Should Twitter have a subscription?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

Founded in 2006, Twitter has 330 million monthly active users, half of which are active daily. It's been used for revolutions, memes, and spreading information. Twitter's founding story started with Noah Glass creating Odeo, which later became a podcasting platform. Jack Dorsey suggested a social network made up of a person's status, which led to the creation of Twitter. Despite creating the name Twitter and contributing to its development, Glass's involvement was not fully recognized. Twitter's success comes from its influence and accessibility, with over 90% of journalists and 83% of world leaders using the platform. However, Twitter only turned a profit in 2017, 12 years after its founding. User and revenue growth has stalled, leading critics to question the ad model. Twitter's CEO, Jack Dorsey, is also the CEO of Square, which has opened him and Twitter to criticism.

The question becomes: Can Twitter use innovation to get beyond the ad model and take advantage of their relevance in our world, especially when Facebook and other social media platforms are able to monetize their traffic at almost triple the rate of Twitter? It seems it’s time for a revolution when it comes to Twitter, so we’re going to answer this question by collecting data from 10, 542 current and prospective Twitter customers who would be interested in a Twitter subscription. Read on to get the data and answers to all these questions.

The wrong revenue model

Despite the negative attention on Trump's use of Twitter, I believe the platform still holds value. However, from a business perspective, Twitter's stock price hasn't increased despite its widespread influence on culture and media since Trump's presidency. While revenue has improved, Twitter's ad-focused revenue model isn't effectively monetizing its traffic. This is similar to YouTube and Facebook, which struggled to monetize non-brand-friendly content. Surprisingly, Twitter only makes about $25 per user per year, compared to Facebook's $7.50 per user per quarter, despite having fewer users. Twitter needs to change its revenue model to better align with its goals and user needs.

So, we're going to walk through how we would actually build a subscription for Twitter and validate just an idea in general. I think a lot of times, especially in B2B businesses, people want to go up market, or downmarket, or everything in between, but don't know where to start. So I think this is a good example to not only show that Twitter has a viable option for a subscription, but also what some of the things that should be in it are.

Twitter's data and analysis

Willingness to pay helps determine feasibility

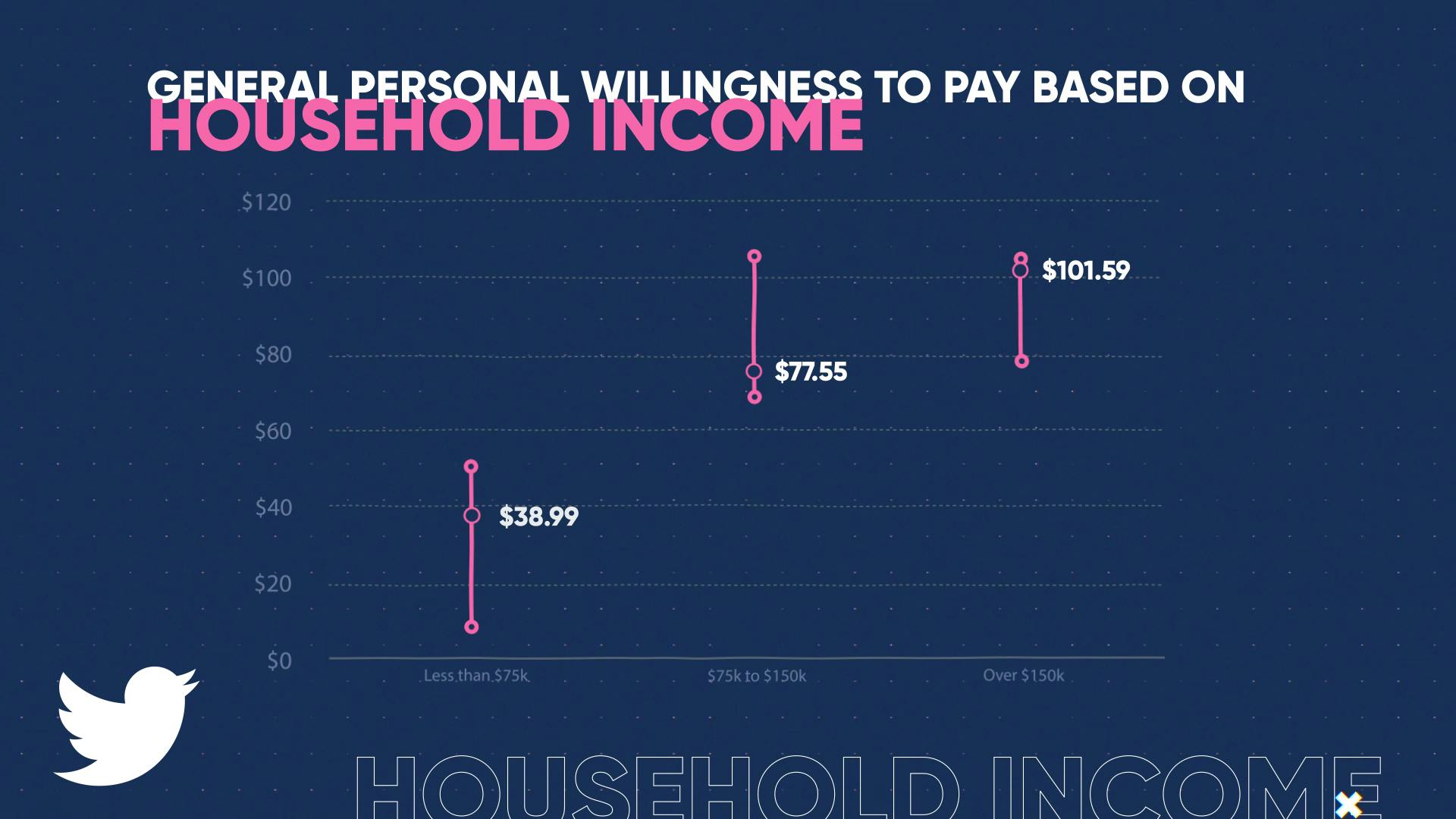

We gathered data on the willingness to pay for a Twitter subscription. This data was collected from both personal and business users. The aim was to understand the baseline of willingness to pay for a subscription with cool features and premiums. For personal subscriptions, those with a household income under $75k are still willing to pay around $40. This may not be the main target audience for a subscription business, but getting just one million users to sign up could still generate over $100 million in revenue. It could also provide Twitter with some flexibility in the context of the ad model. For those with a household income between $75k and $150k, the upper echelon of willingness to pay is $100 per month. The same goes for those making over $150k per year.

There's a small movement around $100 per month. Twitter is like the Apple of social media. For personal use, charge $99 per month at the high end. If a million of the 330 million users sign up, it's great.

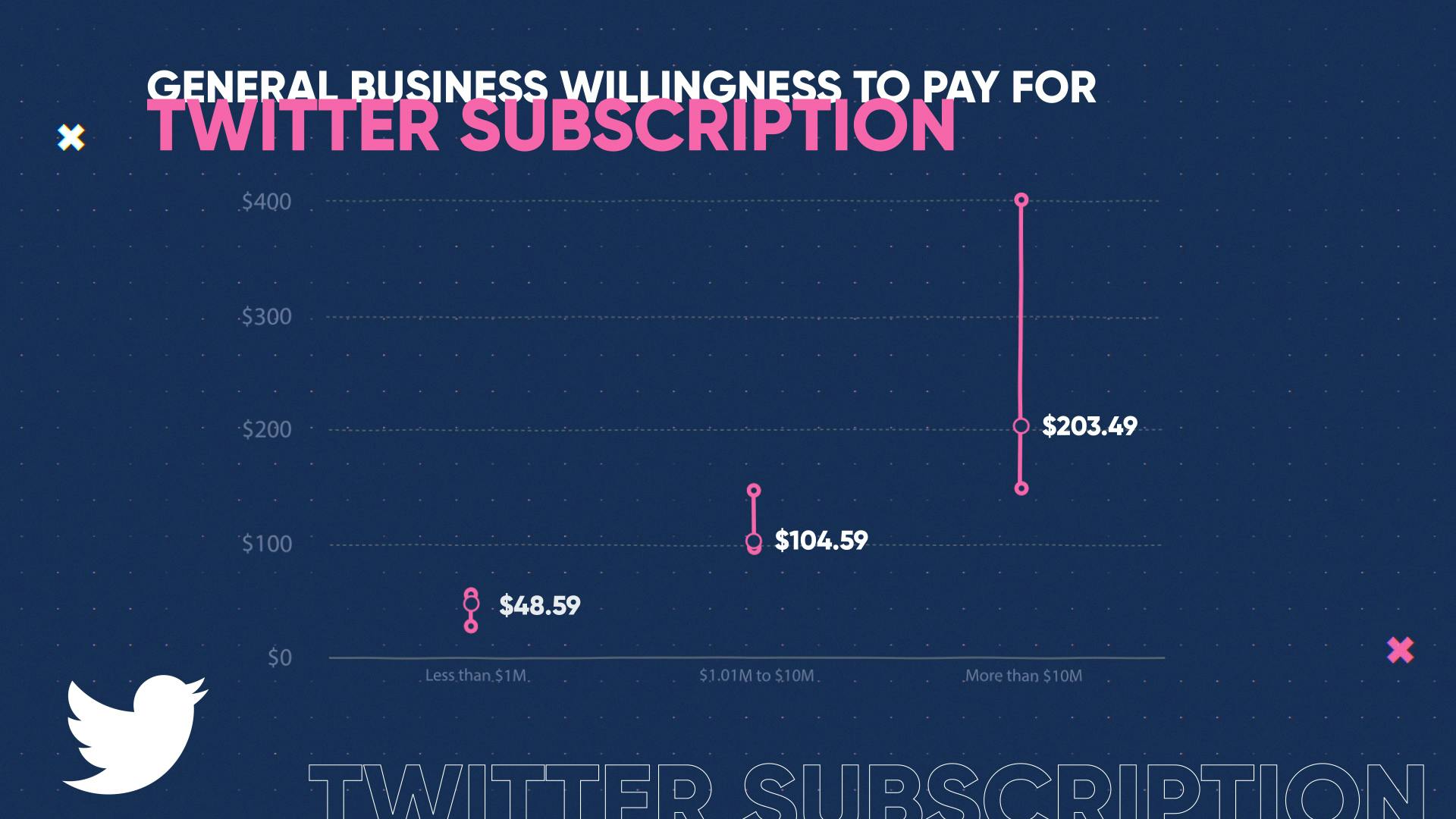

On the business side, those making less than a million a year are willing to pay about $50 a month for a premium product. Those making over a million are willing to pay between $1 and $1,000 with high variance. DTC companies making over a million to 10 million are willing to pay much more. Companies making over 10 million with marketing teams are willing to pay for premium tiers.

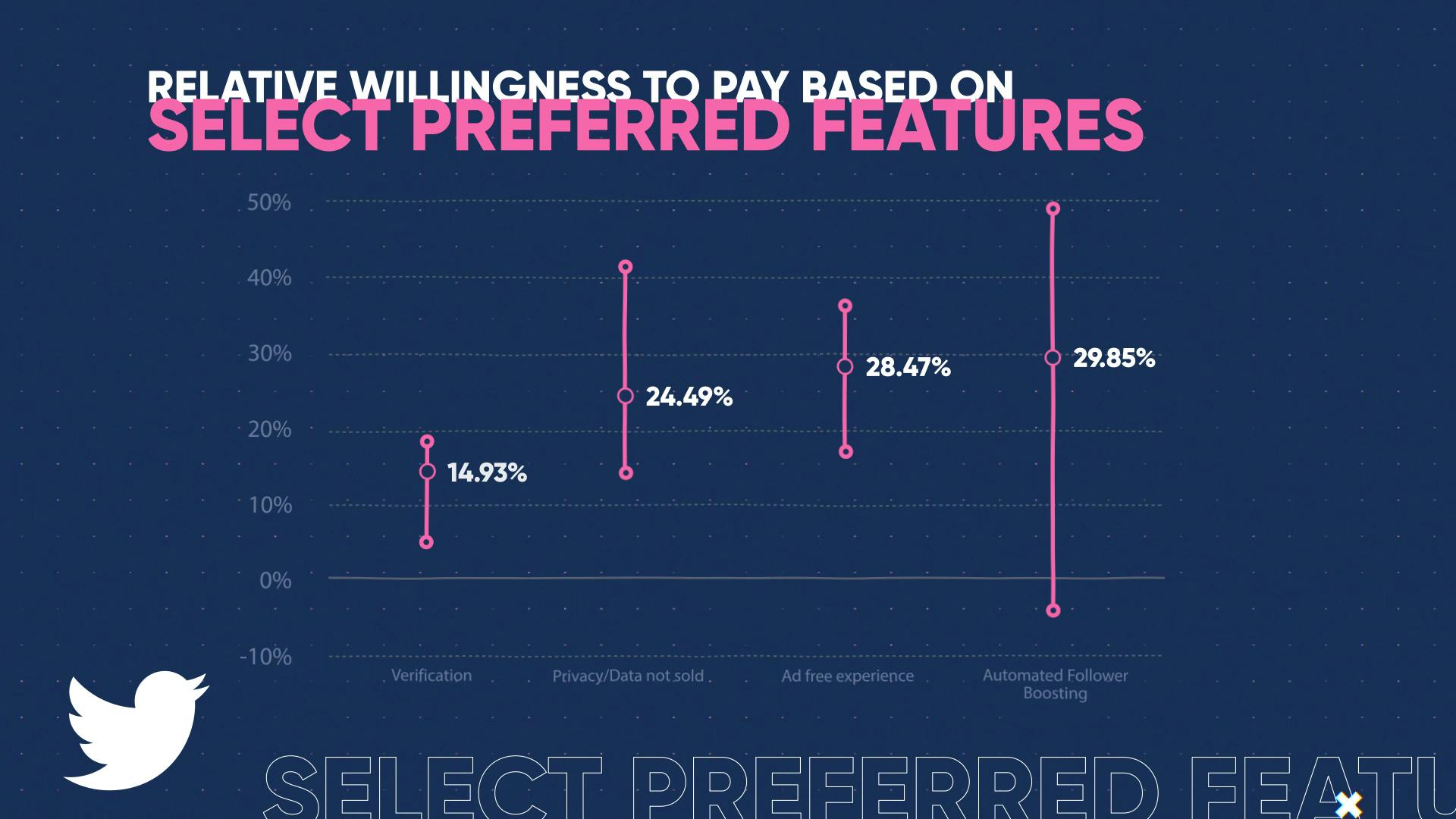

Segment willingness to pay based on value props

To determine viability, segment willingness to pay based on value propositions. A Twitter subscription is a potential opportunity, but charging $1 to $5 per month, as done for ad-driven models, won't be effective unless you have many users. It may be best to use both an ad and subscription model if you have a large user base.

To correlate willingness to pay with desired features, consider whether the value proposition or feature is what someone is seeking. The concept of automated follower boosting has high variance, and the existing subscription costs $100 per month. The company fills remnant inventory with subscriber tweets to attract more users. It is unclear whether this strategy is working. Occasionally, someone who doesn't follow a subscriber will see their promoted tweets and respond.

There are people willing to pay a lot more than others for ad subscriptions. Twitter could offer an ad-free experience as a proxy for privacy, but they may not want to be seen as a privacy-like platform. They could also charge for verification, which some people would pay more for. Twitter has the potential to make money from a premium subscription in addition to ads, like dating apps have done successfully.

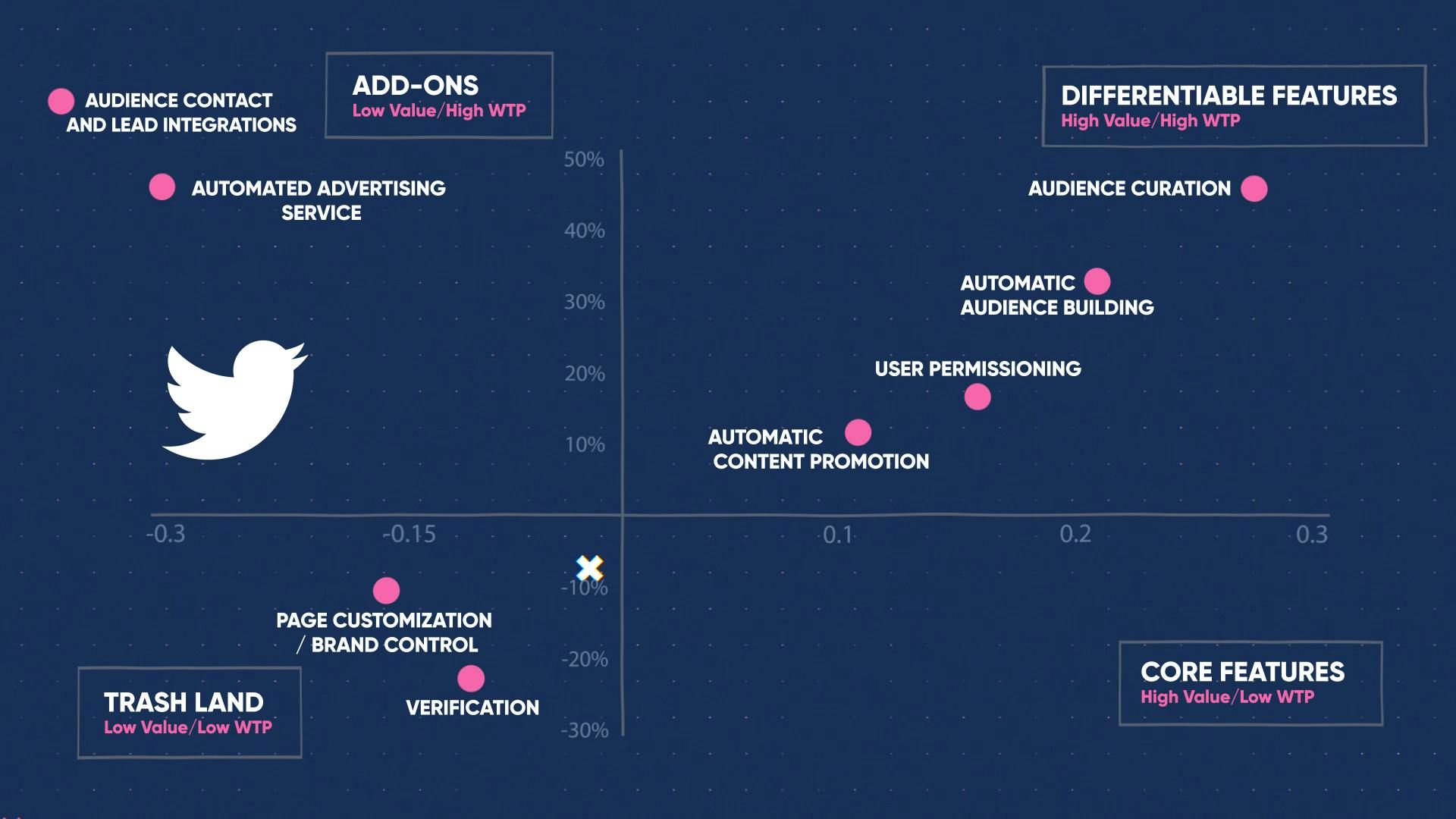

The value matrix

You're about to see something called a value matrix. Here, we collected data from the group comparing feature preferences and plotted those on the horizontal axis. More valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number-one feature preference on the y-axis. Analyzing data in this manner allows us to determine which features are differentiable ad-ons, core, or commoditized for each segment.

Dig deep on feature matrices

Next up, dig deep on feature matrices to build bundles. We're back on the B2B side looking at some of the features that actually moved the needle for this proposed subscription. And you can see automated audience building, again, something that's really resonating with potential users here. It makes a ton of sense—people get on Twitter and want to build their audience. They want to utilize that audience.

I was encouraged by the audience curation aspect of this. Instead of just growing your audience, consider the success of brands like Wendy's on Twitter. For those aspiring to be like Wendy's, a paywall can be implemented to create a community aspect. Page customization and branding, although not impactful from a marketing perspective, can still be valuable. It's important to determine which features will drive value and which should be removed to determine how to monetize. Ad-ons are often overlooked, and with a fragmented user base like Twitter, a consumer play could be pursued alongside a B2B play to hedge ad revenue. It's disappointing to see Twitter not embrace this approach, as it could greatly improve their stock price.

In conclusion, Twitter's revenue model needs to change in order to better align with its goals and user needs. A subscription model may be a viable option for Twitter, but it is important to segment willingness to pay based on value propositions and to determine which features will drive value and which should be removed to determine how to monetize. Ad-ons are often overlooked, and with a fragmented user base like Twitter, a consumer play could be pursued alongside a B2B play to hedge ad revenue. It remains to be seen whether Twitter will take this approach, but it is clear that innovation is necessary for Twitter to get beyond the ad model and take advantage of its relevance in our world.

Want to step up your subscription pricing?

Price Intelligently by Paddle is revolutionizing how SaaS and subscription companies price and package their products. Founded in 2012, we believe in value-based pricing rooted in first-party research to inform your monetization strategies. We combine expertise and data to solve your unique pricing challenges and catapult growth.

Head over to our website to learn more.

(00:00):

Say what you will about Trump, but...

(00:03):

Welcome to Pricing page Teardown, where the ProfitWell Crew breaks down strategies and insights on how subscription companies from all corners of the market can win with monetization.

(00:18):

Welcome

(00:19):

To Pricing page, chair down. I'm Patrick Campbell. I'm Rob Litterst. And this week we are talking about the social network, the good, the bad, the ugly of Twitter. I think it's been great in some places for the world and democracy and all these different things. And then it's been just absolutely terrible for mental health. The way that Twitter makes money because it never reached Facebook level, like engagement and size or YouTube level engagement and size has been the ad model, right? And unfortunately the ad model is toxic in a number of different ways when you don't have that large of a following. And so what we're gonna be doing today is we're gonna be exploring an alternative revenue model for Twitter, and that being the world of subscriptions. Yep. Doing some sort of recurring revenue bundle within Twitter, especially in the context of the privacy concerns ads, and still keep kind of the, the free for all that it's had within the context of other social media websites. Totally. And with that, we're gonna be going through a ton of data, a bunch of lessons on what Twitter could be doing really, really well and some of the things are doing really, really poorly right now. And we're gonna wrap that all into a nice little case study so that you can get your monetization strategy right on the right track.

(01:27):

Founded in 2006, Twitter made micro blogging mainstream and now boast 330 million monthly active users, half of which are active daily. Twitter's influence goes far beyond numbers though as it's been used to disseminate and start revolutions, as well as entertain with dank memes. And you likely don't know the true Twitter founding story, though. Twitter actually started with an entrepreneur named Noah Glass, whose name is noticeably absent from the company's history. Glass initially started a product called oeo, where you could call a phone number and turn your message into an MP3 file hosted on the internet, which morphed into a podcasting platform. The project would later move into Evan Williams apartment, who was an early investor in audio, and later became the company CEO when Apple launched iTunes in 2005, though Oios growth basically halted. So the group looked for another project, this is Reject Dorsey enters the story with an idea for a social network made up of only a person's status.

(02:27):

Glass jumped on board, including coming up with the name Twitter and developed the concept further along with developer Florian Weber Williams was skeptical about the idea, but let Glass continue leading the project. In 2006, everything shifted quickly with Williams buying at a controlling stake in audio firing glass for reasons that seem to vary and are unclear, and then spinning Twitter out into its own company with Dorsey, S C E O, which led to the Twitter we all know and love Glass's name is essentially vanished from Twitter lo, even though his Twitter bio chiefly references his involvement. And to be fair, Williams has also acknowledged on Twitter that glass never got enough credit for Twitter. Twitter success stems from influence and accessibility. Businesses and consumers find it easier to chat and spread information through Twitter versus traditional channels. And with 330 million monthly users, half of which are active daily, Twitter's a lucrative platform, especially when you consider over 90% of journalists and 83% of world leaders use Twitter, including President Trump.

(03:32):

Twitter hasn't been able to monetize this influence in accessibility, though they didn't turn a profit until 20 17, 12 years after its founding to add insult to injury, user and revenue growth has stalled, even though Twitter has never been more relevant in our society. Critics believe that Twitter is essentially the perfect example of how the ad model has become ineffective and old school. Oh, and did we mention that Jack Dorsey is still c o while also being CEO of another public company in Square? It's impressive, but considering Twitter is struggling, this move has opened up Dorsey and Twitter to even more criticism. So the question becomes, can Twitter use innovation to get beyond the ad model and take advantage of their relevance? In our world, especially when Facebook and other social media platforms are able to monetize their traffic at almost triple the rate of Twitter, it seems it's time for a revolution when it comes to Twitter. So we're gonna answer this question by collecting data from current and prospective Twitter customers who would be interested in a Twitter subscription. And we're gonna reveal all the data and answer to these questions coming up.

(04:42):

Are you on Twitter every day? I am. Okay. Why?

(04:45):

It's the only social network that I check. I think there's a lot of value to be had on Twitter.

(04:49):

I think one thing, kind of like the hard transition out of this is that I know everyone's like, oh, Trump, Twitter, everything's terrible. But like think of the, the Arab Spring, right? Like the Arab Spring doesn't happen without Twitter. Totally. But what's really been troubling for me, and this is from a purely business hat on, and it's a little bit like crude to think about one of Twitter's real crimes here has that their stock price really hasn't done much and they have been reported on and just basically just like inundated the entire world of culture and media so much since Trump started running for office. And then once Trump actually became president, the revenue has definitely been in a decent place. The revenue model is so ad driven that the focus that they're getting in terms of Trump, that's not really monetizable traffic no. As much because you saw this with YouTube and Facebook where not so great, not so kid friendly, not so brand friendly content, they couldn't really monetize it, right?

(05:43):

Because you know, the the big brands that were spending a lot of the money, they wanted to make sure that their stuff wasn't being shown next to like crude content or those types of things. Totally. And I think I was surprised at how much money Twitter actually makes per user per year. I think it's about $25. $25, yeah. Per user per year. That's it. Um, yeah, it's, it's basically nothing. Facebook has I think $7 and 50 cents per user per quarter, but they have so many more users than Twitter. So it's kind of like one of those things where like Twitter is literally using the wrong revenue model, but it's one of like the worst revenue models when it comes to what they're trying to do and then ultimately what people actually get out of Twitter. Okay. So what we're gonna do is we're gonna walk through how we would actually build a subscription for Twitter.

(06:28):

Yeah. And validate just an idea in general, I think too, because I think there's a lot of times, especially even in B2B businesses where you're like, oh, let's go up market or let's go down market, or you know, everything in between. Um, and I think it's one of those things that a lot of people don't know where to start, right? So I think this is a good example to not only show like, Hey, Twitter, do you have a viable option for a subscription? Um, and if so, like what are some of the things that should be in it? And then we can kind of rock from there. Let's go.

(06:52):

So where does our data come from? Here at ProfitWell, our price intelligently product combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers. Having the ability to collect data from everyone from a soccer mom or dad in the middle of Kansas all the way to a Fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value which features and which segments are willing to pay more. All in the spirit of determining how a company can use monetization for growth,

(07:40):

Growth.

(07:41):

First up, willingness to pay, helps determine feasibility. We're actually gonna collect what would their willingness to pay be for a Twitter subscription. Now we're gonna do this in a very general, like vague sense mm-hmm. <affirmative>, right? Like let's say Twitter all of a sudden had a subscription, it had, you know, a bunch of cool features and premiums. We just want a baseline of what that willingness to pay would look like, right? And then we wanna understand what that data is so that we can see is this something to even consider under a certain level of how many of our users, you know, would sign up for it. And we collected this both on a personal level but also for a business. Okay. Um, because a business could have a really interesting premium account that could tap into kind of the sprout social or the buffer world.

(08:17):

Oh yeah, definitely. But on the personal side, this is where it was kind of out of control. What you're noticing here for a personal Twitter subscription and say your household income is less than 75,000 a year, your willingness to pay is still like $40. Wow. Right? And not everyone is gonna sign up for that. Um, obviously that's not gonna be, you know, the, the need for a subscription business, but when you have over 300 million users, if we get like a million people to sign up for something that's potentially a hundred million dollar plus business line Oh yeah. That not only is guaranteed and compounds, but also allows Twitter to have some optionality in the context of the ad model, which isn't bad necessarily, but has some misaligned incentives and needs, you know, some tweaking in order to, you know, make Twitter a better business. Now it really gets interesting when you get into the 75 K folks, um, up to one 50 and those making over one 50 as a household, all of a sudden you're looking at basically the 75 to one 50 folks.

(09:09):

They're upper echelon here is a hundred dollars and this is not per year. This is per month. Wow. That's a little bit of a hammer to drop here. And then the, the high end as well for the over, over 150 K folks is also a hundred. So you're noticing that there's this, there's this little bit of movement here right around that a hundred dollars per month range. And I think that Twitter is kind of the, the sheer, the apple of the social media networks, right? On the personal side here, you have an interesting range where you could charge, you know, $99 per month at the high end of this range. And with 330 million users, a million of 'em sign up and things are great. Now, it's really interesting on the business side is we also wanted to look at some data. We didn't describe specifics here, so to be super, super clear, we're just measuring feasibility and folks making less than a million a year willing to pay about $50 a month for a premium premium type of product.

(09:57):

Um, and then those folks over a million, you look at a range of one to 10, a hundred bucks. Wow. And there's high variance here, folks in the DDC space making over a million to 10 million. Their willingness to pay was definitely much, much higher. Oh, I'm sure. And then all of a sudden you get over 10 million and then you have like legit marketing teams. Yeah. And you're more than willing for premium tiers, especially Twitter here. Next up segment, willingness to pay based on value props. Mm-hmm. <affirmative> in order to analyze viability in general, there is definitely an opportunity here for a Twitter subscription. A hundred percent. Um, sometimes we test this for products that are on ad driven models and it's like $1 to $5 per month. Um, that's just not, you know, it's not gonna move the needle unless you have a ton of users.

(10:37):

And if you have that many users, maybe you just do an ad model. Right? Right. Really, you probably should just do both. But what we want to do now is we wanna look at like what is the value proposition or what is the feature that someone is looking for and how does that correlate essentially with willingness to pay? This whole concept of automated follower, um, boosting was basically really, really high variance. And I think that if you think about they already have the subscription, I believe I'm on it, it's like a hundred bucks per month. And I, I believe what they do is they basically take your tweets and then they just kind of use remnant inventory. So just the inventory they can't sell, they basically will fill it with your tweets and then basically that hopefully gets enough views, which then get enough people to follow.

(11:15):

Wow, okay. I have not looked into if this is working at all, right. I just know occasionally I'll tweet something and then someone will be like, why is this a promoted tweet in response, someone who doesn't follow me? But the range there is pretty insane. Oh, it's huge. And what you'll notice though is that those folks, there's enough batch of those folks who are willing to pay much, much more. And these are the folks definitely willing to pay a hundred dollars per month, kind of like the subscription that they already have. But really it's an ad subscription more than anything. Some of the other things that are really interesting is this whole concept of ad-free or privacy, the positioning. I don't think Twitter wants to say we're a privacy like platform. No, I think Twitter wants to kind of shy away from that because they don't want it to be like, oh, if you're not on this, the rest of the platform isn't private.

(11:56):

Right. Um, although I think that they could really boldly go out and say, Hey, if you want your data locked up and everything, you're gonna have to pay us, you know, 50 bucks a month, a hundred bucks a month in this case. Oh, they could totally do that. But they could say an ad-free experience, right? Yeah. Which is kind of a proxy. And then some of their value props into that ad-free experience I would pay for that could be around privacy. I don't, I don't know if I would pay for that personally. People are willing to pay more for verification. Oh yeah. Um, which is like just hype b check mark, you know, type stuff, which is really interesting. But like I don't think they have an excuse. No. And I think that they're just so ad brained out because that's like the environment that they grew up in, that this whole recurring revenue concept was just for B2B companies. And I think that they've seen time and time again with like especially the dating apps, that you can have a premium subscription in addition to the ad driven model. Right. To be successful and to hedge your growth, particularly with recurring revenue,

(12:46):

You're about to see something called a value matrix here. We collected data from the group comparing feature preferences and plotted those on the horizontal axis. More valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number one feature preference on the y axis. Analyzing data in this manner allows us to determine which features are differential add-ons, core or commoditized for each segment.

(13:17):

Next up, dig deep on feature matrices to build bundles. We're back on the B2B side over here, looking at some of the features that actually move the needle for this proposed subscription. And you can see automated audience building, again, something that's really resonating with potential users here. It makes a ton of sense. People get on Twitter, they want to build their audience, they want to utilize that audience. Mm-hmm. <affirmative>, I was really heartened by the audience curation piece of this. Yeah. So it's not just like build me more audience, but it's like, hey, I have this audience of people, you know, think of like Wendy's. Think of some of these brands that just do really, really well on Twitter. Oh yeah. You know, those are probably the ones you don't need this for. But then the next brand's down who want to be the Wendy's, there's no reason you can't put a paywall up there and be a community aspect.

(13:57):

Totally. Page customization, branding, these types of things. They showed up basically in what we call trash land, or at least we call that from a marketing perspective. Mm-hmm. <affirmative>, when people work with us, we call it something else. But these things just don't move the needle for folks. Right. It's just not someone, one of those things to really think about. And I think the thing you have to take away for your business is that you got so many features and functionalities that you can offer. You really, really, really have to make sure that you're essentially understanding which features are going to be value drivers and which features should probably be add-ons. Totally. In order to understand how you should monetize add-ons, one of the most underutilized aspects. And when you have a fragmented user base like Twitter, they might not go after the B2B play here. They might go after the de the the consumer play. Right? Um, or they can do these parallel paths to kind of hedge that ad revenue that they have. And it's just breaks my heart because they absolutely should be thinking this way and it would make their stock price just so much better. Totally.

(14:53):

Let's recap. First up, willingness to pay data helps determine feasibility. It's really, really easy to collect, you know, feedback and generic, you know, kind of Monday morning quarterbacking of what Twitter should do, what a company should do, get some data, go send it out, get that data back, crunch it and it'll tell you, Hey, is this even something we should explore further? That's the first one. Next up segment, willingness to pay based on value props to analyze viability. Once you know it's feasible, then it's like, well, how do I make sure that I take advantage of this feasibility? Exactly. And that's where you need to segment things out, not only from an audience perspective, but also from a feature preference perspective. Finally, dig debunk feature matrices to build value add-ons. One of the most underutilized monetizable instruments in any subscription or recurring revenue business. You should be reconsidering what you're bundling into your tiers versus what should be brought out and sold to the entire user base as an actual add-on.

(15:49):

Well, that's all for this week's episode of pricing page. Tear down. If you enjoyed this, got some value from it, make sure you share it on the social media channel of your choice. Perhaps Twitter, perhaps LinkedIn. We wanna make sure that this gets in the hands of as many people as possible to make sure that they're getting not only enjoyment out of it, but also they're learning just as much as you when it comes to monetization. And if you want this data for your own business, you wanna understand your pricing and monetization path even further, make sure to hit me up@patrickatprovo.com or hit Rob here up@robprovo.com and we'll make sure we get you to the right team inside ProfitWell, uh, to get your monetization running. Who do we have next week? Next week we have, we have a fun one. We have a business that essentially took advantage of the entire downfall of an industry Yes. To be successful. And I don't know if they did that intentionally, but they definitely hit the rave at the right time. And that is Spotify. We're gonna be exploring how Spotify took advantage of the Napster generation to do some things very, very well with their pricing and then very, very poorly with their pricing. And we're gonna wrap all that up into a nice little case study so that everyone can learn about their monetization and get their monetization path moving in the right direction. Let's do it. We'll see you next week.