We collected data from three hundred thousand subscription buyers and five thousand companies to provide data on how much expansion revenue you should have to be successful.

The beauty of the subscription model is that for the first time in our history we have a business model where relationships are built directly into the revenue model. If a customer continues to like you, they aren’t going to churn, and they may even buy more of what you’re selling, so to put it bluntly more is almost always better when it comes to expansion revenue.

This episode was originally produced for Paddle Studios.

What is expansion revenue?

Expansion revenue is any revenue that is generated in excess from a customer's initial purchasing price or contract. Expansion MRR measures the additional monthly recurring revenue that is generated by existing customers.

Up-selling and cross-selling are the primary drivers of expansion revenue:

- You can up-sell customers by upgrading them to a larger plan as their need for your product grows.

- You can cross-sell customers additional features and services to augment the service they already have.

Expansion revenue is the golden honey of your SaaS business because it allows you to generate new revenue from existing customers. It's more financially efficient than generating new revenue from acquired customers because you see an increase in revenue without the costs associated with acquiring a new customer. A 2016 Pacific Crest Survey from David Skok and Matrix Partners shows that the median cost to acquire a dollar of ACV for new customers is $1.16, while the median cost to acquire a dollar of ACV is $0.27 for up-sells and $0.20 for plan expansions. While it takes most companies over a year to earn back the costs associated with acquiring new customers, it takes most companies around one quarter to earn back the costs associated with up-selling and expanding. Earning these costs back faster allows for a shorter time to profitability and the opportunity to hasten growth.

Existing customers represent a huge source of additional revenue if you market to them and monetize them correctly.

Why is expansion revenue important?

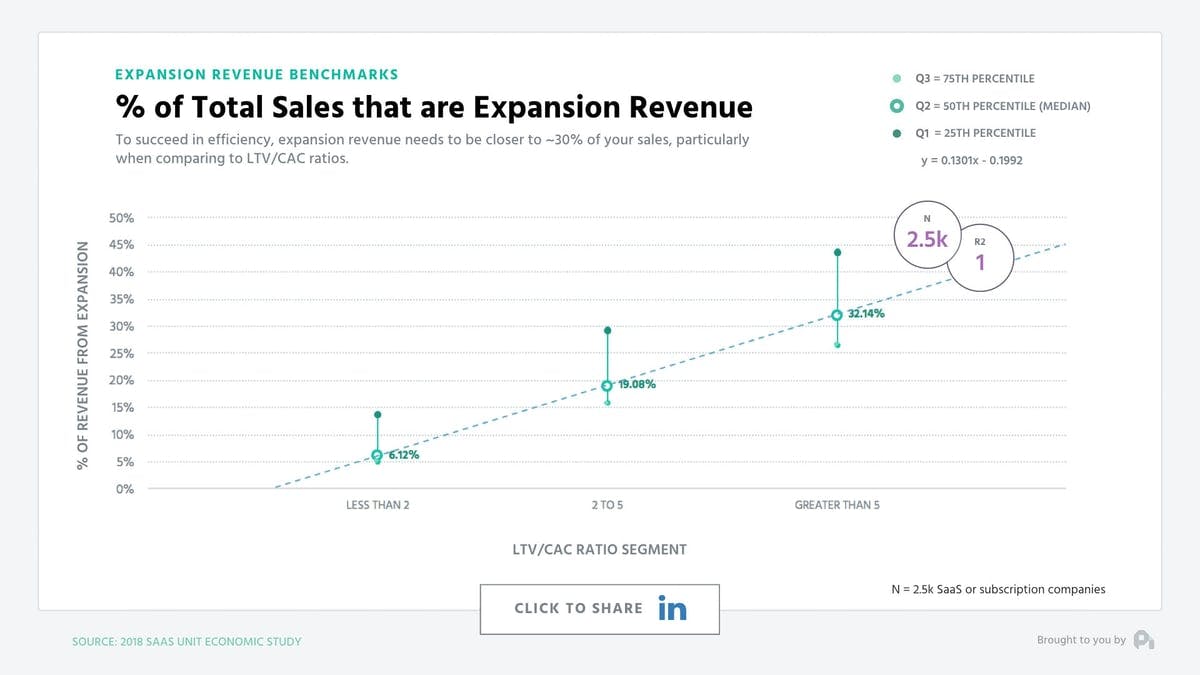

The most efficient companies when looking at LTV to CAC ratios are fueling that efficiency mainly off expansion revenue.

Note that companies who have an LTV to CAC between three and five are seeing a median of just under 20% expansion revenue as a proportion of their total revenue. Those with an LTV to CAC above five are pushing above 30% in terms of expansion revenue.

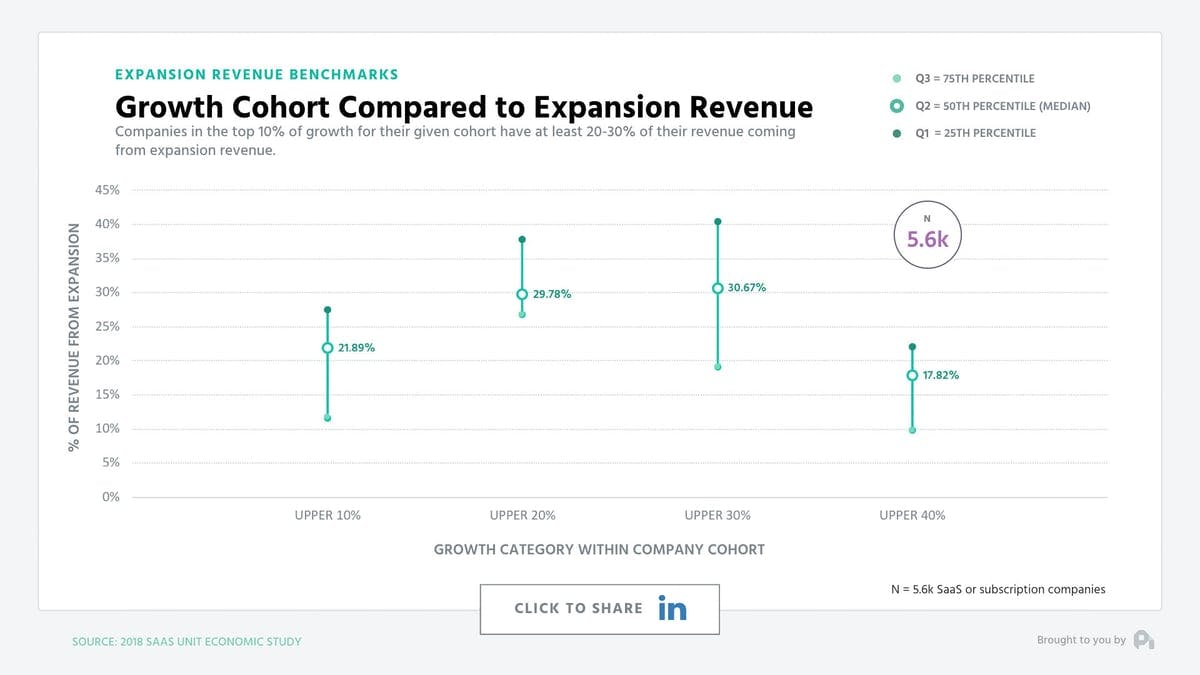

Efficiency doesn’t tell the whole story though. Growth is important, and if you’re efficient you’re not always investing in growth. Interestingly enough though, companies growing in the top 40% of their cohorts are seeing at least roughly 20% of their revenue coming from expansion and a high end of nearly 40% expansion revenue.

So to be blunt - more, more, and more is really an answer of at least 20% and really you should be shooting for closer to 30%.

Of course, this data is highly correlative, because to get proper expansion revenue at these levels, you need good pricing, good product, and ultimately to be using a value metric. Yet, 20 to 30 percent can act as a solid north star to benchmark your efforts going forward. That being said, the answer is probably still more, more, and more.

How do you calculate expansion revenue?

You calculate expansion revenue by summing the total new MRR from upsells and cross-sells.

Expansion revenue does not include revenue from newly acquired customers.

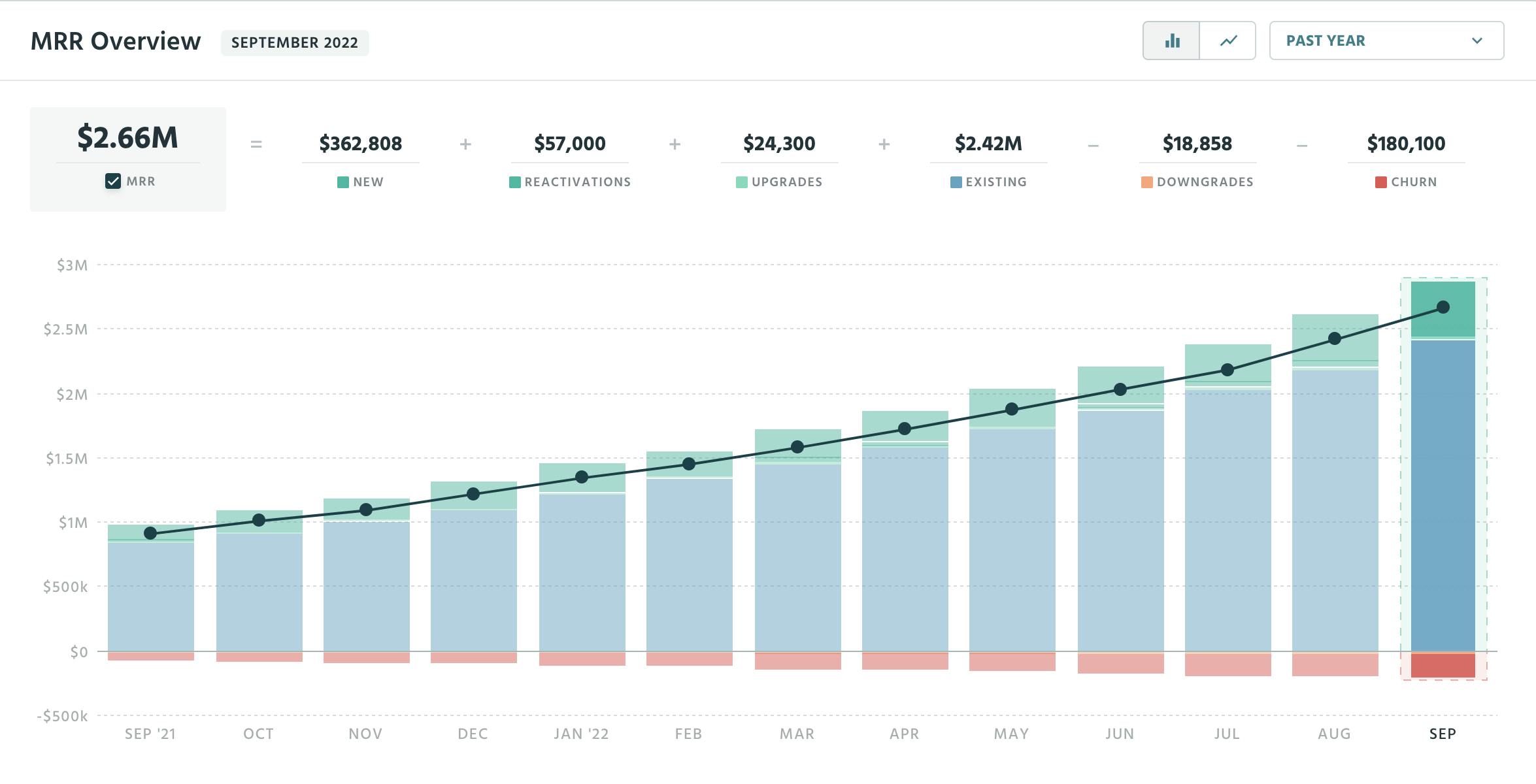

Tools that track subscription metrics—like ProfitWell Metrics, by Paddle—will often show MRR broken down into new revenue, expansion revenue, and lost revenue.

In the graph above, the darker green sections of the bars representing MRR indicate the portion of MRR from expansion revenue.

How do you grow your expansion revenue?

The best practices for both up-selling and cross-selling rely on building a loyal customer base and then providing additional value that those customers are willing to pay for.

Upselling works best when your customers' plans can grow along with your pricing scale. You can create the most effective value metric for your business by:

1. Identifying and monetizing the core value of your product

Pinpoint the solution that the customers get from your product and then create a pricing scale that aligns increasing prices with increasing access to that solution. For example, HelpScout found that customers found value in connecting more of their team members to their support pipeline—therefore a per-value scale made sense with their customer support product. HelpScout grew the average customer expansion revenue to 143% of ARPU over 23 billing cycles.

2. Understanding your typical customer's trajectory with your product

If you forecast how your customer will use your product over time, you can build your pricing scale to match and make upgrades natural. Wistia CEO and founder Chris Savage knew that businesses using video often would put a few videos on a few pages to start—then, if they found that videos improved conversion rates, they would add more videos to more pages. This lead them to create a pricing scale based on volume of videos.

3. Testing different price points and different plan packages

You should create your price points based on buyers' willingness to pay—but don't then set it and forget it. Test different price points for your pricing tiers over time, and experiment with different features in different tiers. Your market is always evolving, and with that willingness to pay and feature preferences change over time. A new price point, a new tier, or a new feature in a package could drive up-sells.

Cross-sells can drive revenue increases when you offer services and products to compliment the service a customer already pays for. You can drive the most cross-sells by:

- Offering one main product and several supplementary products:

Starting by offering single product will allow you to hone in on market-product fit and make sure this product meets your customers' needs. Add-ons give you the opportunity to monetize those existing customers that you already know are a good fit while keeping the focus around your main product. Twilio does this by offering one main API and several related supplementary service—which has allowed them to create loyal customers that contribute 59% more revenue each year than the year before.

- Offering several related products:

Offering several related products allows you to many different ways to get into an organization, and then cross-sell to different team members in that organization who have different needs. Clearbit does this by offering several APIs that serve different functions, but could all be used by different members of the same team.

- Continuing to develop new features based on customers' feedback:

Customers may be willing to pay more for additional features, and continuing to innovate your product and create helpful additions gives you more opportunities to cross-sell these supplements. Develop based on your customers' feedback—you're more likely to create an additional feature that is truly useful to them, and they're more likely to want to pay for it.

Always remain open to honest conversations with your customers about why and how upgrades and cross-sells can improve their experience with your product.

Read more about up-selling and cross-selling strategies here.

How does expansion revenue affect other metrics?

Increasing your revenue by expanding existing customers' plans can help you improve many of your other SaaS metrics. Of course, the benefit of this isn't seeing numbers go up on a page—the benefit is the real-life significance of these metrics on your company's performance and health.

Growing expansion revenue will increase your customers' LTV, decrease the payback period, and decrease net MRR churn.

Lifetime value

Higher subscription payments mean higher LTV: When customers upgrade or purchase an additional service, the value of their monthly or annual subscription price increases. They agree to pay more per month or more per year. This means that a customer's lifetime value increases because they'll end up contributing more revenue over the course of their lifetime.

For example, if a customer signs up at $15/month and stays on with your service for 3 years without ever upgrading, their lifetime value is $540. But if they upgrade to a $30/month plan after one year—and still only stay for 3 years—their lifetime value is $900.

Payback period

The time it takes for a customer to pay back their customer acquisition costs, or the payback period, depends on how high the CAC is and how much a customer contributes in revenue each month or each year. When a customer upgrades or buys an additional service, they contribute more revenue each month or year—which means it takes a shorter time for them to pay back their CAC than it would if they didn't upgrade.

For example, if that same customer that starts on a $15/month plan cost $300 to acquire, it would take your company nearly 20 months to recover that CAC. But if the customer purchases an additional service for $10/month after 6 months and starts contributing $25/month, it would take just over 14 months to recover the CAC. Your company would be out of the red nearly 6 months sooner.

Net MRR churn

Net MRR churn is the difference between MRR lost from downgrades and churn and MRR added from expansion revenue.

When new MRR from expansions is greater than lost MRR, the result is net negative churn. This means your company is making more money from existing customer each month than it is losing from churning customers. This is powerful because it means your company can grow not only by adding customers, but by expanding current customers.

The more you grow your expansion revenue, the more you decrease net MRR churn and push your company towards net negative churn.

Read more about the importance of SaaS metrics in your revenue growth strategy here.