Slack and the war of the words

Does the Slack that sound give you a spike of anxiety? Maybe you fearfully checked your phone or got excited that someone was finally getting back to you. Whatever it was, I’m sure at the very least you’re familiar with Slack.

Personally, I don’t know what I would do without it. Slack lets me communicate with my coworkers, review company updates, and catch up on important details with project collaborators. What’s great is it’s all asynchronous meaning communication isn’t dependent on responding immediately. While it may not be the email killer that some folks have preached, it definitely provides value.

Slack is the fastest growing SaaS company today and (possibly) of all time. While Slack is inherently a business communication tool, its value lies in how it helps people work together. Slack has owned this niche for years, and managed to get a grip on the market before megacorps like Google, Meta, and Microsoft.

Slack is now integrated into the Salesforce ecosystem, joining the company in a near $30 billion acquisition in 2021. With the backing of a SaaS legend in Salesforce, Slack is well equipped to stay on top of a market that they helped pioneer.

As we speak though, a battle is brewing between these companies. So, which collaboration tool will reign supreme? Yes, Slack is leading the way, but will it always be able to fend off the threat that Google, Meta, and Microsoft pose? If you have thoughts, make sure you let me know. For now, let’s dive deep into the origins of this kind of communication, early industry beginnings, and finally what makes Slack such a prime example to learn from.

Lessons from the Top

Slack’s focus on user experience was established early on, maybe before they even knew it. Slack was initially created out of a need for the founders themselves. They needed a reliable communications tool that could eliminate the barriers of communicating across multiple time zones. And as they built it, they did so from a user's perspective and with the experience they wanted and needed in mind.

Today, Slack is the fastest-growing SaaS company, and user experience is still a primary focus. So what can we learn? It’s all about the user experience. If you’re not providing a great experience, you simply won’t last.

- Looks do matter (in SaaS)

Enterprise software has a reputation for having boring design; however, Slack did not follow. They hired a team early on to create something fun and pleasing to look at and, ultimately, to make you want to use it.

And this is backed by data as it shows that people with a positive affinity to a company's design are willing to pay about 20%-25% more. Additionally, individuals with a positive perception of the company’s design have roughly 8%-12% better net retention than those who were neutral or had a negative perception. - Maximizing the freemium model

Slack took the freemium model to another level. Many might even say they gave away too much. But Slack went all in and provided a ton of value. By making a huge chunk of Slack's functionality available for freemium users, it was able to appeal to small and mid-sized teams. - Integrations are a must

Slack has over 2,400 apps available in its Slack App Directory in addition to custom apps. It's integration ability adds that much more value as it truly creates a cohesive platform for your to work from.

And, customers with more integrations are willing to pay anywhere between 8%-30% more for the same core product.

Background

The main purpose of instant messaging (IM) is to ensure that all employees not only communicate, but also collaborate in a highly efficient manner through a variety of methods that go beyond merely sending and receiving messages. Interestingly enough, one of the earliest instances of this sort of collaboration can be attributed to an American President.

On August 15th, 1971 Richard Nixon announced a ninety-day wage-price freeze in an attempt to ease an inflationary boom. At the time the Office of Emergency Preparedness (OEP) was an office that advised and assisted the president in all things involving emergency preparedness policy. The OEP director led a conference call with 25 regional officers. “Anyone have any problems,” he asked. This was largely greeted with silence. The OEP needed to exchange information between academics and networking experts that could help the government better respond to a situation. With a situation like this, there were a lot of issues.

Murray Turoff was a computer scientist working in the OEP. After the call, he took a teletype home, worked round the clock, and four days later came back with a working version of the Emergency Management Information System and Reference Index (EMISARI). This made it possible for participants to submit responses at any time and at any point in the discussion. Government telephone lines were connected to remote teletype terminals and responses were limited to 10 lines (to prevent lengthy government memos). It made it possible for the OEP to ensure that policy interpretation was correct in all regions. Slack didn’t exist yet, but Murray Turoff managed to see the future and is largely credited with pioneering the chat and collaboration space decades before it existed.

It wasn’t until the 1990s that commercial products started to emerge. We saw the likes of AOL Instant Messenger 1997, Yahoo! Pager (1998), and Microsoft’s MSN Messenger in 1999. These were by no means high level work collaboration tools, but they did get the general populace interested in the tech. It wasn’t until instant messaging became ingrained in our everyday actions — social media, checking email, and mobile devices — that these chat platforms truly gained traction. Beginning in 2002, Apple computer users could seamlessly log on to Apple's iChat. Then came Google Talk in 2005, which allowed Gmail users to access the platform with their email contacts as soon as they logged on. It’s important to note though, that while instant messaging became an everyday application in the 2000s and early 2010s, no company had quite cracked the code on how to use it within the business world effectively. But all that changed in 2014.

Early Leaders

Stewart Butterfield was working on a game called Glitch with his team at Tiny Speck. They used an internal communication tool to communicate across offices. Initially, Butterfield had no intention of commercializing the new platform. But upon realizing that he had something more than just an internal communications tool on his hands, Glitch was ditched. In order to make the tool more market-worthy through refinement, Butterfield and his team cajoled their friends to try out the product. Before long, much bigger teams were demoing Tiny Speck's newest invention willingly. While the tool itself was first made available to the public in February 2014, it wasn't until August of that year that it gained another name: Slack.

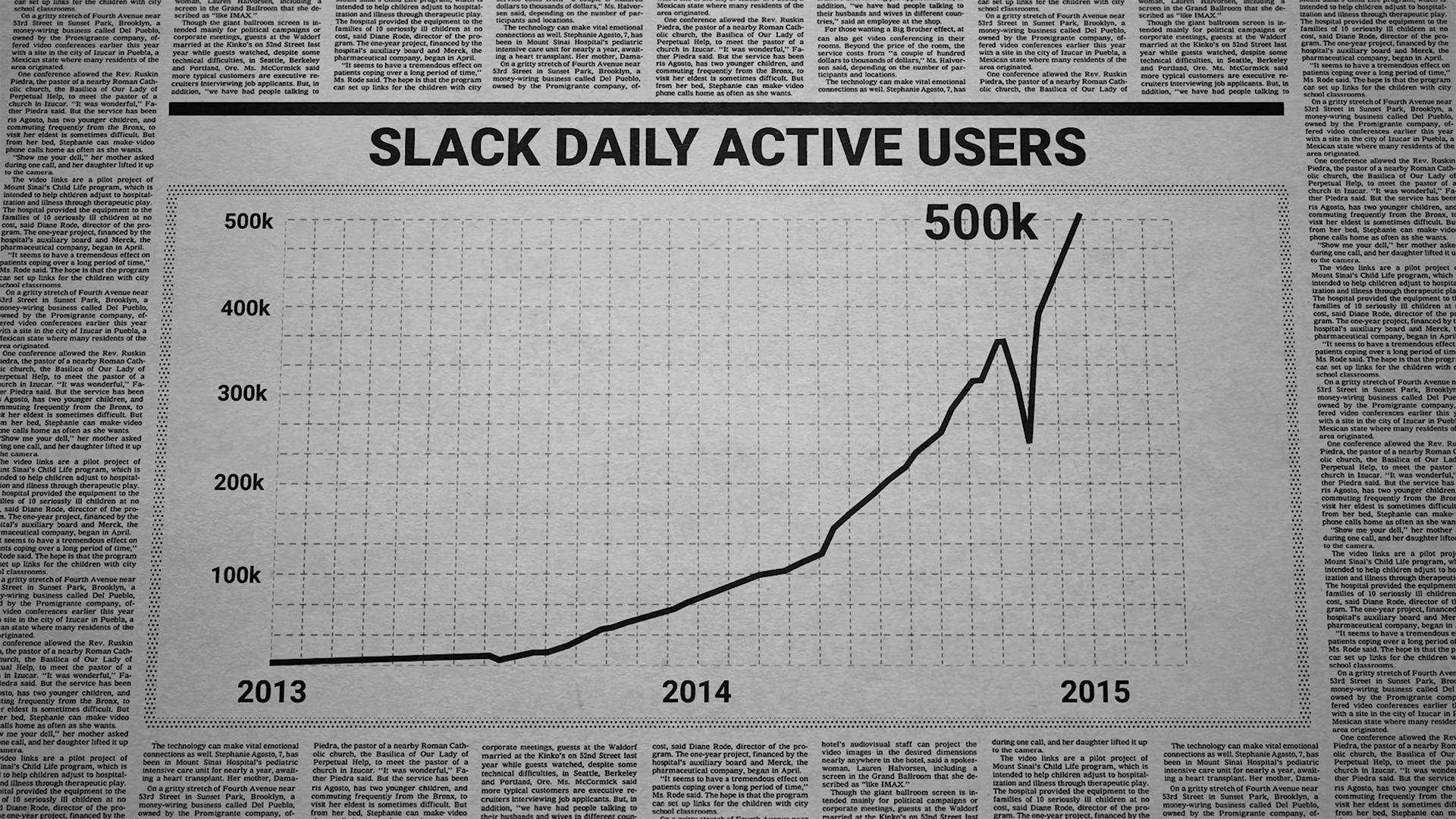

Within a day of its launch, the new communication tool had racked up over 8,000 signups. By April of 2014, Slack had more than 15,000 paid users and 60,000 daily active users. One year later, Slack was worth nearly $3 billion and boasted more than 750,000 active users. What started as an internal communications tool was swiftly becoming a promising, fast-growing entity. By 2016, Slack was reportedly being used by 77% of Fortune 100 companies.

The period between 2016 and 2020 was a defining moment in the history of Slack. Butterfield and his team knew that in order to keep their user base happy and continually attract new funding, they could not merely depend on the app's core features. They needed to innovate further. To that end, Slack added more features, including threaded messaging and Slack Connect. The company also launched 50+ integrations as part of its ever-growing, developer-inspired app directory. In June 2019, Slack finally went public. With its DPO (a non-conventional IPO), the Butterfield-led company was able to bypass the closed-door process of raising capital and subsequently hasten its access to the broader public capital market. Its value at the time sat at $19 billion.

Given that Slack had virtually no competition in the collaboration tools market, big-league legacy companies saw the opportunity to take advantage of Slack’s success. These companies had prior experience running IM programs, so they were able to enter the market relatively quickly. Facebook (now Meta) launched Workplace in October of 2016. Microsoft launched Teams in March of 2017 and finally came Google with Workspace in October of 2020. Out of all three, Microsoft Teams has been the one able to truly give Slack a run for its money (more on them in a bit). In late 2020, Salesforce announced plans to acquire Slack for a cool $27.7 billion. For Slack, the merger was incredibly beneficial in that it afforded the company more resources for competing with the other tech giants.

Reasons for success

Slack’s success came as a result of consistent effort and smart and timely business moves made in the years prior to 2020. First off, Slack boasts an incredibly appealing design. Enterprise software is notorious for being dull, boring, and lifeless. To stand out, Slack hired design firm MetLab to turn its early prototype into a thing of beauty.

A huge part of Slack's consistent success over the years can be attributed to its adoption of the freemium model. With this model, customers start off as non-paying users. They then upgrade to become paying customers if they want to access more advanced functionality. Slack took the freemium model to an extreme by packing the no-cost version with essential features for teams. The only real differences between the paid and free version are the number of messages that can be searched or indexed, and how many integrations teams can connect to. By making a huge chunk of Slack's functionality available for freemium users, the company was able to appeal to small and mid-sized teams interested in buying the product.

Integrations also make Slack an effective collaboration tool because they allow it to bring work into a centralized location. As of 2019, Slack allowed paying users to connect to over 1,500 apps in its directory (now over 2,400), as well as hundreds of thousands of custom applications and integrations. Customers with more integrations within their product appear to be willing to pay between 10 and 30% more than those without integrations, as we found in a ProfitWell study.

Another reason for success is Slack’s "magic number." Slack knows that users who send 2,000 messages are much more likely to stick around and end up paying for the product, helping to identify targets for expansion. The free tier is set up so that users can search 10,000 of their team’s messages. This might seem like a lot, but as companies grow, more and more messages are being sent. Top that off with a 10-app integration limit. As companies need more integrations and send more messages, upgrading to the paid plan makes a lot of sense. When you grow, Slack grows.

And Slack needs this growth especially with the opposition they're up against. For one, both Google and Microsoft have tools that are already widely used by SaaS operators. It’s easier to convert users when they are already in your ecosystem. Further, Google, Microsoft, and Meta boast full-fledged video conferencing features, an area which Slack has yet to perfect.

Slack was growing at a ridiculous pace and boasted over 10 million active users by the end of 2019. In the two weeks following the World Health Organization's (WHO) announcement of an international pandemic, Slack's customer base grew by a whopping 25%, with tweets from CEO Stewart Butterfield stating that the platform had added another two million users. Facebook Workplace saw its user base improve by two million from May 2020 to May 2021. Microsoft Teams, on the other hand, claimed 70 million additional subscribers from April of 2020 to April of 2021.

So that’s it right? Game, set, match? Microsoft takes the crown? Not exactly. Microsoft includes Teams with Office 365. So users of Office 365 may not even be using Microsoft Teams, and instead supplementing it with Slack. Butterfield has said that many Slack customers use the 365 suite. However, it’s gotten heated enough that Slack has a pending antitrust complaint against Microsoft in the EU. Slack argues that Microsoft is using Office's market superiority to force millions of people to utilize Teams through this bundle. Whether or not that complaint will succeed in court remains to be seen. What is clear is that Microsoft, as well as Meta, pose a serious threat to Slack’s success. If their products are “good enough” it’s easy for them to convert a user base that is already hooked up.

Summary

For folks running a SaaS business, internal communication tools like Slack are more or less a no-brainer. We’ve come a long way since Murray Turoff’s initial try. Aside from promoting seamless communication between employees while in and out of the office, these tools help keep people engaged, motivated, and properly aligned with company culture and goals. Specifically, Slack drives the workplace in a way no other tool can, all while empowering real, meaningful team interactions that move the needle for any organization that cares to adopt it.

But Slack needs to be on their toes and fend off competition if it dreams of retaining its position as the leader of the workplace communication market. They need to maintain focus on customer-centric app functionalities. Providing a strong video conferencing feature would be a huge plus. While Slack may not be able to tap into users like Microsoft does with 365, the backing of the Salesforce customer base should prove fruitful.

Ultimately, the winner of the collaboration war is going to be the solution that makes it easiest for people to work together. With Google, Meta, Microsoft, and Slack all putting their best foot forward, it'll be interesting to see how this war plays out in the days to come. Who do you think will come out on top?

Do us a favor?

Part of the way we measure success is by seeing if our content is shareable. If you got value from this episode and write up, we'd appreciate a share on Twitter or LinkedIn.

1

00:00:00,366 --> 00:00:01,199

(Slack notification sound)

2

00:00:01,199 --> 00:00:02,340

- [Ben] Did you hear that?

3

00:00:02,340 --> 00:00:05,970

Did that sound just give you

just a little bit of anxiety?

4

00:00:05,970 --> 00:00:07,620

Maybe you fearfully checked your phone,

5

00:00:07,620 --> 00:00:09,420

or you got excited that someone was

6

00:00:09,420 --> 00:00:11,040

finally getting back to you.

7

00:00:11,040 --> 00:00:11,910

Whatever it was,

8

00:00:11,910 --> 00:00:14,490

I'm sure that you are familiar with Slack.

9

00:00:14,490 --> 00:00:16,470

- Slack is a lot more than just team chat.

10

00:00:16,470 --> 00:00:17,430

- Messaging is viral.

11

00:00:17,430 --> 00:00:18,263

- With Slack!

12

00:00:18,263 --> 00:00:19,740

- Can Microsoft end off Slack?

13

00:00:19,740 --> 00:00:21,360

- Slack is the fastest

growing SaaS company,

14

00:00:21,360 --> 00:00:22,770

possibly of all time.

15

00:00:22,770 --> 00:00:25,620

While Slack is inherently a

business communication tool,

16

00:00:25,620 --> 00:00:28,770

its value lies in how it

helps people work together.

17

00:00:28,770 --> 00:00:30,420

Slack has owned this niche for years

18

00:00:30,420 --> 00:00:33,480

and managed to get a grip on

the market before mega corps

19

00:00:33,480 --> 00:00:35,820

like Google, Meta, and, Microsoft.

20

00:00:35,820 --> 00:00:39,330

Slack is now integrated into

the Salesforce ecosystem,

21

00:00:39,330 --> 00:00:41,880

joining the company in a near-$30 billion

22

00:00:41,880 --> 00:00:43,920

acquisition in 2021.

23

00:00:43,920 --> 00:00:45,690

As we speak, though, a battle is brewing

24

00:00:45,690 --> 00:00:47,010

between these companies.

25

00:00:47,010 --> 00:00:48,720

Yes, Slack is leading the way,

26

00:00:48,720 --> 00:00:50,700

but will it always be able

to fend off the threat

27

00:00:50,700 --> 00:00:52,890

that Google, Meta, and Microsoft pose?

28

00:00:52,890 --> 00:00:54,720

If you have thoughts,

make sure you let me know

29

00:00:54,720 --> 00:00:56,010

in the comments down below.

30

00:00:56,010 --> 00:00:58,440

Let's dive deep into

the origins of this kind

31

00:00:58,440 --> 00:01:01,830

of communication, early industry

beginnings, and finally,

32

00:01:01,830 --> 00:01:05,010

what makes Slack such a

prime example to learn from?

33

00:01:05,010 --> 00:01:07,023

I'm Ben Hillman, and this is Verticals.

34

00:01:09,720 --> 00:01:11,820

The main purpose of tools

like Slack is to ensure

35

00:01:11,820 --> 00:01:13,800

that all employees not only communicate

36

00:01:13,800 --> 00:01:16,350

but also collaborate in

a highly efficient manner

37

00:01:16,350 --> 00:01:18,150

through a variety of

methods that go beyond

38

00:01:18,150 --> 00:01:20,580

merely sending and receiving messages.

39

00:01:20,580 --> 00:01:22,260

One of the earliest instances of this sort

40

00:01:22,260 --> 00:01:25,830

of collaboration can be attributed

to an American president.

41

00:01:25,830 --> 00:01:28,650

On August 15th, 1971,

Richard Nixon announced

42

00:01:28,650 --> 00:01:31,170

a 90-day wage price

freeze in an attempt to

43

00:01:31,170 --> 00:01:32,970

ease an inflationary boom.

44

00:01:32,970 --> 00:01:35,970

- [Nixon] I am today ordering a freeze.

45

00:01:35,970 --> 00:01:38,370

- [Ben] At the time, the Office

of Emergency Preparedness

46

00:01:38,370 --> 00:01:40,650

was an office that advised

and assisted the president

47

00:01:40,650 --> 00:01:43,920

in all things involving

emergency preparedness policy.

48

00:01:43,920 --> 00:01:45,870

They were basically a predecessor to FEMA.

49

00:01:45,870 --> 00:01:48,120

The OEP director led a conference call

50

00:01:48,120 --> 00:01:50,647

with 25 regional officers.

51

00:01:50,647 --> 00:01:53,370

"Anyone have any problems?" He asked.

52

00:01:53,370 --> 00:01:55,830

This was largely greeted with silence.

53

00:01:55,830 --> 00:01:57,870

The OEP needed to exchange information

54

00:01:57,870 --> 00:02:00,240

between academics and networking experts

55

00:02:00,240 --> 00:02:01,260

that could help the government

56

00:02:01,260 --> 00:02:03,390

better respond to a situation.

57

00:02:03,390 --> 00:02:06,360

A conference call was not going to cut it.

58

00:02:06,360 --> 00:02:09,420

Murray Turoff was a computer

scientist working in the OEP.

59

00:02:09,420 --> 00:02:11,580

After the call, he took a teletype home,

60

00:02:11,580 --> 00:02:13,770

worked around the clock,

and four days later

61

00:02:13,770 --> 00:02:15,930

came back with a working version of the

62

00:02:15,930 --> 00:02:19,410

Emergency Management Information

Systems and Reference Index

63

00:02:19,410 --> 00:02:20,430

or EMISARI.

64

00:02:20,430 --> 00:02:22,710

Don't worry, you don't need

to remember that acronym.

65

00:02:22,710 --> 00:02:23,790

But this made it possible

66

00:02:23,790 --> 00:02:25,620

for participants to submit responses

67

00:02:25,620 --> 00:02:28,110

at any time and at any

point in the discussion.

68

00:02:28,110 --> 00:02:30,030

They made it possible

for the OEP to ensure

69

00:02:30,030 --> 00:02:33,720

that policy interpretation

was correct in all regions.

70

00:02:33,720 --> 00:02:35,700

Slack didn't exist yet, and Murray Turoff

71

00:02:35,700 --> 00:02:38,550

didn't invent Slack, but he

managed to see the future

72

00:02:38,550 --> 00:02:40,290

and is largely credited with pioneering

73

00:02:40,290 --> 00:02:42,180

the chat and collaboration space.

74

00:02:42,180 --> 00:02:44,400

It wasn't until the 1990s

that commercial products

75

00:02:44,400 --> 00:02:45,510

started to emerge.

76

00:02:45,510 --> 00:02:48,780

We saw the likes of AOL

Instant Messenger in 1997,

77

00:02:48,780 --> 00:02:53,280

Yahoo Pager in 1998, and

Microsoft's MSN Messenger in 1999.

78

00:02:53,280 --> 00:02:55,680

It wasn't until instant

messaging became ingrained

79

00:02:55,680 --> 00:02:59,490

in our everyday actions like

checking social media, email,

80

00:02:59,490 --> 00:03:01,920

and using mobile devices

that these chat platforms

81

00:03:01,920 --> 00:03:03,390

truly gain traction.

82

00:03:03,390 --> 00:03:05,790

It's important to note, though,

that while instant messaging

83

00:03:05,790 --> 00:03:08,580

became an everyday application in 2000s

84

00:03:08,580 --> 00:03:10,800

and then the early 2010s,

85

00:03:10,800 --> 00:03:12,900

no company had quite cracked the code

86

00:03:12,900 --> 00:03:14,910

or even realized how to use it

87

00:03:14,910 --> 00:03:17,010

within the business world effectively.

88

00:03:17,010 --> 00:03:19,383

All of that was about to change in 2014.

89

00:03:20,820 --> 00:03:23,250

Stewart Butterfield was

working on a game called Glitch

90

00:03:23,250 --> 00:03:25,110

with his team at Tiny Spec.

91

00:03:25,110 --> 00:03:27,780

They used an internal

communication tool to communicate

92

00:03:27,780 --> 00:03:29,220

across offices.

93

00:03:29,220 --> 00:03:31,830

- The intention is that the

experience is very social.

94

00:03:31,830 --> 00:03:33,900

- Initially, Butterfield had no intention

95

00:03:33,900 --> 00:03:36,600

of commercializing the new platform, but

96

00:03:36,600 --> 00:03:38,760

upon realizing that he had something more

97

00:03:38,760 --> 00:03:41,100

than just an internal communications tool

98

00:03:41,100 --> 00:03:44,280

on his hands, Glitch was ditched.

99

00:03:44,280 --> 00:03:46,170

In order to make the

tool more market-worthy

100

00:03:46,170 --> 00:03:48,330

through refinement,

Butterfield and his team

101

00:03:48,330 --> 00:03:50,880

cajoled their friends

to try out the product.

102

00:03:50,880 --> 00:03:53,700

Before long, much bigger

teams were demoing Tiny Specs'

103

00:03:53,700 --> 00:03:55,380

newest invention willingly.

104

00:03:55,380 --> 00:03:57,300

While the tool itself

was first made available

105

00:03:57,300 --> 00:04:00,150

to the public in February

of 2013, it wasn't

106

00:04:00,150 --> 00:04:03,450

until August of that year

that it gained another name:

107

00:04:03,450 --> 00:04:04,320

Slack.

108

00:04:04,320 --> 00:04:05,340

Within a day of its launch,

109

00:04:05,340 --> 00:04:08,730

the new communication tool had

racked up over 8,000 signups.

110

00:04:08,730 --> 00:04:12,630

By April of 2014, Slack had

more than 15,000 paid users

111

00:04:12,630 --> 00:04:15,300

and 60,000 daily active users.

112

00:04:15,300 --> 00:04:18,390

One year later, Slack was

worth nearly $3 billion

113

00:04:18,390 --> 00:04:21,660

and boasted more than

750,000 active users.

114

00:04:21,660 --> 00:04:23,820

What started as an internal

communications tool

115

00:04:23,820 --> 00:04:27,540

was swiftly becoming a

promising, fast-growing entity.

116

00:04:27,540 --> 00:04:29,730

By 2016, Slack was reportedly being used

117

00:04:29,730 --> 00:04:33,240

by 77% of Fortune 100 companies.

118

00:04:33,240 --> 00:04:36,480

The period between 2016 and

2020 was a defining moment

119

00:04:36,480 --> 00:04:38,160

in the history of Slack.

120

00:04:38,160 --> 00:04:40,860

Slack added more features

including credit messaging

121

00:04:40,860 --> 00:04:42,390

and Slack Connect.

122

00:04:42,390 --> 00:04:45,660

The company also launched

50 plus integrations as part

123

00:04:45,660 --> 00:04:49,050

of its ever-growing

developers-inspired app directory.

124

00:04:49,050 --> 00:04:52,830

In June of 2019, Slack finally went public

125

00:04:52,830 --> 00:04:55,590

with its DPO of non-conventional IPO,

126

00:04:55,590 --> 00:04:59,370

the Butterfield-led company

was now valued at $19 billion.

127

00:04:59,370 --> 00:05:02,160

Given that Slack virtually

had no competition early on

128

00:05:02,160 --> 00:05:04,110

in the collaboration tools market,

129

00:05:04,110 --> 00:05:06,480

big league legacy companies

saw the opportunity to

130

00:05:06,480 --> 00:05:08,880

take advantage of Slack's success.

131

00:05:08,880 --> 00:05:12,030

These companies had prior

experience running IM programs

132

00:05:12,030 --> 00:05:13,650

in the 1990s and 2000s,

133

00:05:13,650 --> 00:05:17,160

so they were able to enter

the market relatively quickly.

134

00:05:17,160 --> 00:05:21,270

Facebook, now Meta, launched

Workplace in October of 2016,

135

00:05:21,270 --> 00:05:24,000

Microsoft launched Teams in March of 2017,

136

00:05:24,000 --> 00:05:28,470

and finally came Google with

Workspace in October of 2020.

137

00:05:28,470 --> 00:05:30,720

Out of all three, it's

Microsoft Teams that has

138

00:05:30,720 --> 00:05:33,060

truly been able to give

Slack a run for its money,

139

00:05:33,060 --> 00:05:35,730

but we'll talk about them in a bit.

140

00:05:35,730 --> 00:05:38,910

In 2020, Salesforce announced

plans to acquire Slack

141

00:05:38,910 --> 00:05:42,150

for a cool $27.7 billion.

142

00:05:42,150 --> 00:05:44,880

For Slack, the merger was

incredibly beneficial in that

143

00:05:44,880 --> 00:05:47,370

it afforded the company

more resources for competing

144

00:05:47,370 --> 00:05:48,903

with the other tech giants.

145

00:05:50,940 --> 00:05:52,830

A huge part of Slack's consistent success

146

00:05:52,830 --> 00:05:54,030

over the years can be attributed

147

00:05:54,030 --> 00:05:56,010

to its adoption of the freemium model.

148

00:05:56,010 --> 00:05:58,350

Slack took the freemium

model to an extreme

149

00:05:58,350 --> 00:05:59,880

by packing the no-cost version

150

00:05:59,880 --> 00:06:02,100

with essential features for teams.

151

00:06:02,100 --> 00:06:04,710

The only real differences

between the paid and free version

152

00:06:04,710 --> 00:06:07,590

are the number of messages

that can be searched or indexed

153

00:06:07,590 --> 00:06:10,800

and how many integrations

teams can connect to.

154

00:06:10,800 --> 00:06:14,190

By making a huge chunk of

Slack's functionality available

155

00:06:14,190 --> 00:06:17,010

for free users, the

company was able to appeal

156

00:06:17,010 --> 00:06:19,470

to small and mid-sized teams interested

157

00:06:19,470 --> 00:06:21,180

in buying their product early on.

158

00:06:21,180 --> 00:06:24,090

Integrations also make Slack

an effective collaboration tool

159

00:06:24,090 --> 00:06:25,770

because they allow it to bring work

160

00:06:25,770 --> 00:06:27,840

into a centralized location.

161

00:06:27,840 --> 00:06:30,600

As of 2019, Slack allowed

paying users to connect

162

00:06:30,600 --> 00:06:33,930

to over 1500 apps in its

directory, as well as hundreds

163

00:06:33,930 --> 00:06:37,050

of thousands of custom

applications and integrations.

164

00:06:37,050 --> 00:06:39,510

Customers with more integrations

within their product

165

00:06:39,510 --> 00:06:43,290

appear to be willing to

pay between 10 and 30% more

166

00:06:43,290 --> 00:06:44,820

than those without integrations,

167

00:06:44,820 --> 00:06:47,550

as we found in a ProfitWell study.

168

00:06:47,550 --> 00:06:50,520

Another reason for its success

is Slack's Magic Number.

169

00:06:50,520 --> 00:06:52,920

Slack knows that users

who send 2000 messages

170

00:06:52,920 --> 00:06:55,530

are much more likely to stick

around and end up paying

171

00:06:55,530 --> 00:06:59,460

for the product, helping to

identify targets for expansion.

172

00:06:59,460 --> 00:07:01,590

The free tier allows for a 90 day period

173

00:07:01,590 --> 00:07:03,390

before messages are deleted.

174

00:07:03,390 --> 00:07:05,580

I know that this might

seem like a lot, but

175

00:07:05,580 --> 00:07:09,030

as companies grow, more and

more messages are being sent.

176

00:07:09,030 --> 00:07:11,640

Top that off with a 10

app integration limit,

177

00:07:11,640 --> 00:07:13,170

these companies need more integrations

178

00:07:13,170 --> 00:07:15,150

and need to send more messages.

179

00:07:15,150 --> 00:07:18,150

Upgrading to the paid

plan makes a lot of sense.

180

00:07:18,150 --> 00:07:21,240

When you grow, Slack grows,

and Slack needs this growth,

181

00:07:21,240 --> 00:07:23,460

especially with the opposition

they are up against.

182

00:07:23,460 --> 00:07:25,680

For one, both Google

and Microsoft have tools

183

00:07:25,680 --> 00:07:27,930

that are already widely

used by SaaS operators.

184

00:07:27,930 --> 00:07:31,080

Further, Google, Microsoft, and Meta boast

185

00:07:31,080 --> 00:07:33,300

full-fledged video conferencing features,

186

00:07:33,300 --> 00:07:35,820

an area which Slack has yet to perfect.

187

00:07:35,820 --> 00:07:37,380

Slack was growing at a ridiculous pace

188

00:07:37,380 --> 00:07:41,100

and boasted over 10 million

active users by the end of 2019.

189

00:07:41,100 --> 00:07:43,230

In the two weeks following

the WHO's announcement

190

00:07:43,230 --> 00:07:46,050

of an International Pandemic,

Slack's customer base grew

191

00:07:46,050 --> 00:07:48,360

by a whopping 25%

192

00:07:48,360 --> 00:07:51,120

with tweets from CEO Stewart

Butterfield confirming

193

00:07:51,120 --> 00:07:54,960

that the platform had added

another 2 million users.

194

00:07:54,960 --> 00:07:56,940

Facebook Workplace saw

its user base improve

195

00:07:56,940 --> 00:08:00,483

by 2 million from May

of 2020 to May of 2021.

196

00:08:01,530 --> 00:08:03,540

Microsoft Teams, on the other hand,

197

00:08:03,540 --> 00:08:06,000

claimed 70 million additional subscribers

198

00:08:06,000 --> 00:08:09,513

from April of 2020 to April of 2021.

199

00:08:10,680 --> 00:08:12,090

So that's it, right?

200

00:08:12,090 --> 00:08:13,110

Game set match?

201

00:08:13,110 --> 00:08:15,180

Microsoft takes the crown?

202

00:08:15,180 --> 00:08:16,170

Well ...

203

00:08:16,170 --> 00:08:17,670

Not exactly.

204

00:08:17,670 --> 00:08:20,670

Microsoft includes Teams

with Office 365, so users

205

00:08:20,670 --> 00:08:24,090

of Office 365 may not even

be using Microsoft Teams

206

00:08:24,090 --> 00:08:26,520

and instead, supplementing with Slack.

207

00:08:26,520 --> 00:08:29,250

Stewart Butterfield has said

that many Slack customers

208

00:08:29,250 --> 00:08:31,620

use the 365 Suite.

209

00:08:31,620 --> 00:08:33,510

However, it's gotten heated enough

210

00:08:33,510 --> 00:08:35,580

that Slack has a pending

antitrust complaint

211

00:08:35,580 --> 00:08:38,070

against Microsoft in the EU.

212

00:08:38,070 --> 00:08:40,380

Slack argues that

Microsoft is using Office's

213

00:08:40,380 --> 00:08:42,750

market superiority to

force millions of people

214

00:08:42,750 --> 00:08:45,480

to utilize Teams through its bundle.

215

00:08:45,480 --> 00:08:47,400

Whether or not that complaint will succeed

216

00:08:47,400 --> 00:08:49,020

in court remains to be seen,

217

00:08:49,020 --> 00:08:52,560

but what is clear is that

Microsoft, as well as Meta,

218

00:08:52,560 --> 00:08:55,320

pose a serious threat to Slack's success.

219

00:08:55,320 --> 00:08:57,930

If their products are just

good enough, it's easy

220

00:08:57,930 --> 00:09:00,330

for them to convert a user

base that is already hooked

221

00:09:00,330 --> 00:09:01,473

up to their ecosystem.

222

00:09:03,330 --> 00:09:05,100

For folks running a SaaS business,

223

00:09:05,100 --> 00:09:07,020

internal communication tools like Slack

224

00:09:07,020 --> 00:09:08,790

are more or less a no-brainer.

225

00:09:08,790 --> 00:09:11,940

We've come a long way since

Murray Turoff's initial try.

226

00:09:11,940 --> 00:09:14,010

Aside from promoting

seamless communication

227

00:09:14,010 --> 00:09:16,470

between employees while

in and out of the office,

228

00:09:16,470 --> 00:09:19,290

these tools help keep

people engaged, motivated,

229

00:09:19,290 --> 00:09:22,440

and properly aligned with the

company culture and goals,

230

00:09:22,440 --> 00:09:24,270

but Slack needs to be

on their toes and fend

231

00:09:24,270 --> 00:09:26,940

off competition if it dreams

of retaining its position

232

00:09:26,940 --> 00:09:29,970

as a leader of the workplace

collaboration market.

233

00:09:29,970 --> 00:09:31,500

They need to maintain focus on a

234

00:09:31,500 --> 00:09:33,660

customer-centric app functionalities,

235

00:09:33,660 --> 00:09:35,670

providing a strong video

conferencing feature

236

00:09:35,670 --> 00:09:38,070

would be a huge plus, for starters.

237

00:09:38,070 --> 00:09:40,260

Ultimately, the winner

of the collaboration war

238

00:09:40,260 --> 00:09:42,090

is going to be the solution

that makes it easiest

239

00:09:42,090 --> 00:09:43,830

for people to work together.

240

00:09:43,830 --> 00:09:46,440

With Google, Meta, Microsoft, and Slack

241

00:09:46,440 --> 00:09:48,570

all putting their best foot forward,

242

00:09:48,570 --> 00:09:50,430

it'll be interesting to

see how this war plays

243

00:09:50,430 --> 00:09:51,660

out in the days to come.

244

00:09:51,660 --> 00:09:53,670

Which one do you think

will come out on top?

245

00:09:53,670 --> 00:09:56,640

Will Slack maintain its

place as position leader?

246

00:09:56,640 --> 00:09:58,380

Let me know when the comments down below.

247

00:09:58,380 --> 00:10:01,383

From Paddle, I'm Ben Hillman,

and I'll see you next time.