of like trends or is there some way like you can keep track of all this?

00:08:09:06 - 00:08:42:13

Evan Grubb

This is why I started my newsletter initially. It's because I felt like I was on the ground floor of a lot of these like early trends because I hear the questions from different founders and operators within SaaS companies. And I was like, I don't know if anybody's actually documenting things like should, you know, different companies move to usage pricing or should they change their packaging or how do we approach bundle and so I just wanted to like sort of document the trends and then literally ask the questions and try to answer them with other people in that community.

00:08:42:13 - 00:08:48:21

Evan Grubb

And so that's initially why I started the community, which led me to writing about the company that we're going to talk about today.

00:08:48:21 - 00:09:08:16

Ben Hillman

Before we get into that, I definitely want to talk about state of B2B SaaS pricing report that came out a couple of months ago. And I know well, first of all, you had a little bit involvement with that. I know you did a talk with Andrew DAVIES, our CMO at SaaS stock. Was it or a conference somewhere? But yeah, Tell me a little bit about the state of SaaS pricing report.

00:09:08:19 - 00:09:29:12

Evan Grubb

So Sanji and Sarah on our pricing team led the effort here and basically they went after a lot of SaaS companies and asked them questions about how they approach pricing. And so the idea was like we can get a pretty good grasp on what companies are doing. We can start to see some of the trends and then maybe see like what's working and what's not working so well.

00:09:29:13 - 00:09:33:15

Evan Grubb

So it was a pretty interesting study with some good findings for hopefully everybody in the Chucks it.

00:09:33:15 - 00:10:00:02

Ben Hillman

Out and one of those big findings that we found is that almost 70% of the folks that we surveyed said that they were making pricing changes semiannually or even more frequently. That's fantastic, because I know over the past like ten years appraised intelligently, we've been telling folks like, change your prices frequently. So it sounds like folks are now changing their prices more frequently, as we've been suggesting.

00:10:00:04 - 00:10:08:01

Ben Hillman

But what's next? Like, what's what's the next step, though? What are we trying to get folks to approach? Pricing changes the right way? How are we doing that?

00:10:08:01 - 00:10:31:23

Evan Grubb

Probably just not screwing it up like they're like when we started doing this band, you and me, six or seven years ago, we were trying to educate people on the importance of pricing and packaging, right? That is no longer necessary. Like it seems like everybody understands that pricing is probably the most impactful growth lever you can pull from within a subscription business.

00:10:32:01 - 00:10:48:19

Evan Grubb

The next step, though, is making sure that you're not going in the wrong direction by making mistakes, right? So I think that was one of the takeaways from the State of SaaS report. It's like companies are making changes on a regular basis to both pricing and packaging, but they might not be totally aligned with value in their strategies.

00:10:48:21 - 00:11:12:12

Evan Grubb

So is pricing totally aligned with the elasticity of your buyers or are you are you still giving away too many features and entry level plans, or are you properly creating these expansion paths to boost NDR like those are the it's almost like we've shifted from the importance of the strategy to the importance of the tactics in some ways, so that I see that as sort of the next evolution of pricing within the SaaS community.

00:11:12:13 - 00:11:32:17

Ben Hillman

And on those tactics, I guess this is more strategy. Feel free to correct me here, but we've seen that it's roughly in our survey found that it's like roughly a three way split between folks that are making pricing changes based on competitors cost plus and value based pricing. So what's wrong with this split and without bearing the lead?

00:11:32:17 - 00:11:35:10

Ben Hillman

Like why should we be focused more on value based pricing?

00:11:35:12 - 00:11:36:17

Evan Grubb

Yeah, you're kind of leading the witness.

00:11:36:22 - 00:11:38:14

Ben Hillman

I know, I know. I'm making it easy on you.

00:11:38:16 - 00:12:04:22

Evan Grubb

Cost plus in SaaS doesn't make a ton of sense unless we're talking about infrastructure companies or in some ways I we can talk about like how A.I. is changing pricing a little bit competitive based pricing tends to fail for a couple of reasons why it is you've hopefully built a different product than your competitors and thus probably shouldn't charge the same way that they do.

00:12:05:00 - 00:12:24:23

Evan Grubb

And the second is with the sort of presumption with competitor based pricing, is that your competitors have done their homework and they're doing it right and they probably aren't given some of the the data that we've checked out. So we tend to think that the best approach is this value based strategy. So aligning price with the value description of your end buyers, which by the way, I think most of us would agree with.

00:12:25:05 - 00:12:31:23

Evan Grubb

But again, I think a lot of us don't totally know how to collect the data and action it and create a true value based strategy.

00:12:32:02 - 00:12:49:21

Ben Hillman

And I mean, let's just go a little bit deeper on that. Like, sure, we know there's like we've got plenty of resources on the price intelligently side on the paddle side that like go more in-depth in this. But for the folks that are listening that might want to know more about value based pricing, like where do you start, What do you what are you trying to figure out?

00:12:49:23 - 00:12:50:15

Ben Hillman

What value based.

00:12:50:15 - 00:13:28:22

Evan Grubb

Pricing? There's a couple of things. One is just like talking to existing customers and prospective buyers. So make sure that you know where they're seeing value and you can segment those customers in different ways. So the other piece is defining the outcomes that you're shooting for. So if you're trying to create the sort of PLG land and expand motion like your value based pricing strategy starts within the the entry level tiers, like what are the features that you have to go way up front to to let somebody realize value upfront and then know their buyer part so that once they move on to a new tier, there's this sort of natural expansion over time versus

00:13:28:22 - 00:13:43:18

Evan Grubb

if you're an enterprise company, value based pricing is understanding like what are the optimal price bands or the windows of pricing you can play around with for larger companies and our users, they need how many features they need, etc. For sure, that's not a perfect answer.

00:13:43:20 - 00:14:18:06

Ben Hillman

No, I mean, it's a complex like it's not a simple I mean, it is simple. It's like, you know, just align your pricing to the value that we're providing. That's the thing that we've all always preached. And it's still true to this day. Pretty hard to like debate that fact. But I think what what we're kind of elucidating here is that it's like it is a simple like idea and concept to like get behind, but the actual going into it requires a lot of legwork and it requires a lot of what you're talking about, like talking to your customers and finding out what their willingness to pay data is, You know, what their what the

00:14:18:06 - 00:14:34:14

Ben Hillman

value value props are. Finally finding out all that sort of stuff is again, simple in like concept, but actually going out and doing it just it's a lot of work. You know, that's where not to sell it, not to make your job easier, but that that's where our value really comes from. On the price intelligently side.

00:14:34:14 - 00:14:46:14

Evan Grubb

It's tough to do, but it's not rocket science like it's understanding how buyers behave, their willingness to pay, what features they care about. Yeah, it's it's pretty interesting.

00:14:46:15 - 00:15:16:09

Ben Hillman

And I've always been fascinated by, you know, we say we're not preaching here to raise your prices like like that's not what this is really about. It's about finding the real optimal price point for your buyers. And so I'm curious, in your years of experience talking to all of these companies, have you seen a company like I think I know what this looks like, but have you seen a company actually lower their prices as part of their like new pricing strategy?

00:15:16:11 - 00:15:39:17

Evan Grubb

Definitely, Yeah. And this kind of goes back to what I was saying before. I'd outcome's like if we strip away RR as the target outcome because that's what everybody wants is more money. There's usually like these different metrics that companies are shooting for like Northstar metrics and sometimes they're not super clear. And so it's worth defining those before going into any sort of pricing exercise.

00:15:39:17 - 00:16:06:06

Evan Grubb

But sometimes they are really clear. And so for a company that's shooting for Logo acquisition and R and RPO growth, like sometimes decreasing pricing on your entry level plan can be really, really effective because you lower the barrier to entry, it increases the funnel of paid customers. So at least in the entry level tier. And then if you do your homework, you might find out that there's an expansion path to improve NDR because once they're paid customer, they realize the value they increase over time.

00:16:06:06 - 00:16:13:23

Evan Grubb

And that too begets higher RPU and RPO. So it definitely shakes out that way where lowering price can actually help you in the long run.

00:16:13:23 - 00:16:35:18

Ben Hillman

And with that also look like because what where I thought it would make sense is introducing a new tier potentially whether that's a freemium tier or just a more basic plan that like obviously all companies are different, but like in some instances it probably is like, well there's actually opportunity here to, you know, provide this value to customers that maybe aren't at this next point.

00:16:35:21 - 00:16:42:22

Ben Hillman

And if we introduce this lower tier freemium or whatever, there's that as well. And it doesn't recognize it in that assumption that.

00:16:42:23 - 00:17:16:16

Evan Grubb

You're definitely correct. I would also caution that sometimes, like there's a flip side of the coin, right, where I think a lot of SaaS companies will give away too much functionality upfront in a freemium tier or an entry level paid tier that actually cannibalizes the expansion path. So it's it's a bit of a double edged sword where again and this is where I go back to like defining the outcomes where if you're really focused on logo acquisition might be a good strategy for you, but if you're focused on RPO, RPU growth exclusively could actually hurt you because it's cannibalizing the revenue that you would otherwise get.

00:17:16:16 - 00:17:38:20

Ben Hillman

I think that's a perfect segue way to get into our featured presentation for this for this episode. Costco. The reason why we're talking to you today, Evan, is that you wrote a piece, including a lot of data that we got from, I think from the practical side of things and doing some surveys, finding some willingness to pay data around Costco.

00:17:38:20 - 00:17:58:17

Ben Hillman

And specifically, I know it's titled the 40 year old subscription. I believe is the name if I'm going off a memory. Yeah. So I could gush for days on on this business. Talk to me just a little bit about Costco and how there's this like secret subscription company that we don't really talk about that element.

00:17:58:21 - 00:18:00:08

Evan Grubb

Are you a Costco member?

00:18:00:08 - 00:18:04:12

Ben Hillman

I am. I, I have a little story about that that I'll get into a little bit later. But yes.

00:18:04:12 - 00:18:25:15

Evan Grubb

Okay. So I was not for a long time and my fiancee's mom works for Costco and she's worked for Costco for a long time. And so when when I met her, it kind of seemed like every time I was with her, we started talking about Costco. And that kind of led me down a rabbit hole because she was singing Costco's praises.

00:18:25:17 - 00:18:42:10

Evan Grubb

And I just started like reading about Costco and eventually, like got into the 10-K and like reading the investor reports and stuff and that's when I was like, This is a pretty outstanding business. I know it's not a high take, but I was like, this is a it's a pretty insane business model because they do so many things.

00:18:42:11 - 00:19:12:04

Evan Grubb

Like if you evaluate it was crazy about Costco was if you evaluated them as a retail company like they're fantastic. But if you also evaluated them as a subscription company, they're insane, right? Like they're they're making four something billion dollars off of just subscriptions from from the memberships, which accounts for like 70% of their profit. And in a time where like going to the store to buy things is at an all time low, Costco is outpacing the S&P 500.

00:19:12:06 - 00:19:16:02

Evan Grubb

It's an insane story. So I'm just like super fascinated by that.

00:19:16:04 - 00:19:29:22

Ben Hillman

Yeah, no, that's interesting you bring up. So your his mom works for Costco. I think the employee retention it's like something something crazy. It like people work for Costco and then they just don't really I think it's like their average tenure is like ten years or something like that. Yeah, Yeah.

00:19:30:00 - 00:19:52:22

Evan Grubb

One, they pay their employees way more than their competitors, which, which helps. And they also have really good benefits, which I think goes a long way for people that the leaders of their household. And then I want to say like the brand of Costco is just like super valuable to employees, like they get equity. They believe in the mission.

00:19:53:00 - 00:19:58:16

Evan Grubb

It's not all about the products that they sell, but it's about the whole Costco ethos. So I think that goes a long way.

00:19:58:16 - 00:20:18:04

Ben Hillman

So I want to read off their the code of ethics here for you. In order to achieve our mission, we will conduct our business with the following code of ethics in mind obey the law, take care of our members, take care of our employees, respect our suppliers. And I know that a big thing that's missing from there is like, well, what does that mean?

00:20:18:06 - 00:20:58:01

Ben Hillman

Like for the ultimate goal of, like, making money? Like, that's nowhere in here. Yes, it's a code of ethics, but they say the next sentence there is if we do these four things throughout our organization, then we will achieve our ultimate goal, which is to reward our shareholders. So it's interesting looking at that and it's like they are ultimately thinking about like making money and being a profitable business, but it's like establishing this like foundational system that allows them to do that so that like making money is almost an afterthought in their mind, where it's like if we just focus on the customer and we focus on our members, it's like, that's what we're kind

00:20:58:01 - 00:21:07:06

Ben Hillman

of always preaching at present. 20. It felt like it's like, what are your customers want? Like, that's that's what we're trying to do, in my view, when it comes to like pricing and packaging.

00:21:07:08 - 00:21:23:06

Evan Grubb

Yeah, that's kind of the dream state scenario. I don't know how many companies could, could say that that's the case, but they clearly the shareholder value is is clearly secondary and it's almost an outcome of their operating principles, which is pretty.

00:21:23:06 - 00:21:36:12

Ben Hillman

Awesome. I'd love to get into the membership model, but you and I have talked a little bit offline about this, about how we can't just look at them as a subscription company and we can't just look at them as a retail company.

00:21:36:13 - 00:22:00:07

Evan Grubb

The membership subscription is basically a key to the club and this is something that like we there are subscriptions everywhere now and sometimes they're super aligned to value, sometimes they're just a piece of the equation. Costco does it right because the subscription one, it gets you access to the club, but it's also leaning into this what's called the Suncor cost fallacy.

00:22:00:07 - 00:22:18:01

Evan Grubb

So when you walk into Costco, you know that you're you're already paying $60 or $20 a month, whatever it is. And so you think like, Hey, I might as well just try to go for the best deal. I sort of have to buy a couple of things to justify the cost of this membership. And they have the deals on a lot of things that you wouldn't see otherwise.

00:22:18:01 - 00:22:37:02

Evan Grubb

So it's a really brilliant model. And then on top of that, they have add ons for everything. It's like if you want to travel, if you want to purchase an engagement ring, whatever it is, like, you can get that obviously through Costco. So they capitalize really nicely on that piece. I know you and I talked about the price points of the membership, like why don't they just increase the price so we can talk about that too.

00:22:37:02 - 00:22:39:12

Evan Grubb

But I think it's it's an awesome model for them.

00:22:39:16 - 00:23:10:16

Ben Hillman

If we look at the membership, the pricing page here for Costco, we can see that there are two main plans. They also have the business membership plan. Specifically look at the consumer side. You can get the Gold Star member for $60 a year or the executive member for $120 a year. And just from like doing so many episodes of pricing page tear down, I can see that it's like, they're putting like the tier that they want you to get on the left hand side, like they're putting the like one 120.

00:23:10:16 - 00:23:27:10

Ben Hillman

It's like, that's the first one you're going to see. You can see there's a whole bunch of attention there for best value and exclusive benefits, $60 and 120. I don't we don't know. We don't have insight into how they got to these price points. Do you think that Costco would benefit from like a value based pricing approach?

00:23:27:12 - 00:23:54:08

Evan Grubb

Not necessarily because they are a retail company. There are cost plus company, right? They they part of their mission is they say literally we're not going to upgrade or upcharge these products more than something like 14%. So they will never be a value based pricing strategy like a SaaS company, but with the memberships, they probably could increase price on the base plan like they're at 60 bucks.

00:23:54:10 - 00:24:11:07

Evan Grubb

That could probably be like 80 bucks and they would still be okay. And the 120 could probably be like 150 like, don't hold me to that. But they probably do have a room to raise prices because they haven't done it in a long time. And it sounds like from what I've read, there may be one there may be a price increase on the horizon.

00:24:11:10 - 00:24:34:17

Evan Grubb

That said, I think Costco is really, really focused on retention. Like I think if we go to their North Star metrics, I would guess that they're more focused on retention than they are on the revenue, just the revenue from memberships, because it's so hard to keep consumers like from retention standpoint on subscriptions and they retain 90% of their consumers today.

00:24:34:19 - 00:24:48:07

Evan Grubb

So I think they're really focused on that piece and then they upsell through these other categories, be it the groceries or the engagement rings or travel plans, things like that. So yeah, but I do think there's room to increase price.

00:24:48:08 - 00:25:12:15

Ben Hillman

So I know you mentioned there the like upgrade, like they're not really trying to get you to upgrade actively. However, I did have a really like fun thing that happened to me a couple of weeks ago where they got me to upgrade to their executive plan in checkout. So the way it kind of looked is I basically do all my shopping at Costco.

00:25:12:19 - 00:25:43:03

Ben Hillman

I kind of go like I'd say probably around once a month to get, you know, toilet paper, all that sort of stuff like the groceries get. I get all my gas from Costco. It's the cheapest place to get gas. And I was in the checkout and they like, I forget if there was like a signal or notification or something that they got and someone was flagged over and an associate came over and approached me and was like, Hey, so you're spending enough at Costco that like, it would make a lot of sense for you to upgrade to the executive plan you get.

00:25:43:06 - 00:26:00:19

Ben Hillman

I think it's like 2% cash back in the form of like a check that you get at the end of the year. You don't need to get a new card. You don't get it like, you know, do anything else. All you have to do is like, say yes and we will upgrade you. And that's what I was just like, Well, yeah, like, sure.

00:26:00:21 - 00:26:28:20

Ben Hillman

And so I thought it was fascinating that it's like they are actually trying to get people to that higher tier, but it's tied directly to the value. It's tightly like the in a way they are thinking from like the value first perspective where I am agreeing to give them that, that extra amount. Like, you know, I think it was on top of it is like instead of paying at 120 it was like, no, you just pay the difference between model and it was just like the upgrade experience.

00:26:28:22 - 00:26:36:06

Ben Hillman

They're obviously benefiting from this, but it didn't feel like I was being like sold to when that happened. It was just like a no brainer. I mean, to do it.

00:26:36:10 - 00:26:55:21

Evan Grubb

Well, that's a pretty telltale sign of value based pricing or like effective value based pricing. So like, that's great. The other piece here is kind of the elephant in the room, which is their add on strategy. Like they will get you with a membership price and maybe they'll upgrade you to a higher membership price. But they also have like a million add ons, right?

00:26:55:21 - 00:27:22:06

Evan Grubb

So you can purchase anything you want basically through the Costco ecosystem. You mentioned gas like that's a great one where that keeps you driving into the parking lot and then you can go back into the store. So that's a big piece of this too. It's like they'll they'll crush it from a subscription standpoint through the memberships. But they also have like a whole myriad of add ons that they can use, which, by the way, is a good takeaway for SaaS companies like this is a very underutilized aspect of SaaS pricing I think.

00:27:22:07 - 00:27:32:12

Ben Hillman

Yeah, tell me more about the I know you have a whole section in your article. You talk about add ons and how like this is, this is like truly a concept that SaaS company can take and like a copy, if you will.

00:27:32:12 - 00:27:53:21

Evan Grubb

I think a lot of SaaS companies should leverage add ons more the idea of some features being low, what we call low relative preference, or most of your audience not really needing those features, but those that want them of a high willingness to pay. They basically should be sold la carte, they should be removed from your tiers. So Costco does this through the add ons that we talked about.

00:27:53:23 - 00:28:16:19

Evan Grubb

But if you're an SaaS company and there's a feature that you're giving away for free or at an entry level tier that 20 or 30% of your audience realistic needs, then you're actually cannibalizing expansionary revenue by not removing it and selling it on a cart. And then the other thing is, might hurt you from a retention standpoint if you're giving those features away upfront because somebody might sign up and they go, What the heck am I paying for this tier?

00:28:16:20 - 00:28:22:06

Evan Grubb

I'm using 40% of the features, for example. So it's a win win when you identify those features, right?

00:28:22:06 - 00:28:41:20

Ben Hillman

It's almost like they have this. Like if you were to apply this to a subscription company, it's like there's, there's just two tiers, but like almost everything outside of paying the membership is an add on you. Like, I would almost argue that like even just buying groceries is an add on like, like they're basically all add on company, if you will.

00:28:41:23 - 00:28:43:17

Evan Grubb

Yeah, that's a good point. They pretty much.

00:28:43:17 - 00:29:08:05

Ben Hillman

Are. There's a specific add on that I would love to talk about. It's near and dear to my heart and that is that dog a dollar 50 for a 20 ounce fountain drink and a Costco hot dog. Everyone always talks about how Jim Senegal, the founder, talks to CEO of Costco. You have this in your article and he's saying like, man, like Jim, we're getting we're getting killed on the hot dog here.

00:29:08:05 - 00:29:25:21

Ben Hillman

Like it might make sense like raise prices and Jim Senegal has said multiple times, like if you raise the price of the hot dog, I will and kill you. You wrote about this phenomenon. Why do you think that this deal has remained unchanged for the last 40 years and potentially it could remain unchanged for the next 40 years?

00:29:25:21 - 00:29:45:16

Evan Grubb

Because it's not about the hot dog, it's about the brand, right? It was never about the hot dog. Then. You know, this the thing about this is it's almost become like legend or like Costco law, where it's like now they really can't change the price of the hot dog. I have no idea if that conversation actually happened, but it would be a brilliant PR move if it was just like made up and they just told the world that it happened.

00:29:45:18 - 00:30:05:01

Evan Grubb

Because I don't know how many people really eat the hot dog, but they know that that's a fundamental mission of the company is to keep prices low. So it's like the story tells you so much more about Costco's ethos and about their mission and their brand than the price of the hot dog itself ever would.

00:30:05:02 - 00:30:15:22

Ben Hillman

And that's you've said as much in your article that Costco's prices are their brand. Why is it that that is the case? Like it seems like they should never change their prices ever? Maybe.

00:30:15:22 - 00:30:32:10

Evan Grubb

Well, the prices of their goods are their brand, right? Like they will they cap the markup for certain goods at 14 ish percent, sometimes 11%. So that is definitely part of their brand. And like their inception was a company that I'm forgetting the name of. So that was basically.

00:30:32:10 - 00:30:46:09

Ben Hillman

Said Mart said Mart was started by saw price in the fifties and Jim Senegal like worked there and like stole everything basically from saw price and then the price club happened and they ended up buying price club.

00:30:46:09 - 00:31:10:15

Evan Grubb

Price Club. Yep. That's what I was thinking of. Yes. Thank you. You know more than I do. But like, that was their their founding mission is to be like the cost saving option for consumers. So it makes sense that that's a big piece of their brand. On the membership side, we've talked about it probably enough, but I see that like the price of the memberships being a little bit removed from the brand, like they have some room probably to increase price.

00:31:10:17 - 00:31:32:10

Ben Hillman

Not only has the price stayed the same, but the hot dog is now, I think, ten or 20% bigger and in the original deal it was a 12 ounce can of soda and now you get a 20 ounce fountain drink. That's like with unlimited refills. So not only has the price stayed the exact same, the deal has actually gotten even better.

00:31:32:10 - 00:31:48:18

Ben Hillman

And you get an even more like bang for your buck. And I think that that just elucidates that. Like what we're talking about here is that it's like that is the Costco brand, is that like we're going to continue to offer you this like really great deal and we're going to try as hard as we can to make this like as good as possible.

00:31:48:21 - 00:31:52:20

Evan Grubb

Pretty much it very well could be a loss leader for them. I don't know.

00:31:52:22 - 00:31:53:21

Ben Hillman

Like we don't know.

00:31:53:21 - 00:31:54:18

Evan Grubb

I have to imagine.

00:31:54:21 - 00:32:16:20

Ben Hillman

So, yeah, I've done a whole bunch of research trying to find out like, is this actually a loss later? And I think the closest I've gotten to is Jim. Senegal said at one point like, we're not like actually losing. They've been very cagey, but it's like, I know that they do all the like they have factories, like for the Costco hotdog themselves, it's like completely like almost vertically integrated.

00:32:16:20 - 00:32:29:11

Ben Hillman

It's not clear if it is a loss leader, but like, assuming that it is, I think it's a really good loss leader for them to just sort of that. ADVERTISEMENT Right. When you enter the store Dollar 50 for a hotdog, holy crap, that's a good deal.

00:32:29:15 - 00:32:30:07

Evan Grubb

100%.

00:32:30:07 - 00:33:04:03

Ben Hillman

We did some research a while ago on willingness to pay and we found that the there's a positive association with a brand can swing millions to pay up to 60%. And it sounds like you're saying that like it seems like maybe there might be we don't know Costco. We don't we don't see into them. But if they were to change their prices, even to your to your point of like, okay, they raised, let's say, $80 for the basic and 150 for the executive, that that might have a negative perception and potentially hurt them from the membership standpoint, like maybe hurt their numbers there.

00:33:04:04 - 00:33:08:11

Ben Hillman

Maybe they shouldn't raise their prices like like too much because it might hurt them.

00:33:08:11 - 00:33:31:10

Evan Grubb

Well, this is tricky because when we talk about brand for B2B sales companies, oftentimes pricing or like being an inexpensive provider is not a core pillar of one's brand. So I almost like want to separate those two a little bit. For Costco, it's so like it's literally in the name, like they are the low cost provider for groceries and and for retail consumers.

00:33:31:11 - 00:33:53:05

Evan Grubb

That said, I think that if they keep their goods pricing below 14%, they can still increase their membership pricing. And the reason is people still love that brand like they they appreciate the cap on the prices for the goods and thus they probably ironically have a higher willingness to pay for the membership itself.

00:33:53:05 - 00:34:21:08

Ben Hillman

You mentioned the pricing change that they've said, I think in September of 2023 that they were considering another pricing change, which makes sense because it's been documented that like roughly every five years they raise their price, the price of the membership, $5. And I did some like crude math where I'm not a data scientist, don't quote me on any of this stuff, but I basically found that if you adjust their prices for inflation, it is cheaper today, similar to the hot dog.

00:34:21:08 - 00:34:46:12

Ben Hillman

It's cheaper today to have a Costco membership at $60 a year when it was $25 a year in 1983. If you adjust for inflation, it's like that $25 is actually like $77. So even if they were to raise their prices $5, which I'm almost certain that that is what they're going to do when they raise their prices, it's still going to be cheaper than it was.

00:34:46:14 - 00:34:48:16

Ben Hillman

It's like the deal has gotten even better.

00:34:48:20 - 00:35:05:20

Evan Grubb

That is pretty nuts. But that goes back to the brand, right? Like their brand is keeping prices low. And so if they think that they value the brand and the retention of their their customers over the bottom line in some cases or marginal impact to the bottom line, then it actually makes a ton of sense for them.

00:35:05:20 - 00:35:27:13

Ben Hillman

And you've said as much in like your article that everyone should aspire to have like a 40 year, you know, brand like that people love. But if we get into like sort of the tactical, what folks can actually learn from this who are running their own SaaS company, how do we learn? Is it is it just like is the add ons the only thing we can really take away here is is there something else that folks can learn?

00:35:27:13 - 00:35:53:11

Evan Grubb

I think there's a couple of things we can learn from Costco. We can learn that having a really solid brand is pretty much always valuable when it comes to pricing. We know that willingness to pay is higher for companies that their customers have a higher approval rating of them. Second thing is add ons. We know that if you have a successful add on strategy, you're able to extract more revenue from your your buyers and it helps you from a retention standpoint.

00:35:53:13 - 00:36:14:20

Evan Grubb

The third thing is virality is really, really impactful for Costco, but also for a lot of these B2B companies really more. And so you plug your product like growth. So companies like Cowlersley, right? When you click when you schedule on somebody, call me to book a time. It tells you that it's powered by cowlersley. Or when you take a survey from Typeform, it tells you like, Hey, this was powered by Typeform.

00:36:15:01 - 00:36:26:06

Evan Grubb

That is, that's a way of creating sort of a viral growth strategy for B2B SaaS companies. So that's something that Costco does well that I think we can take away for for the B2B community.

00:36:26:06 - 00:36:33:15

Ben Hillman

I didn't see too much about the referral elsewhere. Other than your article you said there, like that referral program. I don't know if it makes sense to touch on that.

00:36:33:15 - 00:36:49:00

Evan Grubb

The other thing on virality is having like a good referral motion that Costco does really well. You mentioned like the upsell motion and the other the other piece would be the referral piece. There's a good write up, I'm going to butcher it, but there's a good write up by Kyle Poyer at Open View, and he talked about this.

00:36:49:02 - 00:37:09:04

Evan Grubb

He talked about like the value of having really strong customers that can refer you leads, and it's this sort of low calc acquisition play. So that that's another one that I think also good as well that we could take away for, for the B2B community. But otherwise, like we talked about from the jump, they're they're an amazing retail company.

00:37:09:04 - 00:37:18:02

Evan Grubb

They're also an amazing subscription company. They're going to continue, I assume, to make changes. And so it's not a stretch to to look to Costco for for learning's for a lot of us. And to us.

00:37:18:03 - 00:37:41:22

Ben Hillman

It seems like most companies could probably raise their prices that would like just be a good start. But for the most part, pricing changes are that sort of a long tail effect. And much like Costco, it's like they've been around for 40 years, like they've established this brand for 40 years. They've worked on this fact, like their viral growth, if you will, hasn't been like an overnight thing.

00:37:42:03 - 00:38:15:01

Ben Hillman

It's been this this this thing that they've worked on from going back to those code of ethics like that. They've they've been working on it from the get go from before. Costco was even like an idea back in the in the Fed Mart days with stock price and Fed Martin Price Club and all that. So I feel like the lesson from Costco is really just the these things take time like it's it's not just like there's no quick hack that one company can do that's just going to fix their pricing or fix their company problems overnight.

00:38:15:06 - 00:38:41:22

Evan Grubb

I totally agree. I think most companies probably could increase their pricing a lot. A lot of companies this year are underpriced, but it is it's a journey, right? Like pricing is one aspect of a monitor strategy. We've talked about packaging or the add ons, the pricing model itself, like how are you charging customers is on a per user basis on an air token or credit basis, etc..

00:38:41:22 - 00:38:58:15

Evan Grubb

And then also, who are you target? Like who are the buyer personas that are a good fit for your product versus who are the folks that you shouldn't waste your time on targeting? Like, all of this stuff goes into the monetization strategy. I think too often we look at just the price point and assume that we have to get that piece right when in reality it's a much bigger puzzle.

00:38:58:17 - 00:39:23:22

Ben Hillman

So you talked in your article about bucking the status quo and how Costcos kind of differentiated themselves in a very commoditized market, things like vowing to never exceed 14% free returns on other products, free samples, and how companies like Slack Zoom Zendesk did this with software. How can one just getting a specific as we possibly can without being able to see into their folks that are listening to this companies?

00:39:24:00 - 00:39:31:03

Ben Hillman

How do you learn from those examples? Like what what is like blocking the status quo really like look like on an individual basis?

00:39:31:08 - 00:39:59:03

Evan Grubb

Well, I can speak to this from a monetization standpoint. From a product building standpoint, I'm a dummy. I think there's a there's a question also about like how do we buck the status quo? And then also how do we justify making pricing changes right now when it's like a really hard time to to increase pricing for customers and it's a hard time to land B-to-B customers at the foundation of this is probably thinking from first principles or about what buyers care about and what they value.

00:39:59:03 - 00:40:22:04

Evan Grubb

And I know that sounds like super cliché, but for example, if you if you look at Zendesk or you look at companies in the customer service space for a long time, they've charged on a per agent or a per user basis. But we see now with, with the, the, with AI and with the productivity of users that is able to generate charging on a per user basis is diminishing.

00:40:22:04 - 00:40:53:13

Evan Grubb

Right. Because we probably have fewer agents and they're able to be more productive. So reality, you can think more from first principles and get an idea that, hey, if we're charging on value, we're actually monetizing. The number of happy customers were conversations completed at a successful outcome. And so that's the kind of thinking that I'm super interested in, is like, how do we change these monetization models that have been around for a long time with the introduction of technology and some market changes and trends and adjust them so that they're more aligned with value?

00:40:53:15 - 00:41:15:14

Ben Hillman

This stuff is not rocket science, as you said, to borrow your phrase, but it does take a lot of, you know, patience and and working at it and slowly, slowly changing the direction of the ship just ever so slightly. Well, cool. Evan, thank you so much for coming on. What where can people find you? Is there a good plug for you to plug at this point?

00:41:15:14 - 00:41:32:00

Evan Grubb

Yes. You can check out my newsletter. Evan Grub Dot Substack icons called Notes from the Pricing Underground. Otherwise you can hit me up on LinkedIn or shoot me the email Evan Duck, Rabbit, Babble.com and happy to chat about pricing, but thanks for having me on that course.

00:41:32:00 - 00:41:37:20

Ben Hillman

And that's Evie and G.R. UPB, correct? Yeah, awesome. Thanks so much, Evan.