Both Busuu and Duolingo are huge players in the language learning market. Duolingo is arguably the more popular platform and is well-known for its fun and playful branding and gamified learning approach. Busuu, on the other hand, positions its brand as the practical learning alternative.

In this week's Pricing Page Teardown, Peter and I talk through these opposing strategies, focusing on which one is best suited for expanding into a more business-focused market. Busuu and Duolingo are both going after personal users at the moment, so whichever company gets a head start on this larger market share is largely dependent on their pricing strategies.

How much do Busuu and Duolingo cost?

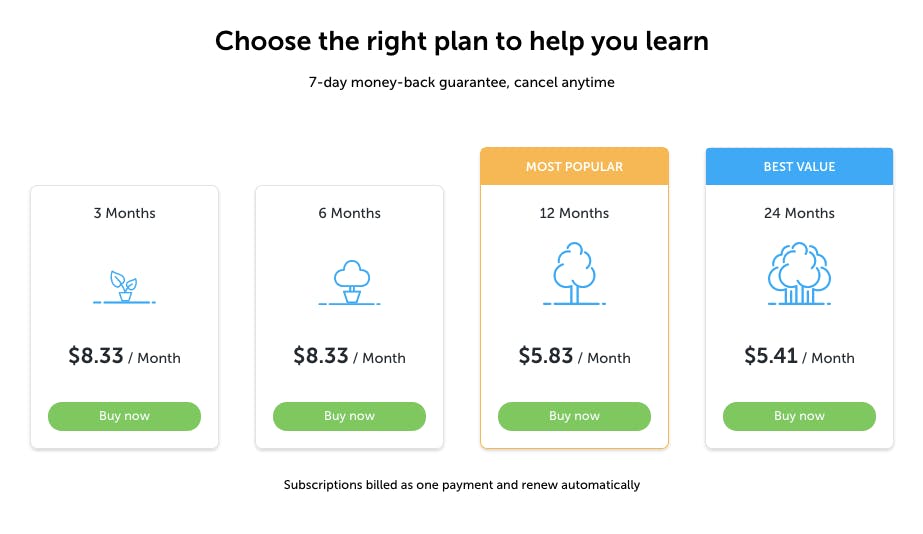

Busuu starts out with a freemium plan, offering upgrades to premium based on the plan length. For three or six months, it is $8.33 per month; for 12 months, that decreases to $5.83; and for 24 months, it's only $5.41. Duolingo also starts with a freemium plan with the option to upgrade to Duolingo Plus at a flat $6.99 a month.

Busuu's pricing model will help them beat Duolingo to the business market

“Busuu's price scales depending on how long you sign up for, and I love it! Three months vs. six months at the same price is a really effective strategy that a lot of people don't think about.”

From an acquisition standpoint, both Busuu and Duolingo rely on the power of the freemium model. After that, Busuu definitely comes out ahead with their contract-length pricing tiers. Duolingo's one-size-fits-all approach doesn't give them nearly as much room to expand into the business market.

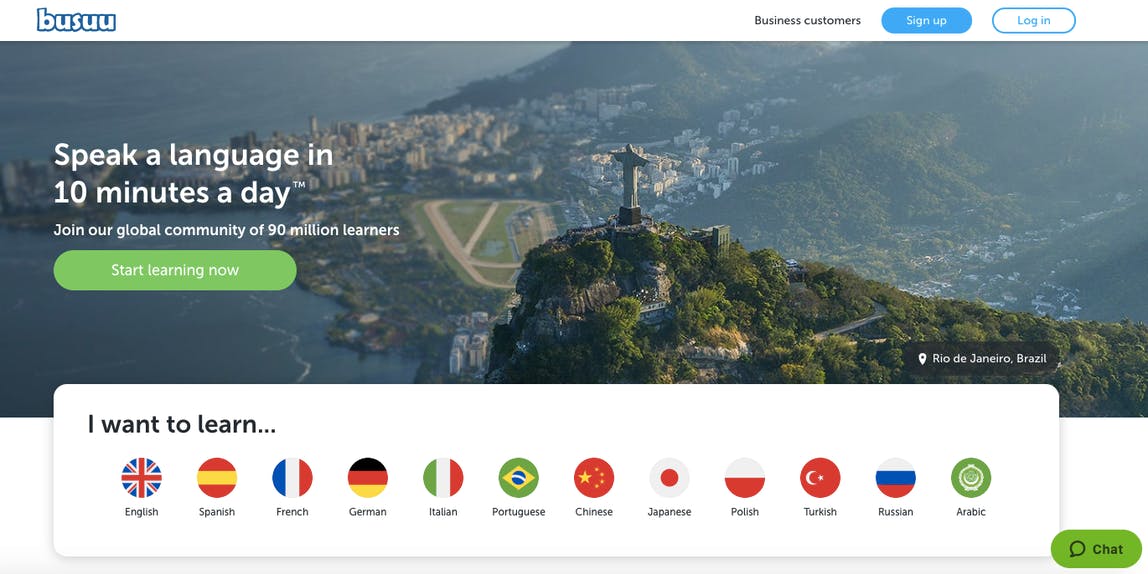

Busuu's value proposition and page design also do a lot to promote their practicality in the face of Duolingo's fun and playful branding.

On their home page, Busuu speaks directly to the value and efficiency of their platform, saying 'Speak a language in 10 minutes a day™', and adds in some social proof by calling out their 'global community of 90 million learners.'

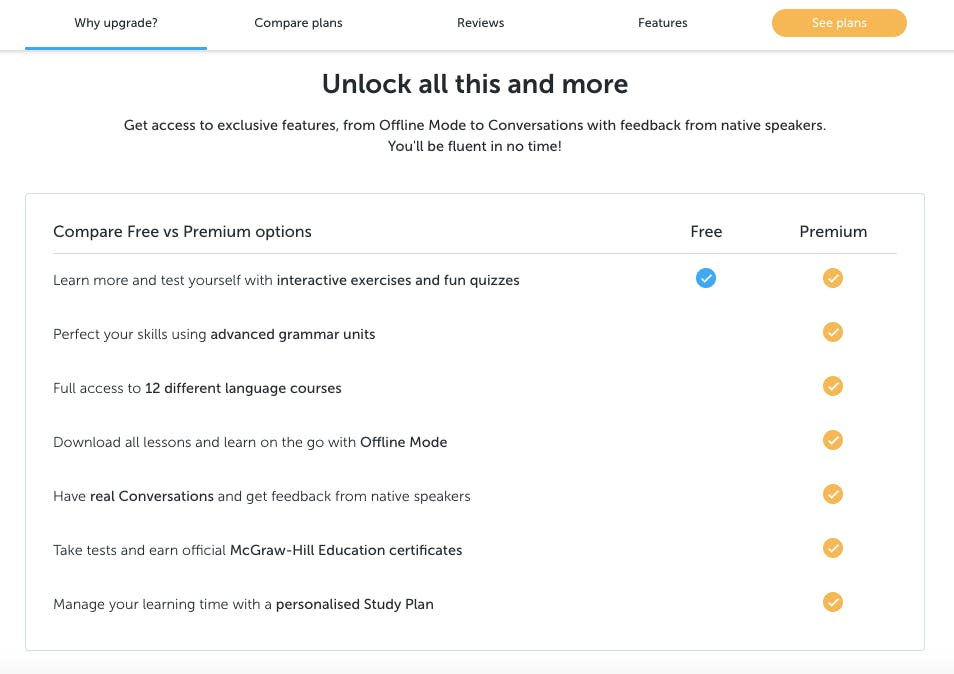

These sentiments are what underpin Busuu's unique value proposition. And you can see that carried through to their Busuu Premium pricing page as well.

The features they call out are all focused on showing potential customers how practical and effective their platform can be. This is especially true when you consider their offer of native speaker conversations, certificates, and personalized study plans.

But Busuu doesn't differentiate their pricing tiers based on these features; they use contract length instead.

This is a great tactic because it gives Busuu a way to show the Most Popular and Best Value plans, as well as drive potential customers towards an annual package. Annual pricing, in general, helps potentially decrease churn and keep average revenue per user (ARPU) high.

Duolingo goes for a much simpler and straightforward approach, with a home page that plays up the freemium aspects of their platform.

Their 'Learn a language for free. Forever.' value proposition is not as specific as Busuu's and only showcases one aspect of what Duolingo's overall platform has to offer.

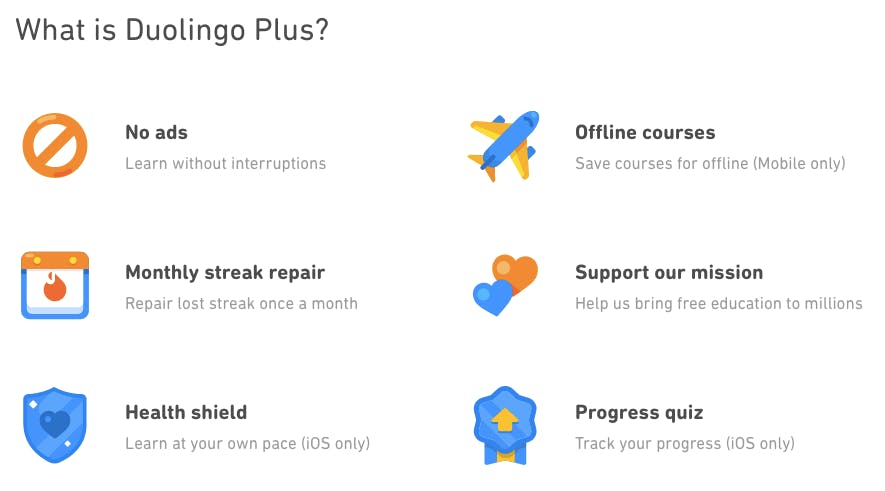

You don't get much more on their Duolingo Plus pricing page either.

The 'Boost your learning.' statement doesn't provide any qualifying information about why a customer should pay $6.99 a month for this plan. You only get to that by scrolling lower down the page.

Their biggest selling points are No ads and Offline courses, which according to some data we'll talk through a bit later, isn't the best position to take. That said, their page design is a lot more colorful and fun than Busuu's, which is on brand for an app that's trying to gamify their user's language learning.

That gamification is what Duolingo is known for, and likely one of the main drivers for their growth, at least in terms of their mobile app. But if they want to expand out of the personal market and appeal to more businesses, they need to switch up their positioning.

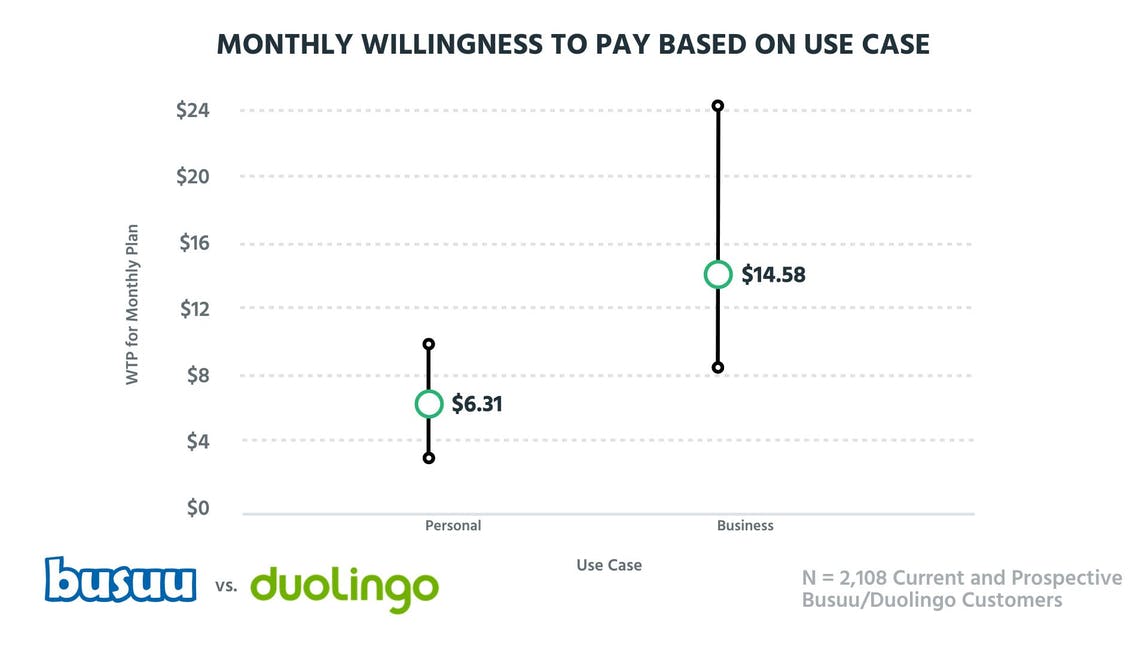

If you're asking yourself why either company should make that change, take a look at this data from current and prospective customers about their willingness to pay:

Business use cases have more than twice the willingness to pay than personal use cases. Both Busuu and Duolingo currently sit squarely in the willingness to pay range for personal use cases, with Busuu priced higher in their three- and six-month tiers. Using these tiers, they can more easily move up towards the $14.58 average we see for business use cases.

At $6.99 a month across the board, Duolingo would have to do a lot more restructuring of their pricing to meet what businesses are willing to pay. And in doing so, they'll potentially alienate some of their current user base, who see it more as a game than a learning tool.

Localization should be a part of everyone's pricing strategy

When we dig into the data a bit further, interesting opportunities arise for both companies in terms of willingness to pay. Probably the most important of those opportunities is related to price localization, which is when you tailor your price to the willingness to pay of a specific area.

“Localizing your price points is actually a really strong growth lever because the demand and the cost of living are going to be different based on the country or area your customers are in.”

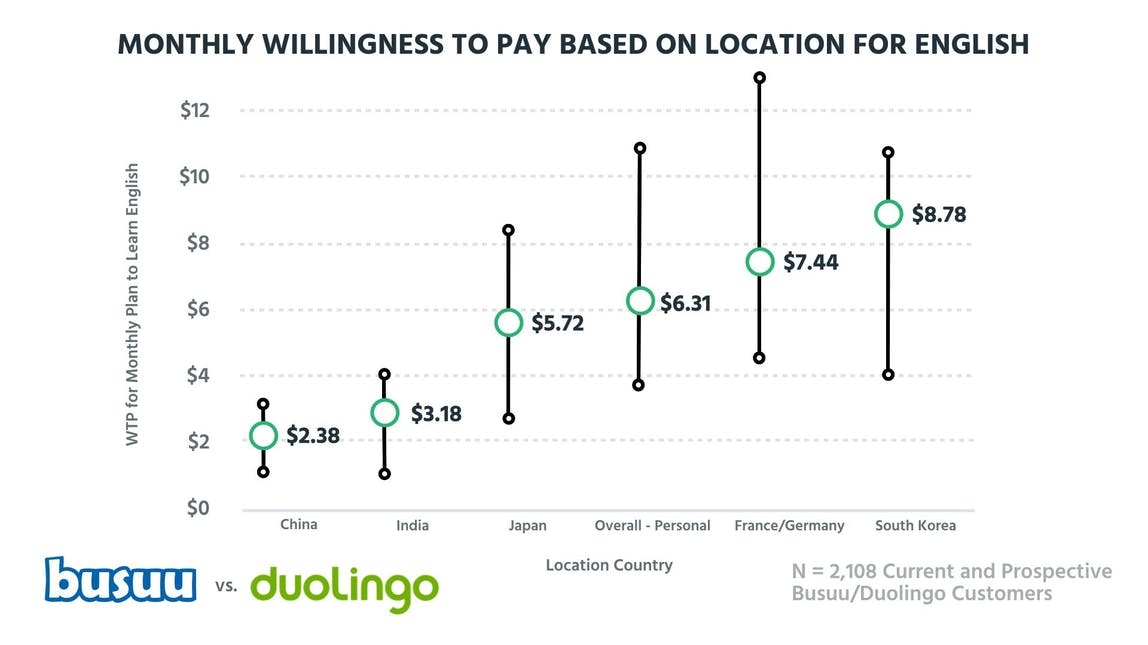

Of the 2,108 current and prospective customers we surveyed, France/Germany and South Korea definitely have the most potential.

Using the $6.31 Overall - Personal willingness to pay as our base, France/Germany averages more than a dollar higher at $7.44, and South Korea above that with an average of $8.78. If they're not doing it already, these two companies can make a direct impact on their revenue just by localizing price for a few specific countries.

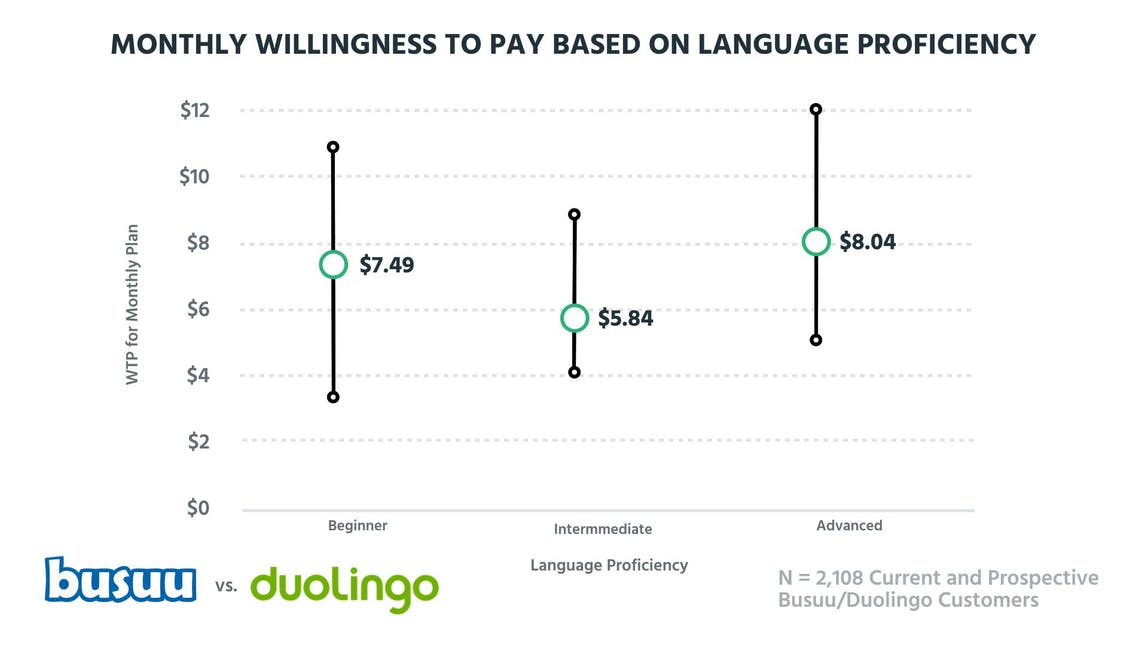

Busuu and Duolingo also have a bit of an opportunity when it comes to language proficiency. Right now, it looks like they're only really targeting beginners.

If they continued to target beginners, both companies only have the opportunity to raise their prices above the $7.49 average, up to about $11. While that is higher than both currently offer, it doesn't consider any other segments. While there's a bit of a dip when it comes to Intermediate speakers, willingness to pay increases again for Advanced language proficiency.

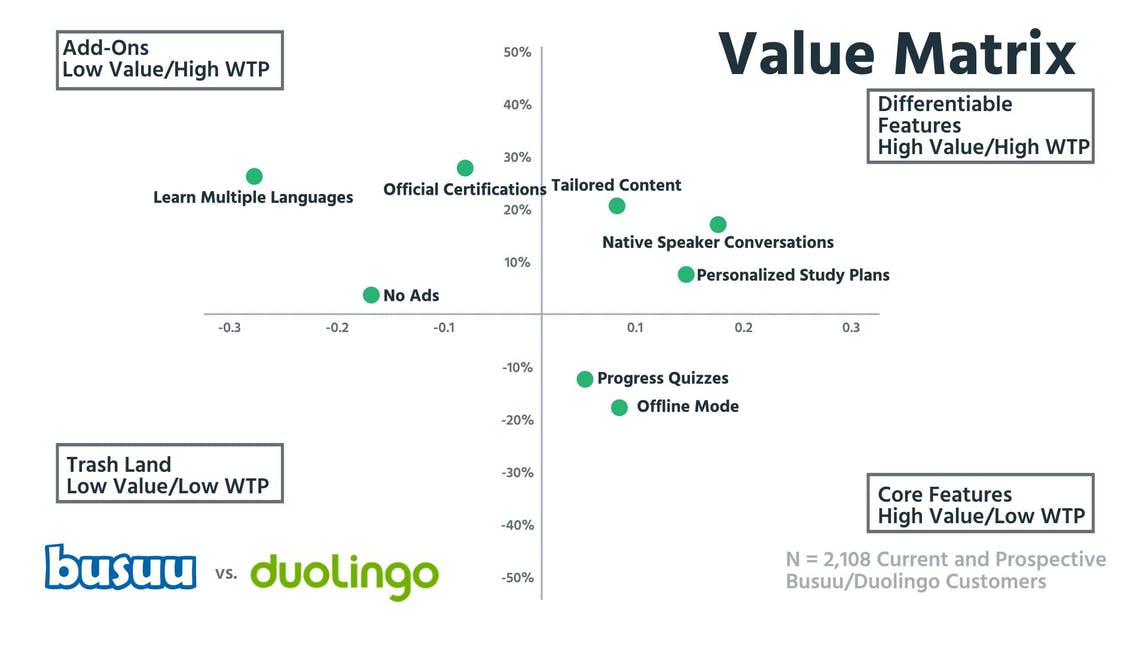

Both companies could easily create a premium or enterprise tier that speaks directly to the needs of these Advanced language learners, thereby justifying a higher price tag for Differentiable Features.

Busuu does this somewhat already, offering their premium package with Native Speaker Conversations and Personalized Study Plans, but their pricing doesn't match the uptick in customer willingness to pay we see in this value matrix. They could easily break these out into a higher-priced package for Advanced learners and target them with specific messaging. Busuu also misses the opportunity for an Add-On with their offer of Official Certifications.

Duolingo is behind the curve here as well, and more so than Busuu. They differentiate their Plus plan with the offer of No ads, Progress Quizzes, and Offline Mode. An ad-free experience isn't something that many people are willing to pay for, and the quizzes and offline offer are pretty much table stakes for a language learning app. Duolingo will need to do a lot more to catch up with Busuu if they're going to capitalize on this feature preference.

Duolingo needs better positioning to compete with Busuu

While both companies are doing well in the personal market, there's work to do if they want to expand into businesses. That's part of the reason both Peter and I would go for Busuu as a user and investor. Busuu has a better grasp on their strategic positioning and has obviously put a lot of thought behind their product marketing.

That's not to say that Duolingo hasn't, it's just that their playful branding and gamified learning don't really appeal to us, and would be a harder sell as a business use case.

There's definitely work to be done by both companies, but in the long run, Busuu definitely has a lot less to do to expand their product offering into the larger, business-focused market.