Why did Adobe Buy Figma?

Since 1982, Adobe has dominated the software market. Responsible for such products like Illustrator, Photoshop, After Effects, and inventing the PDF. But, what if I told you that half of those products I just listed were acquisitions? In fact, in its 40-year-plus existence, Adobe has acquired over 50 companies.

Just recently, Adobe announced they would spend $20 billion to acquire Figma, four times the price of their next highest purchase. History tells us that Adobe will adopt Figma as one of its own and that Figma fans have nothing to worry about in regards to the product being shut down. Or, does it? In this episode, we’re going to look at two key acquisitions made by Adobe that differ wildly with the eventual fate of the product. From there, we can draw insight on what lies ahead for Figma, Adobe, and the greater SaaS world.

Lessons from the Top

There's divided opinion about whether the Figma multi-billion acquisition is good for the SaaS industry. Lack of competition means Adobe continues to dominate the industry, and Figma will now have to succeed in concert with Adobe, not in spite of Adobe. Whether this acquisition will have a PhotoShop outcome or a FreeHand outcome, remains to be seen.

Experts warn, however, that if the current generation of SaaS startups keep entering into mergers and acquisitions with the same legacy companies, they'll never be able to break the hold that entrenched platform companies have over the enterprise software market.

Still, there's a lot we can learn from both Adobe and Figma.

- Adobe Today

Adobe is worth about $160 billion to date, and with its recent acquisition of Figma, it’s set to continue on that path. I think we can all agree that Adobe is a behemoth in the visual design industry. And whether you love it or hate it, one thing you can’t deny is that for the past 40 years Adobe has been very wise and forward-thinking when it comes to their business decisions.Every move and every acquisition, whether the objective was to eliminate the competition or expand its offering, it has been very strategic and has ensured its continued growth and expansion. - Figma

What we can learn from Figma is how far drive and focus can take you, even in a short period of time. Figma’s purpose wasn’t to compete with Adobe, its purpose was to create a product that made designing and collaboration easier and better. It succeeded and because of that it was able to take on Adobe and give it some serious competition — worth $20 billion.

Photoshop

In 1987, Thomas Knoll was attending the University of Michigan when he decided to distract himself from his studies with a coding project that would display grayscale images on a black and white monitor. He called this program “Display”. Thomas’ brother, John, worked for a little company known as Industrial Light and Magic (ILM). John asked Thomas if he could help him program a computer to process image files digitally, and Display seemed like a perfect starting point.

Thomas worked on Display adding all sorts of capabilities like color processing as well as the ability for users to change features like color balance, hue, and saturation. Thomas kept looking for a new name to use that would set the product apart but each time, the name appeared taken like ImagePro and PhotoHut. Eventually, the brothers settled on a name that would stick until this day: Photoshop.

John traveled all around Silicon Valley searching for an investor that would help them distribute the product. Eventually, it caught the attention of the executives at Adobe. At the time, Adobe was in agreement with a different image-editing program known as ColorStudio. Convinced that Photoshop was better, Adobe worked out an agreement with the Knoll brothers to distribute the product in return for royalties. It would function as a companion product for Adobe’s Illustrator, a vector graphics editor released in 1987.

Photoshop version 1.0 shipped in February of 1990 at a list price of $895 exclusively for Macintosh. This was before SaaS so the on-prem software would be iterated several times until its current form in the cloud.

Photoshop’s dominance was massive. It became a verb. I’m sure if I told you something is “shopped” you know exactly what I’m talking about. In 1995, Adobe bought out the Knoll brothers’ royalty agreement for $34.5 million. Adobe had clearly realized that acquiring Photoshop would be lucrative not only in dollars and cents, but also in the minds of its customers.

By adding Photoshop to Adobe’s product offering, they would create a strong foothold in the image processing industry. It became a bedrock for their creative ecosystem. Photoshop joined, in-house created video editor, Premiere, and was later itself joined by further acquisitions of After Effects and Audition. The Knoll brothers also benefited. In addition to their generous sum, they ended up working with Adobe for years after the acquisition. At the 2019 Oscars, the two received a Scientific and Engineering Award. But perhaps best of all, whenever you open the Photoshop program even to this day, you can still see their names.

But not all of Adobe’s acquisitions end up so rosy…

FreeHand

In 1988, two corporations, Aldus and Altsys, reached a licensing agreement to release a vector graphics editor named FreeHand, and graphics program, PhotoStyler. FreeHand and PhotoStyler competed with Adobe’s Illustrator and Photoshop respectively.

The firms tried to top one another by going back and forth with different feature releases over the next several years. The ensuing battle would not last long as in 1994 Adobe Systems announced that they had an agreement with Aldus Corporation to merge in a $525-million deal. But our acquisition of focus wouldn’t occur just yet. Because of the competition between their two main products, Altsys sued Aldus over a non-compete clause within the FreeHand licensing agreement.

FreeHand’s dedicated customer base had cause for concern as the merger would result in Adobe killing the PhotoStyler product, ending all competition with Photoshop. FreeHand users were assured by Altsys CEO and founder, James Von Ehr, that “no one loves FreeHand more than we do. We will do whatever it takes to see it survive.”

In October of 1994, The Federal Trade Commission ordered that Adobe divest FreeHand in order to prevent competition from ending. They further ordered that for a period of 10 years from the date on which this order became final, respondents shall not acquire any professional-illustration software or enter into any exclusive license with a professional-illustration software.

Altsys retained the rights to FreeHand but instead of keeping it in house, decided to sell it to a different company: Macromedia. Macromedia was able to bolster its product offerings and 200,000 FreeHand customers came with it. James Von Ehr joined as well, becoming a vice-president of Macromedia.

Over the next decade, Macromedia became Adobe’s new foe. Already supported by other competitive products like Flash and Dreamweaver, Macromedia had plenty of incentive to keep the game going. The two sparred back and forth, continuing the battle that Altsys had started years before. Meanwhile in 1997, James Von Ehr left Macromedia to start a new venture, which left the door open for something drastic to happen in 2005.

On April 18 of that year, Adobe announced they would acquire Macromedia in a stock swap of $3.4 billion. They had waited just over the 10-year limit imposed by the American government and with FreeHand champion, James Von Ehr, no longer present, users were on edge. In 2006, the FreeHand community protested Adobe's announcement of discontinuing development with the "FreeHand Support Page" petition. Soon after in 2007, the "FreeHand Must Not Die" petition was filed. Adobe assured users as late as June of 2006 that they continued to support FreeHand and develop it based on customer needs. But less than a year later, in May of 2007, Adobe announced the end of FreeHand.

Freehand users were incensed. In 2011, the Free Macromedia FreeHand Organization filed a civil antitrust complaint against Adobe Systems, Inc alleging that "Adobe has violated federal and state antitrust laws by abusing its dominant position in the professional vector graphic illustration software market."

In a bid to win over some of the protesters, Adobe opted for a settlement, where members of the Free Macromedia FreeHand Organization received a discount on Adobe products and a promise for product-development of Adobe Illustrator based on their requests. It was too late. FreeHand was finished.

Figma

As mentioned, Adobe has had dozens of acquisitions over the years, consistently topping billions of dollars. Photoshop and FreeHand were just two extreme examples of what Adobe is capable of. So now, let’s take a look at Figma.

In 2012, Dylan Field dropped out of Brown University and took $100,000 as a Thiel Fellow to start his own business. He was joined by fellow computer science student, Evan Wallace. Convinced that design is collaborative by nature, the two focused primarily on moving the process to the cloud and allowing maximum flexibility for teams to collaborate.

After launching in December 2015, Field asserted in a Tech Crunch Interview that his big competitor "doesn't understand collaboration" and the Adobe Creative Cloud is "really cloud in name only." He further noted that "Design is undergoing a monumental shift — going from when design was at the very end of the product cycle, where people would just make things prettier to now, where it runs through the entire process." The goal at Figma was to do for interface design what Google Docs did for text editing. And that's precisely what he did.

Over the years — and especially after the 2013 deprecation of Adobe Fireworks, more and more UX designers felt that the creative Cloud did not match market expectations. While Photoshop and Illustrator were powerful programs in their own right, they lack the in-browser functionality of Figma.

In the years that followed its launch, Figma built out the platform to expand access and usability for individual designers, small firms, and giant enterprise companies alike. The company launched plug-ins in 2019, allowing developers to optimize work, be faster, and more creative. Figma launched an educational platform called Community, which allows designers to publish their work for others to view, remix, and learn from.

Adobe tried to compete with their own product, Adobe XD that they launched in 2016, but whether through a lack of focus or not enough dedicated resources, they couldn’t compete.

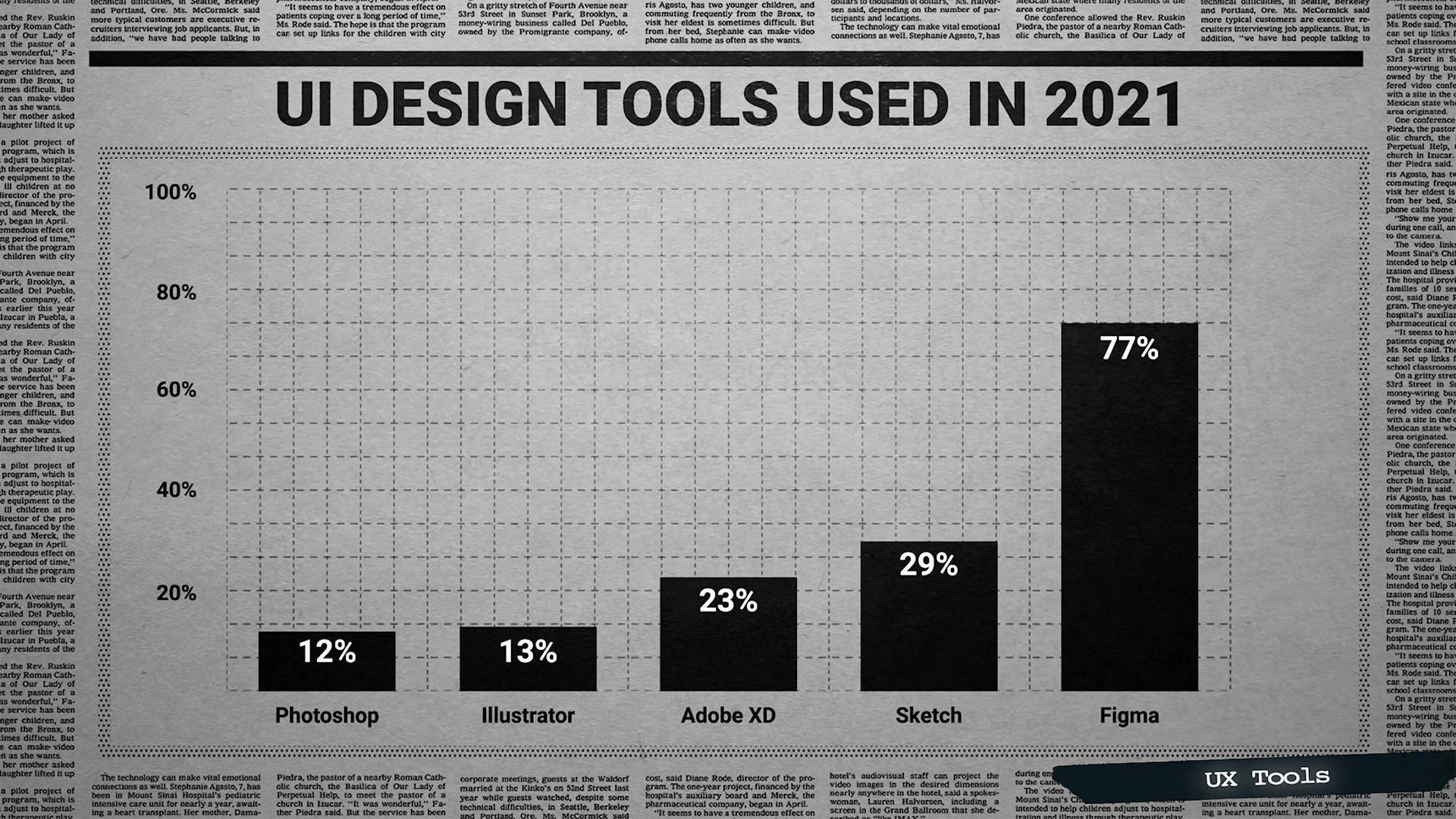

By 2021, Figma was well and truly the king of the web-based design world, and by some distance. Among over 3,000 surveyed by UX Tools in 2021, Figma was the preferred UI design tool at 77%, up from just 11% in 2017. This is compared to Adobe XD, which has never cracked 25%.

In June of 2021, Figma had a valuation of $10 billion, quintupling its price tag from the previous year. But a few months later, Adobe proposed a deal to purchase Figma at twice that price in what is one of the biggest software deals in history. So what does this mean for Figma fans and the SaaS world?

Reasons for concern

With our two previous examples in Photoshop and FreeHand, we see contrasting stories. With Photoshop, Adobe incorporated it into their core offering and treated it as one of their own with its creator staying on to oversee the development of the product. I bet a few of you were surprised to hear that Photoshop was an acquisition in the first place. Additionally, there wasn’t much competition at the time, the folks at Adobe simply realized the potential for the software and capitalized on it.

With FreeHand, we see a multi-decade battle of Adobe zeroing in on its competition and tactically dismantling it in favor of its own, even with the promise to keep it going. And it wasn’t the only time Adobe has done this.

Adobe realized the potential with Figma, just like all the acquisitions they made before. They have a consistent track record of hitting on heavy bets as to where software and SaaS is going even if they weren’t the ones to develop the product themselves.

Many designers worry that Adobe won't let Figma flourish — as was the case with FreeHand. It's also one of the strongest rivals to Adobe XD, which hasn't been able to keep pace with Figma's innovations. In particular, there are concerns that Adobe's acquisition could result in Figma slowly shutting down its free membership, alongside losing the freedom to develop independently from Adobe.

Dylan Field is trying his best to ease concerns. In an interview with The Verge, he assured Figma users that he was going nowhere and that Figma was poised for even more growth inside Adobe. He explained, "First of all, we're gonna give our users a ton more functionality…There's not a price increase here — we're doing everything we can to keep prices the same… We're gonna continue to not just innovate, but innovate quickly… And that's a challenge, but it's one I'm down to sign up for."

Only time will tell if Figma will be a Photoshop or a FreeHand.

Summary

In general, there's divided opinion about whether this multi-billion acquisition is good for the SaaS industry. Lack of competition means Adobe can get away with a subpar product. Figma will now have to succeed in concert with Adobe, not in spite of Adobe. Hopefully Dylan Field sticks around in order to avoid a similar situation with FreeHand an James Von Ehr

Experts warn that the current generation of SaaS startups will never be able to break the hold that entrenched platform companies have over the enterprise software market, if they keep entering into mergers and acquisitions with the same legacy companies.

Will there be a new Adobe, Google, or Salesforce, or are all SaaS companies destined to be acquired by those who came before? Let us know what you think.

Do us a favor?

Part of the way we measure success is by seeing if our content is shareable. If you got value from this episode and write up, we'd appreciate a share on Twitter or LinkedIn.

1

00:00:00,210 --> 00:00:01,043

- Adobe.

- Adobe.

2

00:00:01,043 --> 00:00:02,670

- Adobe.

- Adobe will acquire

3

00:00:02,670 --> 00:00:04,710

rival design platform, Figma.

4

00:00:04,710 --> 00:00:08,100

- Since 1982, Adobe has

dominated the software market,

5

00:00:08,100 --> 00:00:10,950

responsible for such products

like Illustrator, Photoshop,

6

00:00:10,950 --> 00:00:13,593

After Effects, and even

inventing the .pdf.

7

00:00:14,490 --> 00:00:16,470

But what if I told you

that half of those products

8

00:00:16,470 --> 00:00:19,380

that I just listed were acquisitions?

9

00:00:19,380 --> 00:00:21,660

In fact, in its 40-year plus existence,

10

00:00:21,660 --> 00:00:24,510

Adobe has acquired over 50 companies.

11

00:00:24,510 --> 00:00:25,830

Just recently, Adobe announced

12

00:00:25,830 --> 00:00:28,800

that they would spend $20

billion to acquire Figma,

13

00:00:28,800 --> 00:00:31,470

four times the price of

their next highest purchase,

14

00:00:31,470 --> 00:00:33,900

and history tells us that

Adobe will adopt Figma

15

00:00:33,900 --> 00:00:35,640

as one of its own, and Figma fans

16

00:00:35,640 --> 00:00:36,960

have nothing to worry about

17

00:00:36,960 --> 00:00:41,580

in regards to the product

being shut down, or do they?

18

00:00:41,580 --> 00:00:43,980

In this episode, we're gonna

look at two key acquisitions

19

00:00:43,980 --> 00:00:45,780

made by Adobe that differ wildly

20

00:00:45,780 --> 00:00:48,120

with the eventual fate of the product.

21

00:00:48,120 --> 00:00:50,490

From there, we can draw

insight on what lies ahead

22

00:00:50,490 --> 00:00:54,000

for Figma, Adobe, and

the greater SaaS world.

23

00:00:54,000 --> 00:00:56,553

I'm Ben Hillman, and this is Verticals.

24

00:00:59,400 --> 00:01:01,470

In 1987, Thomas Knoll was attending

25

00:01:01,470 --> 00:01:03,420

the University of Michigan when he decided

26

00:01:03,420 --> 00:01:06,690

to distract himself from his

studies with a coding project

27

00:01:06,690 --> 00:01:08,490

that would display gray scale images

28

00:01:08,490 --> 00:01:10,230

on a black and white monitor.

29

00:01:10,230 --> 00:01:12,660

He called this program "Display."

30

00:01:12,660 --> 00:01:15,660

Thomas' brother John worked

for a little known company

31

00:01:15,660 --> 00:01:19,350

known as Industrial

Light and Magic, or ILM.

32

00:01:19,350 --> 00:01:21,330

John asked Thomas if he could help him

33

00:01:21,330 --> 00:01:24,690

program a computer to process

image files digitally,

34

00:01:24,690 --> 00:01:27,750

and Display seemed like

a perfect starting point.

35

00:01:27,750 --> 00:01:28,770

Thomas worked on Display,

36

00:01:28,770 --> 00:01:31,530

adding all sorts of capabilities

like color processing,

37

00:01:31,530 --> 00:01:33,840

as well as the ability for

users to change features

38

00:01:33,840 --> 00:01:36,510

like color balance, hue, and saturation.

39

00:01:36,510 --> 00:01:38,490

Eventually, the brothers settled on a name

40

00:01:38,490 --> 00:01:41,820

that would stick until

this day, Photoshop.

41

00:01:41,820 --> 00:01:43,500

Eventually, it caught the attention

42

00:01:43,500 --> 00:01:45,240

of the executives at Adobe.

43

00:01:45,240 --> 00:01:47,550

Adobe worked out an agreement

with the Knoll brothers

44

00:01:47,550 --> 00:01:50,130

to distribute the product

in exchange for royalties.

45

00:01:50,130 --> 00:01:52,350

Photoshop would function

as a companion product

46

00:01:52,350 --> 00:01:55,650

for Adobe's Illustrator, which

was a vector graphics editor

47

00:01:55,650 --> 00:01:57,270

released in 1987.

48

00:01:57,270 --> 00:02:01,470

And so, Photoshop version 1.0

shipped in February of 1990

49

00:02:01,470 --> 00:02:05,913

at a list price of $895

exclusively for the Macintosh.

50

00:02:07,549 --> 00:02:10,080

Photoshop's dominance was massive.

51

00:02:10,080 --> 00:02:12,540

In 1995, Adobe bought

out the Knoll Brothers'

52

00:02:12,540 --> 00:02:15,363

royalty agreement for $34.5 million.

53

00:02:16,380 --> 00:02:18,900

Photoshop joined in-house

created video editor Premier

54

00:02:18,900 --> 00:02:21,420

and was later itself joined

by further acquisitions

55

00:02:21,420 --> 00:02:23,580

of motion graphics editor After Effects,

56

00:02:23,580 --> 00:02:25,440

and audio program Audition.

57

00:02:25,440 --> 00:02:27,090

Eventually, these products will become

58

00:02:27,090 --> 00:02:30,210

the foundation to Adobe's

core SaaS offering,

59

00:02:30,210 --> 00:02:31,860

Adobe Creative Cloud.

60

00:02:31,860 --> 00:02:33,570

The Knoll brothers also benefited.

61

00:02:33,570 --> 00:02:35,490

In addition to their generous sum,

62

00:02:35,490 --> 00:02:36,720

they ended up working with Adobe

63

00:02:36,720 --> 00:02:38,910

for years after the acquisition,

64

00:02:38,910 --> 00:02:40,770

and in 2019, the two received

65

00:02:40,770 --> 00:02:43,260

a scientific and engineering

award at the Oscars.

66

00:02:43,260 --> 00:02:45,540

But perhaps best of all

is whenever you open

67

00:02:45,540 --> 00:02:48,030

the Photoshop program, even to this day,

68

00:02:48,030 --> 00:02:50,250

you can still see the brothers' names.

69

00:02:50,250 --> 00:02:53,790

But not all of Adobe's

acquisitions have ended up so rosy.

70

00:02:53,790 --> 00:02:57,300

In 1988, 2 corporations,

Aldus and Altsys reached a

71

00:02:57,300 --> 00:03:00,150

licensing agreement to release

a vector graphics editor

72

00:03:00,150 --> 00:03:04,350

named Freehand and a graphics

program, PhotoStyler.

73

00:03:04,350 --> 00:03:06,390

Freehand and PhotoStyler competed with

74

00:03:06,390 --> 00:03:09,060

Adobe's Illustrator and

Photoshop respectively.

75

00:03:09,060 --> 00:03:12,090

In 1994, Adobe Systems announced

that they had an agreement

76

00:03:12,090 --> 00:03:17,090

with Aldus Corporation to

merge in a $525 million deal,

77

00:03:17,490 --> 00:03:19,950

but this isn't our acquisition of focus.

78

00:03:19,950 --> 00:03:23,160

Altsys sued Aldus over

a non-compete clause

79

00:03:23,160 --> 00:03:25,740

within the Freehand licensing agreement.

80

00:03:25,740 --> 00:03:29,160

Freehand users were assured

by Altsys CEO and founder

81

00:03:29,160 --> 00:03:32,970

James Van Ayer that "No one

loves Freehand more than we do.

82

00:03:32,970 --> 00:03:35,670

We will do whatever it

takes to see it survive"

83

00:03:35,670 --> 00:03:39,330

and Freehand's dedicated customer

base had cause for concern

84

00:03:39,330 --> 00:03:41,040

as the merger would result in Adobe

85

00:03:41,040 --> 00:03:43,290

killing the PhotoStyler product,

86

00:03:43,290 --> 00:03:45,270

ending competition with Photoshop.

87

00:03:45,270 --> 00:03:48,030

In October of 1994, the

Federal Trade Commission

88

00:03:48,030 --> 00:03:51,120

ordered that Adobe divest

Freehand in order to prevent

89

00:03:51,120 --> 00:03:54,127

competition from ending

for a period of 10 years.

90

00:03:54,127 --> 00:03:56,880

"From the date on which

this order becomes final,

91

00:03:56,880 --> 00:03:58,590

respondents shall not acquire

92

00:03:58,590 --> 00:04:01,260

any professional illustration software."

93

00:04:01,260 --> 00:04:03,060

Altsys retained the rights to Freehand,

94

00:04:03,060 --> 00:04:04,980

but instead of keeping it in-house,

95

00:04:04,980 --> 00:04:08,490

decided to sell it to a

different company, Macromedia.

96

00:04:08,490 --> 00:04:12,210

Over the next decade, Macromedia

became Adobe's new foe.

97

00:04:12,210 --> 00:04:15,450

In 1997, James Von Ayer left Macromedia.

98

00:04:15,450 --> 00:04:18,300

This left the door open for

something drastic to happen.

99

00:04:18,300 --> 00:04:20,370

On April 18th of 2005,

100

00:04:20,370 --> 00:04:22,740

Adobe announced that they

would acquire Macromedia

101

00:04:22,740 --> 00:04:26,280

in a stock swap of $3.4 billion.

102

00:04:26,280 --> 00:04:28,380

They'd waited just over the 10 year limit

103

00:04:28,380 --> 00:04:30,150

imposed by the American government,

104

00:04:30,150 --> 00:04:33,390

and with Freehand champion James

Von Ayer no longer present,

105

00:04:33,390 --> 00:04:34,800

users were on edge.

106

00:04:34,800 --> 00:04:36,960

In 2006, the Freehand community

107

00:04:36,960 --> 00:04:39,510

announced the Freehand

support page petition,

108

00:04:39,510 --> 00:04:43,080

and soon after in 2007,

the "Freehand Must Not Die"

109

00:04:43,080 --> 00:04:44,400

petition was also filed.

110

00:04:44,400 --> 00:04:47,820

Adobe assured users as

late as June of 2006

111

00:04:47,820 --> 00:04:50,160

that they would continue

to support Freehand

112

00:04:50,160 --> 00:04:52,290

and develop it based on customer needs,

113

00:04:52,290 --> 00:04:55,380

but less than a year

later, in May of 2007,

114

00:04:55,380 --> 00:04:57,930

Adobe announced the end of Freehand.

115

00:04:57,930 --> 00:05:00,120

Freehand users were incensed.

116

00:05:00,120 --> 00:05:02,760

In 2011, the "Free Macromedia

Freehand" organization

117

00:05:02,760 --> 00:05:06,210

filed a civil antitrust

complaint against Adobe Systems,

118

00:05:06,210 --> 00:05:07,320

but it was too late.

119

00:05:07,320 --> 00:05:09,093

Freehand was finished.

120

00:05:09,990 --> 00:05:12,720

As mentioned, Adobe has

had dozens of acquisitions

121

00:05:12,720 --> 00:05:16,800

over the years, consistently

topping billions of dollars.

122

00:05:16,800 --> 00:05:19,740

Photoshop and Freehand were

just two extreme examples

123

00:05:19,740 --> 00:05:21,780

of what Adobe is capable of.

124

00:05:21,780 --> 00:05:24,510

So now let's take a look at Figma.

125

00:05:24,510 --> 00:05:27,060

In 2012, Dylan Field dropped

out of Brown University

126

00:05:27,060 --> 00:05:29,400

and took $100,000 as a field fellow

127

00:05:29,400 --> 00:05:31,320

to start his own business.

128

00:05:31,320 --> 00:05:33,540

He was joined by fellow

computer science student,

129

00:05:33,540 --> 00:05:34,373

Evan Wallace.

130

00:05:34,373 --> 00:05:36,660

Convinced that design is

collaborative by nature,

131

00:05:36,660 --> 00:05:39,600

the two focus primarily on

moving the process to the cloud

132

00:05:39,600 --> 00:05:42,660

and allowing maximum flexibility

for teams to collaborate.

133

00:05:42,660 --> 00:05:44,790

After launching in December of 2015,

134

00:05:44,790 --> 00:05:47,130

Field asserted in a Tech Crunch interview

135

00:05:47,130 --> 00:05:50,700

that his big competitor doesn't

understand collaboration

136

00:05:50,700 --> 00:05:52,410

and that the Adobe Creative Cloud

137

00:05:52,410 --> 00:05:55,170

is really cloud in name only.

138

00:05:55,170 --> 00:05:58,230

Over the years, and especially

after the 2013 depreciation

139

00:05:58,230 --> 00:06:01,110

of Adobe Fireworks, more

and more UX designers

140

00:06:01,110 --> 00:06:02,340

felt that the Creative Cloud

141

00:06:02,340 --> 00:06:04,770

did not match market expectations.

142

00:06:04,770 --> 00:06:07,530

While Photoshop and Illustrator

are powerful programs

143

00:06:07,530 --> 00:06:08,700

in their own right,

144

00:06:08,700 --> 00:06:11,370

they lack the in browser

functionality of Figma.

145

00:06:11,370 --> 00:06:14,700

Adobe tried to compete with

their own product, Adobe XD,

146

00:06:14,700 --> 00:06:16,740

that they launched in 2016,

147

00:06:16,740 --> 00:06:18,180

but whether through a lack of focus

148

00:06:18,180 --> 00:06:20,130

or not enough dedicated resources,

149

00:06:20,130 --> 00:06:21,720

they just couldn't compete.

150

00:06:21,720 --> 00:06:24,630

By 2021, Figma was well and truly the king

151

00:06:24,630 --> 00:06:28,020

of the web-based design

world, and by some distance.

152

00:06:28,020 --> 00:06:30,480

Among over 3000 individuals surveyed

153

00:06:30,480 --> 00:06:35,340

by UX Tools in 2021, Figma was

the preferred UI design tool,

154

00:06:35,340 --> 00:06:39,630

at 77%, up from just 11% in 2017,

155

00:06:39,630 --> 00:06:43,980

compared to Adobe XD, which

has never cracked 25%.

156

00:06:43,980 --> 00:06:48,030

In June of 2021, Figma had

a valuation of $10 billion,

157

00:06:48,030 --> 00:06:50,940

quintupling its price tag

from the previous year,

158

00:06:50,940 --> 00:06:52,710

but then, a few months later,

159

00:06:52,710 --> 00:06:56,250

Adobe proposed a deal to purchase

Figma at twice the price,

160

00:06:56,250 --> 00:06:59,220

in what is one of the biggest

software deals in history.

161

00:06:59,220 --> 00:07:00,900

Now that we're caught up to today,

162

00:07:00,900 --> 00:07:02,550

what does this mean for Figma fans

163

00:07:02,550 --> 00:07:04,530

and the SaaS world at large?

164

00:07:04,530 --> 00:07:07,140

With our two previous examples

in Photoshop and Freehand,

165

00:07:07,140 --> 00:07:09,000

we see contrasting stories.

166

00:07:09,000 --> 00:07:10,890

With Photoshop, Adobe incorporated it

167

00:07:10,890 --> 00:07:14,250

into their core offering and

treated it as one of their own.

168

00:07:14,250 --> 00:07:16,200

I bet a few of you were

even surprised to hear

169

00:07:16,200 --> 00:07:18,720

that Photoshop was an

acquisition in the first place.

170

00:07:18,720 --> 00:07:20,910

Additionally, there wasn't

much competition at the time.

171

00:07:20,910 --> 00:07:22,410

The folks at Adobe simply realized

172

00:07:22,410 --> 00:07:25,110

the potential for this

software and capitalized on it.

173

00:07:25,110 --> 00:07:27,630

With Freehand, we see

a multi-decade battle

174

00:07:27,630 --> 00:07:29,910

of Adobe zeroing in on its competition

175

00:07:29,910 --> 00:07:32,670

and tactically dismantling

it in favor of its own,

176

00:07:32,670 --> 00:07:34,680

even with a promise to keep it going.

177

00:07:34,680 --> 00:07:37,410

And it wasn't the only time

that Adobe has done this.

178

00:07:37,410 --> 00:07:39,600

Adobe realized the potential with Figma,

179

00:07:39,600 --> 00:07:42,240

just like all of the acquisitions

that they made before,

180

00:07:42,240 --> 00:07:43,740

and they have a consistent track record

181

00:07:43,740 --> 00:07:44,970

of hitting on heavy bets

182

00:07:44,970 --> 00:07:47,460

as to where software and SaaS is going,

183

00:07:47,460 --> 00:07:48,360

Even if they weren't the ones

184

00:07:48,360 --> 00:07:49,830

to make the product themselves.

185

00:07:49,830 --> 00:07:52,890

Many designers worry that

Adobe won't let Figma flourish,

186

00:07:52,890 --> 00:07:54,840

as was the case with Freehand.

187

00:07:54,840 --> 00:07:57,720

In particular, there are

concerns that Adobe's acquisition

188

00:07:57,720 --> 00:07:59,880

could result in Figma slowly shutting down

189

00:07:59,880 --> 00:08:02,280

its free membership,

alongside losing the freedom

190

00:08:02,280 --> 00:08:04,050

to develop independently from Adobe.

191

00:08:04,050 --> 00:08:06,000

Dylan Field appears to be aware of this,

192

00:08:06,000 --> 00:08:08,460

and it seems that he's

trying to ease concerns.

193

00:08:08,460 --> 00:08:09,600

In an interview with the Verge,

194

00:08:09,600 --> 00:08:12,180

he assured Figma users

that he was going nowhere

195

00:08:12,180 --> 00:08:15,030

and that Figma was poised for

even more growth inside Adobe.

196

00:08:15,030 --> 00:08:16,890

Only time will tell if Figma will be

197

00:08:16,890 --> 00:08:19,080

a Photoshop or a Freehand.

198

00:08:19,080 --> 00:08:21,090

In general, there's divided opinion about

199

00:08:21,090 --> 00:08:22,950

whether this multi-billion acquisition

200

00:08:22,950 --> 00:08:24,810

is good for the SaaS industry.

201

00:08:24,810 --> 00:08:26,880

Lack of competition

means Adobe can get away

202

00:08:26,880 --> 00:08:28,311

with a subpar product.

203

00:08:28,311 --> 00:08:31,620

Figma will now have to

succeed in concert with Adobe,

204

00:08:31,620 --> 00:08:32,820

not in spite of Adobe.

205

00:08:32,820 --> 00:08:34,680

Hopefully, Dylan Fields sticks around

206

00:08:34,680 --> 00:08:37,680

in order to avoid a similar

situation with Freehand

207

00:08:37,680 --> 00:08:39,000

and James Von Ayer.

208

00:08:39,000 --> 00:08:41,340

Further, experts warn that

the current generation

209

00:08:41,340 --> 00:08:44,220

of SaaS startups will never

be able to break the hold

210

00:08:44,220 --> 00:08:46,140

that entrenched platform companies have

211

00:08:46,140 --> 00:08:48,150

over the enterprise software market,

212

00:08:48,150 --> 00:08:50,430

especially if they keep

entering into mergers

213

00:08:50,430 --> 00:08:52,860

and acquisitions with the

same legacy companies.

214

00:08:52,860 --> 00:08:55,200

Will there be a new Adobe,

Google, or Salesforce

215

00:08:55,200 --> 00:08:56,460

or are all SaaS companies

216

00:08:56,460 --> 00:08:59,280

destined to be acquired

by those who came before?

217

00:08:59,280 --> 00:09:01,740

Let us know what you think

in the comments down below.

218

00:09:01,740 --> 00:09:05,943

From Paddle, I'm Ben Hillman

and I'll see you next time.