When Microsoft double-crossed Intuit

Hefty fines and prison time. That’s what’ll happen if you don’t have your books in order. You need someone to prevent all the inaccuracies, outdated reports, and unverifiable data that ultimately makes your back office a living hell. It’s a job that often goes thankless. Thankfully there’s an entire segment of businesses that exist to help you out.

At the beginning of 2020, the accounting software market as a whole was valued at $11.9 billion. And it's projected to reach $70 billion by 2030. Several companies are jostling for the ultimate crown like Xero, Sage, and Zoho. But one company has been in the game longer than most.

Today, Intuit has a vast SaaS product line from QuickBooks to Mint, to their recent acquisition of MailChimp in 2021. But not too long ago, they endured a decades-long battle with Microsoft in an effort to win the top spot in bookkeeping.

At one point, the war seemed to be over before it could truly begin, but something happened that forced Intuit to fend off Microsoft in any way that only they could. The result of which gives folks running their own SaaS company many examples to learn from.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

Lessons from the Top

Managing business finances is not typically something most business owners look forward to, but it is absolutely necessary in order to run a successful business. In fact, improperly managing your financials will not only be a living hell for you, but you'll likely not have a business for long. There are serious legal implications associated with non compliance and/or improper record keeping. However, the complexities of business accounting are intimidating and are only getting more complicated with time.

Luckily, Intuit understood the intricacies of accounting as well as how the evolution and expansion of technology could facilitate this complex process. Intuit's ability to evolve and transform in line with customers' needs is what makes Intuit an undisputed leader in the accounting software market today, leaving Microsoft in the dirt.

- A solid business model

Intuit's business model was built with the foresight of constant transformation in the space due to the evolutionary nature of technology. It embraces and encourages innovation and transformation across the entire company. It's how the whole business operates. Because of this, hundreds of what started as experimental projects have become successful products or features. - Commitment to customer success & satisfaction

In SaaS, customer relationships are crucial. But nurturing those relationships and maintaining long-term customer satisfaction is not easy. You have to stay close and actively listen to their needs. Intuit's commitment to ensuring its customers are successful, not only in using its product, but that their business as a whole is being set up to succeed, has been key to Intuit's growth and success.

Intuit has been very strategic when it comes to product developments, integrations, and acquisitions. All of these have perfectly aligned to offer a well-rounded solution that better serves its customers. - Make your product a household name

Never underestimate the power of consumer marketing. You may not think of marketing your SaaS product or service as you would a laundry detergent or cereal brand, but maybe you should. In the case of Intuit, its investment in making Quicken a household name paid off big. It was one of the main reasons it was able to defeat a giant like Microsoft.

Background

Today, the flexibility of reporting features in some modern accounting software tools allows you to stay compliant with the complex and ever-changing global tax laws. Payments expert Digital River predicts that within a few years, "nearly every tax authority will have some form of real-time reporting requirement and will likely have a way to plug into a financial system and collect information on a real-time basis." But it wasn’t always as easy as we make it at Paddle.

Accounting dates back thousands of years and has been used in many parts of the world from Mesopotamian civilizations to Italian accounting pioneer, Luca Pacioli, in 1494. But accounting as we know it today started sometime in the last century.

In 1983, Scott Cook went to Stanford University and placed an advertisement for a programmer position. While there, he bumped into Tom Proulx. Proulx agreed to write a simple check-balancing program for Cook. In his dorm, Proulx created the first Quicken program, which he and Scott used to launch Intuit.

After a few difficult years of trying to popularize the product to no avail, Quicken's Apple version finally started to get positive attention. Consequently, sales hiked. By the late 1980's, Quicken had become one of the best-selling personal accounting software solutions around. Suddenly, Intuit had little problem securing financing. By 1991, the company's sales had skyrocketed to $55 million, up from just $20 million three years earlier.

In 1993, Intuit went public. By this time, Microsoft had launched their own product to compete with Quicken, releasing Microsoft Money in 1991. Realizing that Intuit was in the lead, Microsoft made an offer that they couldn’t refuse.

Early Leaders

In October of 1994, Microsoft offered to purchase Intuit in a stock swap for $1.5 Billion. At the time, it was Microsoft’s largest acquisition ever. Speaking of the acquisition, Bill Gates said "Intuit is a phenomenal company and it is a unique situation where the sum is greater than the parts. Certainly managing finances, in the broadest sense, is one of the major opportunities that the electronic world will present. That is a major part of the future of software and Microsoft wants to be there."

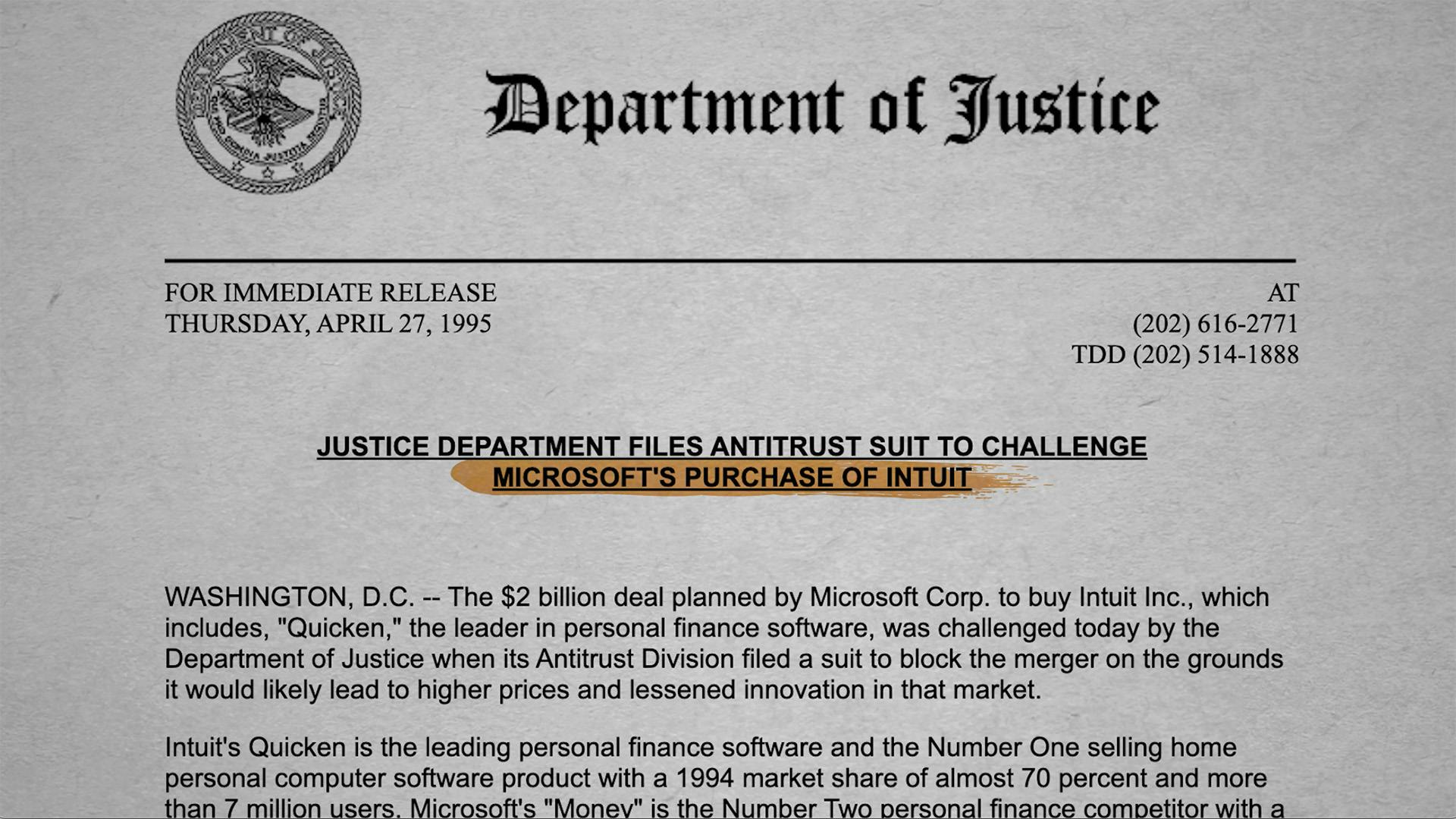

This victory, however, would be short lived. The US Department of Justice sued to block the deal citing that it would effectively give Microsoft a Monopoly of the personal finance market. In their research, the Justice Department found that Intuit’s Quicken commanded 69% of the market, while Microsoft Money had 22 percent. Ultimately, Microsoft decided to pull out of the deal. During negotiations, Bill Gates reportedly told Scott Cook that if Scott fought the merger, he would use the sum that would have gone toward the acquisition towards battling Intuit.

Microsoft went all out to try and dethrone Intuit. The company added a ton of partners, revamped the product's design, and tried to integrate a host of new financial planning tools.

Intuit, on the other hand, had the advantage of QuickBooks, Intended to offer small business owners the same flexibility, structure, and compliance as Quicken did for individuals. And in 2000, the software was improved to include audit trails, double entries, and other industry-level compliant items.

That same year, The Wall Street Journal reviewer, Walt Mossberg, gave Microsoft Money the edge over Quicken. However, even with this positive review, Money never truly managed to overtake Intuit.

Microsoft tried one last time, in 2005, to outmaneuver Intuit with the launch of Small Business Accounting to rival QuickBooks. But like all the previous episodes, the move backfired badly. "They've come up against Intuit six times in the past, and each time they have retreated with a bloody nose," Intuit VP Dan Levin said.

In 2009, Microsoft announced that Microsoft Money would no longer be available for purchase. Competition had been fierce but, ultimately, Intuit won out. It was somewhat surprising that Intuit succeeded, especially considering many computer makers pre-loaded Microsoft Money on new PCs. So, what were the key differences that made Intuit soar and Microsoft plunge?

Reasons for success

The main reason Intuit knocked out Microsoft Money is because they continued to get closer and closer to the customer, including going above and beyond to correct errors.

In 1987, for instance, Intuit got complaints from Quicken customers who were only getting the message "getcache" on the screen when trying to record a transaction. This was back when Intuit was strictly an on-prem solution. Twenty thousand copies had already been sold. So Intuit staff created 20,000 bug-free disks and mailed one to every customer. As a result, customer satisfaction increased.

Additionally, Intuit has made it its mission to pursue strategic acquisitions that play to this overarching goal. Acquiring platforms like Credit Karma, Mint.com, and Mailchimp are aimed at solving pain points tangentially related to Intuit's core accounting offering. Credit Karma allows the company to give folks their credit score, which makes the product sticky. Mint is an automatic tracker of finances, which plugs right into Intuit’s tax software. Mailchimp is a fantastic tool that helps small businesses run more efficiently (For more on Mailchimp, you can check out our previous episode about how Mailchimp gets your email past the spam filter).

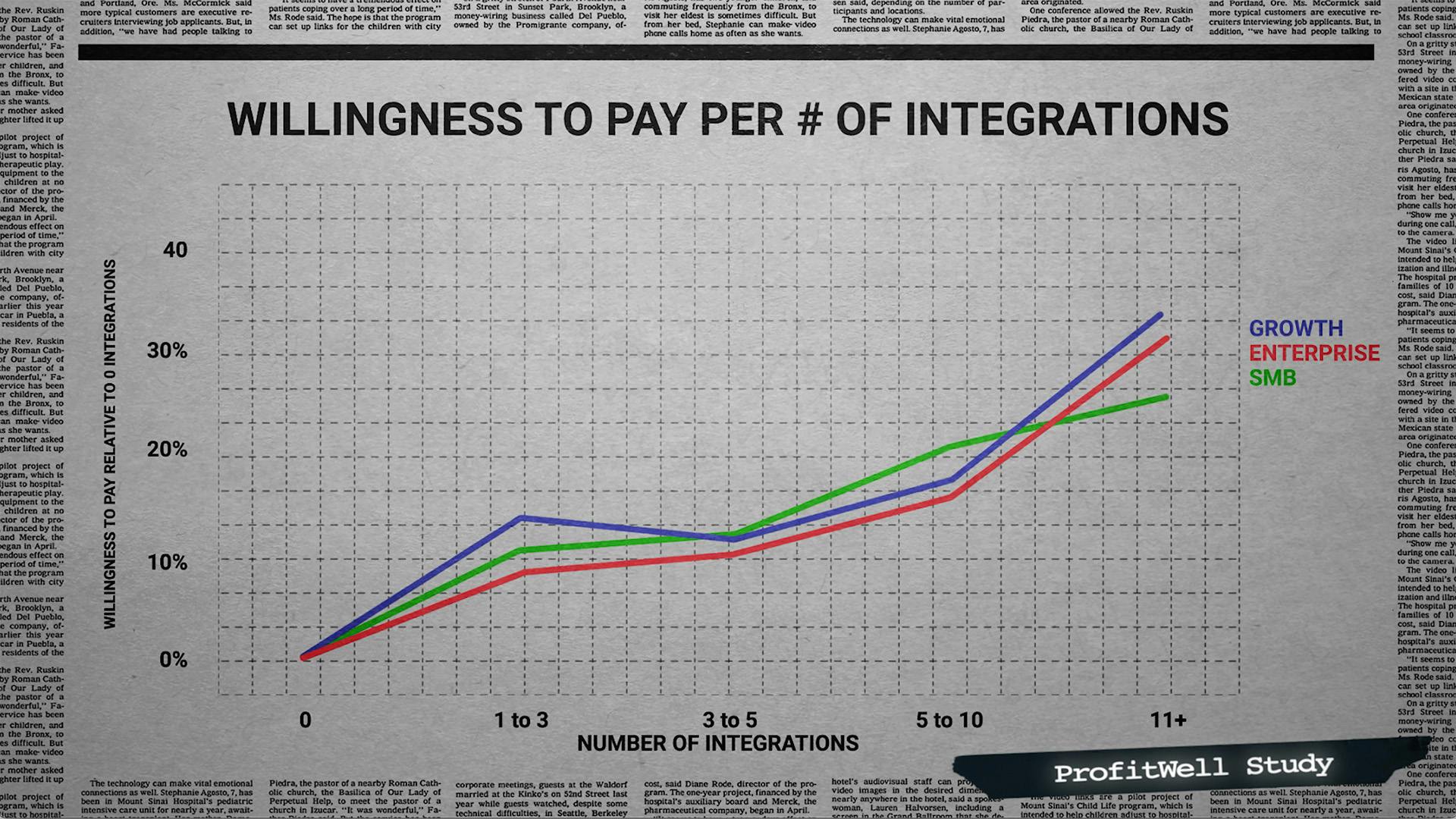

In 2011, further expanding on its well-rounded solution offering, the company also launched a platform called Intuit Anywhere, which allowed customers to try out different integrations within the QuickBooks Online ecosystem. Ultimately, this turned into the integrations Intuit offers today with options like Shopify, gusto, and even Etsy. Integrations are important — in a ProfitWell study, we found that customers with more integrations within their product appear to be willing to pay between 10 and 30% more than those without integrations.

Another factor that helps Intuit stay fresh is they hold on to the startup mindset. They emphasize experimentation including encouraging engineers to use unstructured time to spend on projects of their own choosing. According to then CTO Tayloe Stansbury in 2013, about 300 of those projects turned into products or features of existing products. It’s simple, by encouraging innovation, Intuit is gaining innovation.

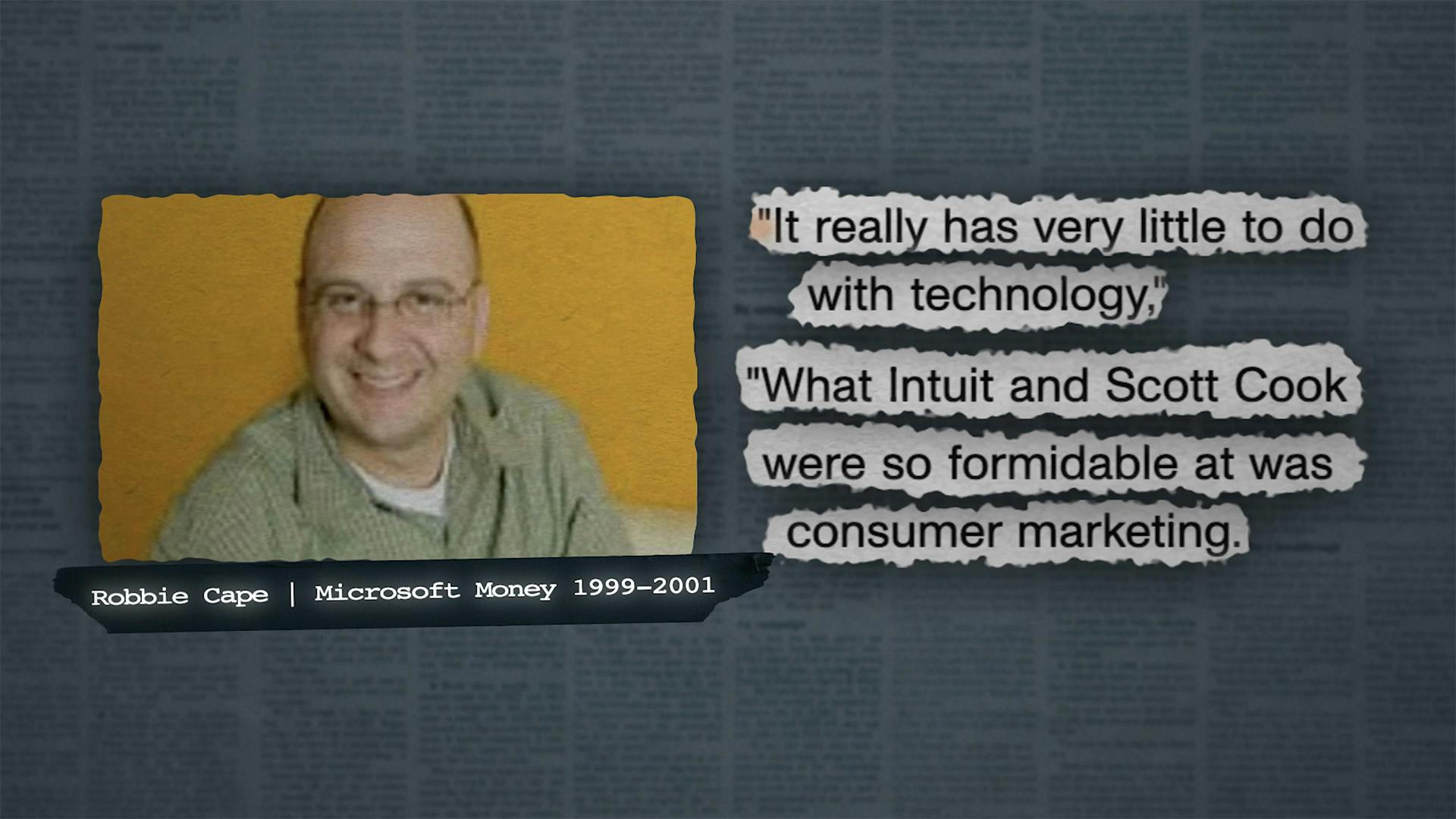

But perhaps the greatest reason Microsoft lost to Intuit is because of their efforts in marketing. Robbie Cape ran Microsoft Money from 1999-2001. He said “It really has very little to do with technology. What Intuit and Scott Cook were so formidable at was consumer marketing. He treated marketing Intuit very much the same way as one would treat marketing a bar of soap or bottle of shampoo. He made Quicken a household name.”

Summary

Today, over 29 million small business owners in the US use QuickBooks to manage their finances. Intuit didn't become the undisputed king of the accounting software space by luck. In retrospect, it's the company's desire to get closer and closer to the customer that got it to its current position. It was able to pull off this feat despite the heavy competition posed by Microsoft, a much bigger company than itself. Today, Intuit is comfortably one of the most valuable SaaS companies out there, with a market cap of $137.04 billion (as of 2020).

But, Intuit shouldn’t get too comfortable. There are still issues they must address within their products. Though Quickbooks is notable in the United States, the same can’t be said for the rest of the world. They have to watch out for folks like Xero in New Zealand, Zoho in India, and Sage in the UK. And while these companies have footings in their own countries, they are making waves abroad as well.

Additionally, the same marketing that turned Quicken into a household name got Intuit into some hot water in May of 2022. Their “free, free, free” ad campaign for TurboTax was found to be using deceptive tactics to drive low-income tax filers toward their services. This was instead of the free federally supported services, which this group qualified for. Intuit paid out a $141M settlement for this clever ad campaign.

Ultimately, a SaaS company that wishes to topple Intuit has to go a few extra miles beyond the incumbent. It must create a formidable relationship with customers and meet them where they are. What company do you think that will be? Xero? Sage? A newbie? Let me know what you think.

If you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

1

00:00:00,083 --> 00:00:02,419

- Justice Department

has charged Microsoft.

2

00:00:02,419 --> 00:00:03,795

- Intuit is best in the tax show.

3

00:00:03,795 --> 00:00:05,255

It's crushing H&R Block.

4

00:00:05,255 --> 00:00:07,382

- Hefty fines and prison time.

5

00:00:07,382 --> 00:00:09,843

That's what'll happen if you

don't have your books in order.

6

00:00:09,843 --> 00:00:11,886

You need someone to prevent

all the inaccuracies,

7

00:00:11,886 --> 00:00:14,389

outdated reports, and unverifiable data

8

00:00:14,389 --> 00:00:17,225

that ultimately makes your

back office a living hell.

9

00:00:17,225 --> 00:00:18,435

At the beginning of 2020,

10

00:00:18,435 --> 00:00:19,978

the accounting software market as a whole

11

00:00:19,978 --> 00:00:22,480

was valued at $11.9 billion

12

00:00:22,480 --> 00:00:25,483

and is projected to reach

over 70 billion by 2030.

13

00:00:25,900 --> 00:00:28,319

Several companies are jostling

for the ultimate crown

14

00:00:28,319 --> 00:00:30,697

like Zero, Sage and Zoho.

15

00:00:30,697 --> 00:00:33,324

But one company has been in

the game longer than most.

16

00:00:33,324 --> 00:00:34,159

- Intuit.

- Intuit.

17

00:00:34,159 --> 00:00:34,993

- Intuit.

18

00:00:34,993 --> 00:00:35,827

- I love those guys.

19

00:00:35,827 --> 00:00:37,746

- Today, Intuit has a

vast SaaS product line

20

00:00:37,746 --> 00:00:39,122

from TurboTax to Mint

21

00:00:39,122 --> 00:00:41,916

to their recent acquisition

of Mailchimp in 2021.

22

00:00:41,916 --> 00:00:43,126

But not too long ago,

23

00:00:43,126 --> 00:00:45,545

they endured a decades

long battle with Microsoft

24

00:00:45,545 --> 00:00:48,298

in an effort to win the

top spot in bookkeeping.

25

00:00:48,298 --> 00:00:50,592

At one point, the war seemed to be over

26

00:00:50,592 --> 00:00:52,302

before it could truly begin.

27

00:00:52,302 --> 00:00:53,970

But something happened that forced Intuit

28

00:00:53,970 --> 00:00:56,931

to fend off Microsoft in

any way that they could.

29

00:00:56,931 --> 00:00:58,266

The result of which gives folks

30

00:00:58,266 --> 00:01:01,478

running their own SaaS company

many examples to learn from.

31

00:01:01,478 --> 00:01:02,687

We'll get into all of that soon.

32

00:01:02,687 --> 00:01:04,606

But first, some background.

33

00:01:04,606 --> 00:01:06,900

I'm Ben Hillman and this is "Verticals".

34

00:01:10,403 --> 00:01:12,280

Accounting dates back thousands of years

35

00:01:12,280 --> 00:01:14,240

and has been used in

many parts of the world

36

00:01:14,240 --> 00:01:16,117

from Mesopotamian civilizations

37

00:01:16,117 --> 00:01:20,246

to Italian accounting

pioneer, Luca Paoli in 1494.

38

00:01:20,246 --> 00:01:22,165

But accounting as we know it today

39

00:01:22,165 --> 00:01:24,125

started some time in the last century.

40

00:01:25,210 --> 00:01:28,254

In 1983, Scott Cook went

to Stanford University

41

00:01:28,254 --> 00:01:31,007

and placed an advertisement

for a programmer position.

42

00:01:31,007 --> 00:01:32,884

While there, he bumped into Tom Proulx.

43

00:01:32,884 --> 00:01:35,762

Proulx agreed to write a

simple check balancing program

44

00:01:35,762 --> 00:01:39,432

for Cook which ended up

becoming the Quicken program.

45

00:01:39,432 --> 00:01:42,310

He and Scott used this to launch Intuit.

46

00:01:42,310 --> 00:01:43,561

After a few difficult years

47

00:01:43,561 --> 00:01:45,313

of trying to popularize the product,

48

00:01:45,313 --> 00:01:47,357

Quicken's Apple version finally started

49

00:01:47,357 --> 00:01:48,942

to get positive attention.

50

00:01:48,942 --> 00:01:51,152

Consequently, sales spiked.

51

00:01:51,152 --> 00:01:52,320

By the late 1980s,

52

00:01:52,320 --> 00:01:54,155

Quicken had become one of the best selling

53

00:01:54,155 --> 00:01:56,908

personal accounting

software solutions around.

54

00:01:56,908 --> 00:02:00,203

Suddenly, Intuit had a little

problem securing financing,

55

00:02:00,203 --> 00:02:02,038

courting several VCs.

56

00:02:02,038 --> 00:02:04,332

In 1993 Intuit went public.

57

00:02:04,332 --> 00:02:06,501

By this time, Microsoft had

launched their own product

58

00:02:06,501 --> 00:02:10,255

to compete with Quicken releasing

Microsoft Money in 1991.

59

00:02:10,255 --> 00:02:13,633

But realizing that Intuit

was in the lead by far,

60

00:02:13,633 --> 00:02:16,302

Microsoft made an offer

that they couldn't refuse.

61

00:02:17,554 --> 00:02:20,890

In October of 1994, Microsoft

offered to purchase Intuit

62

00:02:20,890 --> 00:02:24,144

in a stock swap for $1.5 billion.

63

00:02:24,144 --> 00:02:27,480

At the time, it was Microsoft's

largest acquisition ever.

64

00:02:27,480 --> 00:02:29,649

Speaking of the acquisition,

Bill Gates said,

65

00:02:29,649 --> 00:02:32,819

"Intuit is a phenomenal company

and it is a unique situation

66

00:02:32,819 --> 00:02:35,196

where the sum is greater than the parts.

67

00:02:35,196 --> 00:02:37,532

Certainly, managing finances

in the broadest sense

68

00:02:37,532 --> 00:02:40,118

is one of the major opportunities

that the electronic world

69

00:02:40,118 --> 00:02:42,370

will present, and

Microsoft wants to be there.”

70

00:02:42,370 --> 00:02:44,873

...And this victory will be shortlived.

71

00:02:44,873 --> 00:02:47,292

The US Department of Justice

sued to block the deal,

72

00:02:47,292 --> 00:02:49,419

citing that it would

effectively give Microsoft

73

00:02:49,419 --> 00:02:52,213

a monopoly of the personal finance market.

74

00:02:52,213 --> 00:02:53,882

In their research, the Justice Department

75

00:02:53,882 --> 00:02:57,427

found that Intuit's Quicken

commanded 69% of the market

76

00:02:57,427 --> 00:03:00,013

while Microsoft Money had 22%.

77

00:03:00,013 --> 00:03:02,891

Ultimately, Microsoft decided

to pull out of the deal.

78

00:03:02,891 --> 00:03:06,311

During negotiations, Bill Gates

reportedly told Scott Cook

79

00:03:06,311 --> 00:03:08,605

that if Scott fought the

merger, he would use the sum

80

00:03:08,605 --> 00:03:10,648

that would've gone

towards the acquisition,

81

00:03:10,648 --> 00:03:15,069

towards battling Intuit, and

the battle had just begun.

82

00:03:15,069 --> 00:03:18,156

Microsoft went all out to

try and dethrone Intuit.

83

00:03:18,156 --> 00:03:20,366

The company added a ton of partners,

84

00:03:20,366 --> 00:03:23,077

revamped the product's

design, and tried to integrate

85

00:03:23,077 --> 00:03:25,622

a host of new financial planning tools.

86

00:03:25,622 --> 00:03:29,000

An advantage that Intuit had

was its QuickBooks software

87

00:03:29,000 --> 00:03:30,793

intended to offer small business owners

88

00:03:30,793 --> 00:03:33,338

the same flexibility,

structure and compliance

89

00:03:33,338 --> 00:03:34,964

as Quicken did for individuals.

90

00:03:34,964 --> 00:03:37,675

- From the Make us of Quicken,

so you know it's easy to use.

91

00:03:37,675 --> 00:03:39,761

- And in 2000, the software was improved

92

00:03:39,761 --> 00:03:41,763

to include audit trials, double entries,

93

00:03:41,763 --> 00:03:44,098

and other industry level compliant items.

94

00:03:44,098 --> 00:03:46,809

- It integrates with

Microsoft Word and Excel.

95

00:03:46,809 --> 00:03:48,978

- That same year, Wall

Street Journal reviewer,

96

00:03:48,978 --> 00:03:52,690

Walt Mossberg gave Microsoft

Money the edge over Quicken.

97

00:03:52,690 --> 00:03:55,443

However, even with this positive review,

98

00:03:55,443 --> 00:03:58,363

Money never truly managed

to overtake Intuit.

99

00:03:58,363 --> 00:04:01,032

Microsoft tried one last time in 2005

100

00:04:01,032 --> 00:04:02,533

to outmaneuver Intuit.

101

00:04:02,533 --> 00:04:05,620

They launched Small Business

Accounting to rival QuickBooks.

102

00:04:05,620 --> 00:04:07,497

But like all the previous episodes,

103

00:04:07,497 --> 00:04:09,123

the moved backfired badly.

104

00:04:09,958 --> 00:04:13,253

Intuit VP Dan Levin said

they've come up against Intuit

105

00:04:13,253 --> 00:04:15,380

six times in the past and each time

106

00:04:15,380 --> 00:04:17,548

they've retreated with a bloody nose.

107

00:04:17,548 --> 00:04:20,051

It seems as if the battle had just ended.

108

00:04:21,427 --> 00:04:23,763

In 2009, Microsoft announced

that Microsoft Money

109

00:04:23,763 --> 00:04:25,807

would no longer be available for purchase.

110

00:04:25,807 --> 00:04:29,102

Competition had been fierce,

but ultimately Intuit went out.

111

00:04:29,102 --> 00:04:31,271

It was somewhat surprising

that Intuit succeeded

112

00:04:31,271 --> 00:04:33,356

especially considering

many computer makers

113

00:04:33,356 --> 00:04:35,817

preloaded Microsoft Money on new PCs.

114

00:04:35,817 --> 00:04:36,985

So, what were the key differences

115

00:04:36,985 --> 00:04:39,570

that made Intuit soar

and Microsoft plunge?

116

00:04:40,571 --> 00:04:42,907

The main reason that Intuit

knocked out Microsoft Money

117

00:04:42,907 --> 00:04:44,659

is because they've always continued

118

00:04:44,659 --> 00:04:47,120

to get closer and closer to the customer,

119

00:04:47,120 --> 00:04:50,206

including going above and

beyond to correct errors.

120

00:04:50,206 --> 00:04:52,875

In 1987, for instance,

Intuit got complaints

121

00:04:52,875 --> 00:04:55,295

from Quicken customers who

were only getting the message

122

00:04:55,295 --> 00:04:59,048

get cash on the screen when

trying to record a transaction.

123

00:04:59,048 --> 00:05:02,302

This was back when Intuit was

strictly an on-prem solution.

124

00:05:02,302 --> 00:05:04,804

20,000 copies had already been sold,

125

00:05:04,804 --> 00:05:08,016

so Intuit staff created

20,000 bug free discs

126

00:05:08,016 --> 00:05:10,893

and mailed one to every

single customer for free.

127

00:05:10,893 --> 00:05:13,646

As a result, customer

satisfaction increased.

128

00:05:13,646 --> 00:05:15,648

Additionally, Intuit

has made it its mission

129

00:05:15,648 --> 00:05:17,650

to pursue strategic acquisitions

130

00:05:17,650 --> 00:05:19,902

that play to this overarching goal.

131

00:05:19,902 --> 00:05:23,197

Acquiring platforms like Credit

Karma, Mint and Mailchimp

132

00:05:23,197 --> 00:05:25,867

are aimed at solving pain

points tangentially related

133

00:05:25,867 --> 00:05:27,910

to Intuit's core accounting offering.

134

00:05:27,910 --> 00:05:29,954

Credit Karma allows the

company to give folks

135

00:05:29,954 --> 00:05:33,458

their credit score on demand

which makes the product sticky.

136

00:05:33,458 --> 00:05:35,501

Mint is an automatic tracker of finances

137

00:05:35,501 --> 00:05:38,588

which plugs right into

Intuit's tax software.

138

00:05:38,588 --> 00:05:40,173

Mailchimp is a fantastic tool

139

00:05:40,173 --> 00:05:43,009

that helps businesses send better emails.

140

00:05:43,009 --> 00:05:44,802

For more on Mailchimp, you can check out

141

00:05:44,802 --> 00:05:47,680

our previous episode about

how Mailchimp gets your email

142

00:05:47,680 --> 00:05:49,432

past the spam filter.

143

00:05:49,432 --> 00:05:51,100

In 2011, further expanding

144

00:05:51,100 --> 00:05:52,810

on its well-rounded solution offering,

145

00:05:52,810 --> 00:05:56,230

the company also launched a

platform called Intuit Anywhere

146

00:05:56,230 --> 00:05:58,691

which allowed customers to

try out different integrations

147

00:05:58,691 --> 00:06:01,235

within the QuickBooks online ecosystem.

148

00:06:01,235 --> 00:06:03,363

Ultimately, this turned

into the integrations

149

00:06:03,363 --> 00:06:04,947

that Intuit offers today.

150

00:06:04,947 --> 00:06:08,117

With options like Shopify,

Gusto, and even Etsy.

151

00:06:08,117 --> 00:06:09,786

Integrations are important.

152

00:06:09,786 --> 00:06:12,580

In a study, we found that

customers with more integrations

153

00:06:12,580 --> 00:06:14,999

within their product

appear to be willing to pay

154

00:06:14,999 --> 00:06:19,379

between 10 and 30% more than

those without integrations.

155

00:06:19,379 --> 00:06:21,422

Another factor that

helps Intuit stay fresh

156

00:06:21,422 --> 00:06:23,800

is they hold on to the startup mindset.

157

00:06:23,800 --> 00:06:26,677

At one point, they call themselves

the 30-year-old startup.

158

00:06:26,677 --> 00:06:28,262

They emphasize experimentation,

159

00:06:28,262 --> 00:06:31,182

including encouraging engineers

to use unstructured time

160

00:06:31,182 --> 00:06:34,394

to spend on projects

of their own choosing.

161

00:06:34,394 --> 00:06:38,106

According to then CTO

Tayloe Stansbury in 2013,

162

00:06:38,106 --> 00:06:41,067

about 300 of those projects

turned into products

163

00:06:41,067 --> 00:06:43,319

or features of existing products.

164

00:06:43,319 --> 00:06:44,195

It's simple.

165

00:06:44,195 --> 00:06:47,573

By encouraging innovation,

Intuit is gaining innovation.

166

00:06:47,573 --> 00:06:50,076

But perhaps the greatest

reason Microsoft lost to Intuit

167

00:06:50,076 --> 00:06:52,537

is because of their efforts in marketing.

168

00:06:52,537 --> 00:06:56,374

Robbie Cape ran Microsoft

Money from 1999 to 2001.

169

00:06:56,374 --> 00:06:59,419

He said, "It really has

little to do with technology.

170

00:06:59,419 --> 00:07:02,046

What Intuit and Scott

Cook were so formidable at

171

00:07:02,046 --> 00:07:03,840

was consumer marketing.

172

00:07:03,840 --> 00:07:06,092

He treated marketing Intuit

very much the same way

173

00:07:06,092 --> 00:07:08,261

as one would treat marketing a bar of soap

174

00:07:08,261 --> 00:07:10,012

or a bottle of shampoo.

175

00:07:10,012 --> 00:07:11,973

He made Quicken a household name."

176

00:07:11,973 --> 00:07:15,268

- If you can use a checkbook,

you can use Quicken.

177

00:07:15,268 --> 00:07:17,353

- Today, Intuit is comfortably

178

00:07:17,353 --> 00:07:19,939

one of the most valuable

SaaS companies out there

179

00:07:19,939 --> 00:07:23,151

with a market cap of over $100 billion.

180

00:07:23,151 --> 00:07:25,236

But Intuit shouldn't get too comfortable.

181

00:07:25,236 --> 00:07:27,071

There are still issues they must address

182

00:07:27,071 --> 00:07:28,573

within their own products.

183

00:07:28,573 --> 00:07:30,575

Though QuickBooks is notable

in the United States,

184

00:07:30,575 --> 00:07:32,952

the same can't be said

for the rest of the world.

185

00:07:32,952 --> 00:07:35,872

They have to watch out for

folks like Zero in New Zealand,

186

00:07:35,872 --> 00:07:38,791

Zoho in India and Sage in the UK.

187

00:07:38,791 --> 00:07:40,209

And while these companies have footings

188

00:07:40,209 --> 00:07:43,838

in their own countries, they're

making waves abroad as well.

189

00:07:43,838 --> 00:07:46,257

Additionally, the same

marketing that turned Quicken

190

00:07:46,257 --> 00:07:48,217

into a household name got Intuit

191

00:07:48,217 --> 00:07:50,511

into some hot water in May of 2022.

192

00:07:50,511 --> 00:07:53,222

Their free, free, free

ad campaign for TurboTax

193

00:07:53,222 --> 00:07:55,391

was found to be using deceptive tactics

194

00:07:55,391 --> 00:07:58,686

to drive low income tax

filers toward their services.

195

00:07:58,686 --> 00:08:00,897

This was instead of the free

federally supported services

196

00:08:00,897 --> 00:08:02,899

which this group qualified for.

197

00:08:02,899 --> 00:08:05,902

Intuit paid out 141 million settlement

198

00:08:05,902 --> 00:08:07,195

just for this ad campaign.

199

00:08:07,195 --> 00:08:09,947

Ultimately, a SaaS company

that wishes to topple Intuit

200

00:08:09,947 --> 00:08:12,658

has to go a few extra

miles beyond the incumbent.

201

00:08:12,658 --> 00:08:14,285

What company do you think that will be?

202

00:08:14,285 --> 00:08:17,288

Zero, Sage, maybe a newbie?

203

00:08:17,288 --> 00:08:19,332

Let me know what you think

in the comments down below.

204

00:08:19,332 --> 00:08:21,667

From Paddle, I'm Ben Hillman,

205

00:08:21,667 --> 00:08:23,169

and I'm not gonna cross Intuit.