Poor cash flow forecasting is a major reason businesses fail. There are a lot of challenges to come up with an accurate cash flow forecast, but it needn't be perfect to provide you with important information. In this post, we'll explain what cash flow forecasting is, and go over some best practices for performing your cash flow forecasting.

What is cash flow forecasting?

Cash flow forecasting is the process of predicting what the financial situation of your company will be in the future. It relies on counting up all your expected income and expenses and using that to determine your cash position and make cash flow projections. Cash flow forecasts help businesses manage liquidity and predict whether they'll have enough cash on hand to meet financial obligations.

Three reasons an accurate cash flow forecast matters for your SaaS business

So how exactly does an accurate cash flow forecast help a business manage liquidity? And what types of decisions does it empower business owners to make? Let's look at three ways a cash flow forecast brings value to your business operations.

- Clearly identify inflows and outflows — The cash flow forecasting process requires you to develop a very transparent and thorough assessment of your cash inflows and outflows. This, in turn, helps to give you a better picture of what makes your business operate and what your overall financial picture looks like.

- Proactively identify cash balance shortfalls and adapt to them — Getting caught off guard by a lack of funds is a great way to make sure your business doesn't thrive. With an accurate cash flow forecasting model in place, you'll gain a better overview of future and be able to see these potential cash shortfalls well in advance. The right approach to management and forecasting will give you time to make the proper budgeting adjustments and plans that will allow the business to weather the storm.

- Make data-driven decisions for financial planning — A business needs to plan for the future in order to be successful. But it's hard to put a plan for growth in place if you don't have the proper to plan ahead. By predicting cash flow as accurately as possible, you can also determine what investments you can make towards your growth.

What to include on your SaaS cash flow forecast?

If you're convinced of the value of cash flow forecasts, then the next step is to create one for your business. In order to do that, you'll need to know the sorts of things that go into a cash flow forecast. The list below may not be complete, as it varies depending on your business. So be sure to adjust the inputs for the income statement to match your situation.

Cash inflows

In order for a cash flow forecast to be accurate, it needs to take every source of incoming cash into the account. It's very easy for a business to look at revenue and neglect other, less visible, forms of incoming cash. Let's take a look at some common items that count towards cash inflow.

- Revenue from sales — This is your business's primary source of and the one that everyone remembers to include in the list. Remember, though, this is a cash flow forecast, not a profit forecast. You should only include the money that you expect to be deposited into your bank account.

- One-time sales — It's obvious to remember to count your subscription recurring revenue, but don't forget to include those one-time sales in your cash flow statement.

- New funding — Part of planning for growth is planning for future investments. The funds for these investments in your small business often come in the form of loans or money from outside investors. Whatever the source, if additional funding is part of your plans, it should be included in your cash flow forecast.

- Sale of assets — It isn't uncommon for businesses to upgrade their hardware and sell the equipment being replaced. If you routinely sell off old equipment, then the money from sales of that equipment should be included in the cash flow forecasting.

- Interest — The money sitting in your bank accounts often gains interest. Depending on how much money there is, this interest could be a significant amount of cash. Regardless, it should be included in your list of cash inflows.

Cash outflows

Similarly to cash inflows, it's easy to look at the common sources of cash outflow, but ignore the less visible ones. Again, every business will differ, but here are the common things to look for:

- Day-to-day business expenses — These are your obvious expenses. Things such as payroll, utilities, loan payments, repayments, employee reimbursement claims, and other expenses that first come to mind when you think of what your business is spending money on.

- Purchase of assets — We previously talked about sources of funding being an item that gets counted in the list of inflow activities. If you have procured funds, then you have some plan on how to spend them. As you plan out how to spend this new cash inflow, be sure to include those items on the cash outflow side.

- Other fees — Smaller fees are often forgotten about. Be sure to include every payment you're making to SaaS services you may be subscribed to, as well as any other small fees that can be predicted, such as those taken by payment processors.

- Taxes — Forgetting to set aside money for taxes would be a huge mistake, so add your estimated tax payments to your cash flow forecast as well.

Two cash flow forecasting methods

Now that you have an idea of the types of variables that go into a cash flow forecast, let's talk more specifically about the forecasting method itself. There are actually two methods that can be used for cash flow forecasting: direct and indirect. Understanding the difference will help you decide which is right for your business.

Direct

The direct method is less commonly used, but much easier to calculate. The direct cash flow forecasting formula is exactly what you would expect: . As you can see, this method directly uses cash inflow and outflow to generate its output. The reason this method isn't very common is that it can become cumbersome to gather the data, especially for companies that use accrual-basis rather than cash-basis accounting.

Indirect

The indirect method for conducting cash flow forecasting starts with net income and then accounts for items that affect profit but not cash flow. In accrual-basis accounting, transactions are recorded before money actually changes hands. So accounts receivable and accounts payable must be adjusted to account for the actual flow of cash. Similarly, money that's been set aside for taxes, but not spent yet, needs to be added back in. Of course, you still must account for the money coming in from funding or paid back to sources of funding, as well as any assets purchased or sold.

Three cash flow forecasting best practices for accurate projections

Getting the best results isn't just about knowing how to forecast cash flow, you must also have a proper system in place for actually managing the calculations. Which brings us to the meat of this post. By following these three best practices, you can help ensure that your cash flow forecast is as accurate as possible, regardless of which method you decide to use.

Scope out your short-term and medium-term financial plan

You can't accurately forecast what money will be coming in and going out if you don't also accurately plan your finances for the time period being considered.

Be consistent with reporting and communication

Doing anything inconsistently will give you inconsistent results. Cash flow forecasting is no exception. Once you decide to do it, maintaining the data should become a regular part of your operation.

Automate to minimize human error

There are many errors that can be made in cash flow forecasting. Using automation tools and practical accounting forecasting software will drastically reduce the chances of those errors occurring.

Build your own cash flow model with this template

It's simple to get started building a cash flow model with this free template. With this template you can:

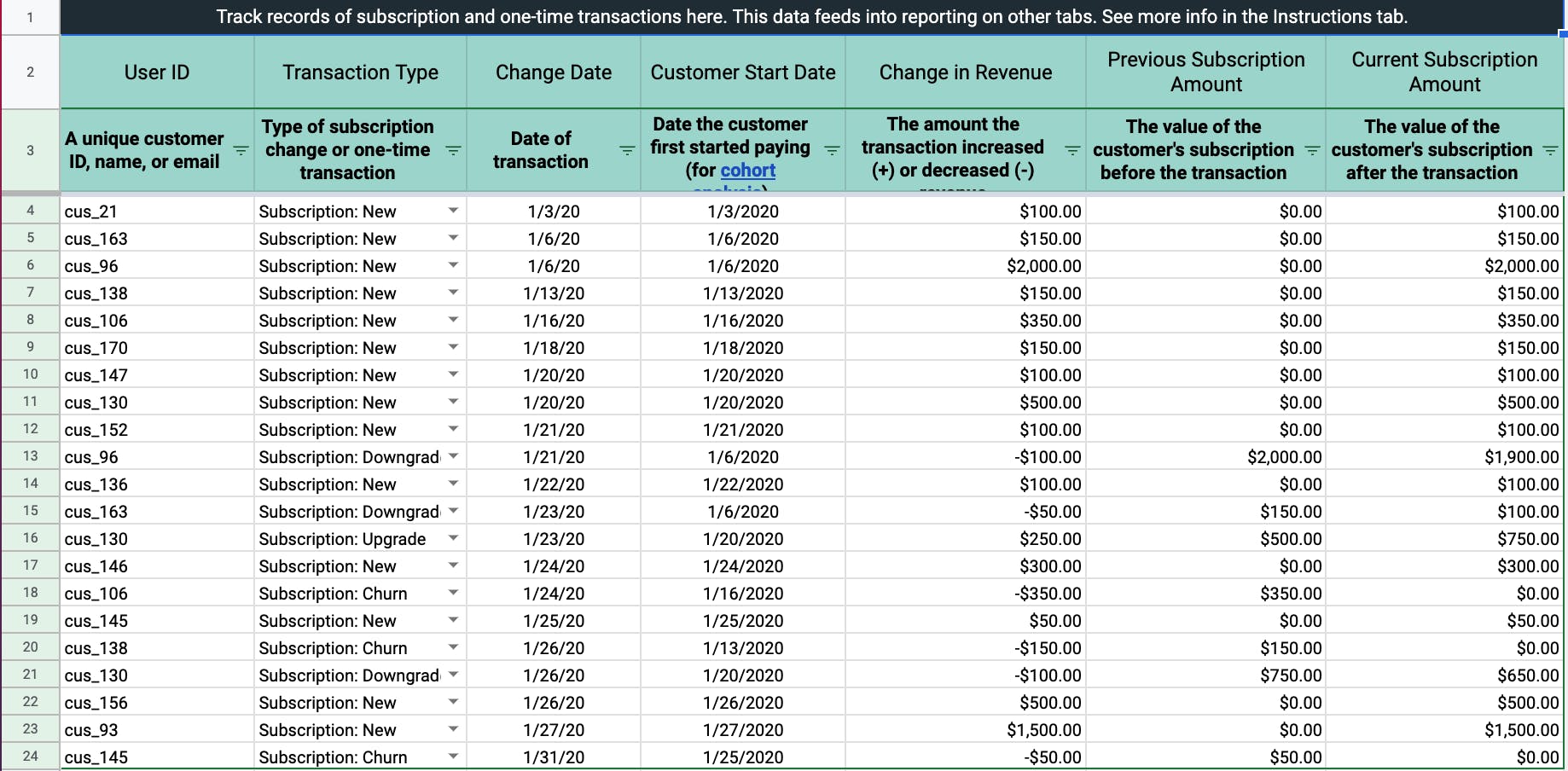

- Maintain records of your customer transactions.

- See your subscription over the course of a single month.

- See how has trended by month.

- See how and expansion revenue have impacted net retention over time.

- See how subscription revenue and one-time transactions lead to cash flow for your business.

- Quickly calculate measures of like payback period, and more.

You can start by simply navigating to the Transactions tab of the spreadsheet and keeping the data filled in. With this, you'll be able to generate a cash flow model as well as several other useful metrics. The data in the transactions tab will allow you to record your subscription and one-time revenue using highly detailed reporting that will power the other reports to give you a very granular look at your finances. This information will help you make more informed decisions about a wide variety of business operations.

Accurate cash flow forecasting with ProfitWell Metrics

The template above is a great way to get started tracking important metrics about your business, but it still requires a lot of manual work. We can help. ProfitWell Metrics subscription analytics can help automate all of your subscription reporting, eliminating human error. Our powerful—and free—subscription analytics tool was designed specifically with the needs of SaaS businesses in mind. It will provide you with accurate, real-time reporting and analytics—everything you need to know to keep growing—all in one place.

Cash flow forecasting FAQs

What's the difference between indirect and direct cash flow forecasting?

Direct cast flow forecasting is calculated by plugging in cash inflow and outflow directly. Indirect forecasting works, instead, by taking the net income and adding or subtracting categories of items to account for the difference between items calculated on an accrual basis versus the actual exchange of cash.

What are the benefits of cash flow forecasting?

Cash flow forecasting allows you to get a more complete picture of your company's financial health. You'll be able to more accurately plan for future expenses, predict negative cash flow, and see when other potential cash flow problems will arise well in advance, so you can prepare for them.

How do you create a cash flow forecast?

A cash flow forecast is created by estimating what your income will be over a given period of time and subtracting away expected and planned expenses. This can either be direct, based on actual cash flow, or indirect, based on net income and accrual entries adjusted for the flow of cash.