It's a lesser known fact that how you design your product pricing affects your bottom line even more than the your acquisition and retention strategies. Which raises the question, how should you be designing yours?

- How is SaaS pricing different?

- Why SaaS pricing is important

- Pricing strategy vs model

- 3 popular SaaS pricing strategies

- Cost-plus pricing

- Competitor-based pricing

- Value-based pricing

- 4 step pricing process

- SaaS pricing models

- Flat-rate pricing

- Usage-based pricing

- Tiered pricing

- Per-active-user pricing

- Per-feature pricing

- Freemium pricing

- Real-world examples

- Changing your model

- Key takeaways

Here's a fun fact: A 1% improvement in how you monetize can lead to a 12.7% increase in profit.

If your SaaS company doesn’t have a pricing strategy in place, you’re leaving huge revenues on the table. Defining your SaaS pricing model is one of the most important steps you can take for business success.

Companies pour blood, sweat, and tears into creating a great product and bringing in new customers. Yet most SaaS companies don’t know what they’re worth to their customers or how best to communicate value. With so many SaaS pricing models to choose from, it could easily be a case of analysis paralysis.

Yes, nailing your pricing strategy is crucial to SaaS success—but it doesn’t have to be that difficult. Let’s take a dive into SaaS pricing: why it’s important, how to build your own kick-ass pricing strategy, and some examples of great pricing strategies and models from the real world.

How is SaaS pricing different?

In the subscription-based pricing model, customers pay on a regular basis for continued use of a service or product. This means the strategies for setting subscription prices are very different than pricing traditional products—ongoing customer payments and complex product packages mean SaaS companies need to put more thought into their pricing.

What's to gain from nailing your SaaS pricing?

Most SaaS companies we come across take one of two approaches to their pricing:

- They either set their prices on instinct when they start the business and then forget to ever take a second look.

- Or, they’re simply too terrified of scaring away potential customers to make the changes needed to keep the business profitable and growing.

If you can get over the fear of failure, though, the benefits of nailing your SaaS pricing are worth it. You’ll not only gain a valuable advantage over your competitors (who themselves are too afraid to manage their own pricing), you’ll also unlock fresh growth and sustainability for your company.

Gain a competitive advantage

You’re not the only company that struggles with pricing—many other SaaS companies you’re likely competing with are avoiding optimizing their pricing for all the same reasons.

By optimizing your pricing, you’ll gain an advantage in the market—and every little bit counts, especially with all software going to $0.

Provide true value for customers

More than anything, customers want to buy products they can easily justify; purchases they can reflect back on later and think “that was a great decision.” Finding a price your customers are eager to pay means pricing based on value instead of your business costs or competitors’ pricing models.

I’ll dig into this in more detail in a later section, but if you haven’t factored in value-based pricing on your current SaaS pricing, you might want to read this.

Unlock an untapped growth lever

Ask any SaaS founder what growth means to them, and they’ll likely respond with “more customers.” But, it turns out monetization has a far bigger impact on the bottom line than acquisition.

In fact, our study of 512 SaaS companies showed monetization was 4x more efficient than acquisition in improving growth and 2x more efficient than efforts to improve retention.

Strengthen your SaaS unit economics

Boiled down, SaaS success depends on the balance of two metrics: customer lifetime value (CLV) and customer acquisition cost (CAC). At its most basic, you need to make sure your CLV is substantially higher than your CAC; otherwise, you’re not going to grow.

- It lowers your CAC through better positioning and packaging and targeting ideal customers; and

- It increases CLV through higher prices and better retention.

The result? A stronger SaaS business, faster growth, and increased revenues.

Now you’ve seen all the benefits of optimizing your SaaS pricing, it’s time to leave the kiddie pool and dive deep into creating your own pricing strategy and choosing the right model for your business.

The difference between a pricing strategy and a pricing model

First up, a quick look at the semantics. Pricing strategy and pricing model are terms that are often used interchangeably. Let's clear up what we're talking about.

Pricing strategy is the guiding processes and principles that lead you to your chosen price points, product packaging, and model. The best pricing strategy greatly depends on the market you operate in and the customers you serve.

Pricing models are the format and structure of your pricing and packaging. You can work out a company's pricing model from their pricing page, without any real insight into who they are and what they do.

3 popular SaaS pricing strategies

SaaS pricing strategies run the gamut from picking numbers out of thin air at one end of the spectrum all the way to fully optimized, value-driven pricing plans at the other. Think of pricing like a game of darts: you can throw at random, or you can aim for specific points on the board, but without data to tell you where to aim, you might as well be shooting in the dark.

The reality is that pricing for maximum revenue doesn’t have to be difficult—you just need the right pricing strategy. Each of the pricing strategies below has its place for different business types, but in SaaS, the only viable option in our experience is value-based pricing.

Cost-plus pricing

Cost-plus pricing is what people automatically think of when they think of “pricing strategy.” It’s the most basic form of pricing: add up all your costs, add a few percentage points of profit margin, and that’s where you set your prices. For a SaaS company, those costs might include things like product development and design, the company’s own SaaS providers, and the costs of the team.

Going back to our darts analogy, cost-plus pricing ensures you’ll at least be landing on the board—but anything beyond that is left to chance.

That’s where the good news ends, however. Cost-plus pricing is nowhere near the best solution for maximizing SaaS revenue since the costs for delivering a single account of a SaaS product can be very low. Your pricing should be based on the value that your customers will get out of using your product, not how much you paid your developers.

Competitor-based pricing

Instead of using your business costs as a benchmark for your pricing, competitor-based pricing involves setting prices based on what your competitors are already charging. Depending on how well your competitors have set their pricing, competition-based pricing can get you closer to a pricing bull’s-eye—the strategy works particularly well for newer companies unsure of the value of their product and without existing sales data to back up their decisions.

Our advice? Look, but don’t touch. You want to know where your competitors are pricing their products so that you’re in the same ballpark, but they should not be guiding your decisions.

Value-based pricing

To put it bluntly, value-based pricing is the only pricing strategy you should choose for your SaaS company. Instead of looking inwardly at your own company or laterally towards your competitors, with value-based pricing, you look outward. You look for pricing information from the people who are going to make a decision depending on your price: your customers.

- Your pricing matches exactly what they’re willing to pay for the value you provide.

- You can offer packages and price points that precisely meet their needs because you understand what your customers truly want.

- You can start at a higher price point than your competitors—if you find that customers are willing to pay that price—which leads to higher revenue from the start.

undefined

So what’s the downside, then? All this research takes time. Learning how willing each customer is to pay isn’t the easiest thing to do, which is why most people stick to competitor-based or cost-plus pricing. You have to be dedicated to finding out about your customers and your product to perform value-based pricing effectively.

Keep in mind, too, that even value-based pricing doesn’t give you a silver bullet. Instead, it spits out a range of prices that still forces you to make a decision on the exact price and how you package those prices for customers, leading perfectly into our next section: how should you package your SaaS pricing?

The 4 steps that make up a great SaaS pricing process

Pricing is an ongoing process, a set of steps companies should keep repeating until they find a viable (and profitable) pricing strategy.

The process we follow covers four main steps: Problem, Cause, Solution, and Implementation.

Problem: find the main obstacles your company is facing

The #1 question any SaaS company asks is, “What is stopping us from growing?”

It might seem like a straightforward question on the surface, but the problems range far and wide—it could be product, people, customers, or any one of a dozen other areas. The only way to find the answer is to chip away at this question, drill down into your biggest problem areas, and gaps in understanding.

SaaS companies tend to face five major problem areas when it comes to growth:

- Poor unit economics

- Poor user retention

- Poor MRR retention

- Poor acquisition volume

- Poor conversion

Almost all of these (with the exception of acquisition volume) can be solved by improving your pricing strategy. You need to explore these areas deeper, focusing on one at a time, and collect the necessary data to define the problem. These are the things that are stopping you from succeeding and stopping your customers from succeeding with you.

Cause: use data to discover the root cause of these issues

To find out what that underlying disease truly is, you have to go to the source: your customers.

Customers are the only people who can tell you why they don’t value your product as it stands. Unfortunately, the vast majority of SaaS companies usually avoid this step for three main reasons:

- It takes time.

- They’re scared of what they’ll find out.

- They think they already have the answers.

By asking the right questions of your customers and adding the right data to your buyer personas, you can find out more about where your company is succeeding and where it is failing than you ever would looking at an analytics dashboard.

I won’t beat around the bush—it takes hard work. You’ll no doubt hear things you don’t like, and you’ll need to face the harsh reality of your current pricing strategy.

But all of this is data that makes your company better and moves you up and to the right.

Solution: use data-driven experiments to test viable solutions

This is the fun (and also the scary) part. Running tests and gathering data to validate or invalidate your hypotheses are vital for identifying the best long-term pricing strategy that you can.

By testing small changes often, you can quickly get reliable data on each of your individual hypothesis. You can see what works and what doesn’t, and only take the time and effort to permanently implement the changes that maximize growth and revenue.

Implementation: put into action the best solutions

This is where you take the results from your experimentation and embed them into your pricing.

This is the entire point of your pricing process, though also the part that companies rarely follow up on. Going live with major pricing changes is terrifying for any SaaS company. Will customers recoil at the new prices? Will acquisition drop off a cliff?

With quantified buyer personas, though, you can make these changes confidently, safe in the knowledge that the value you provide aligns with what the customers want and what they are willing to pay.

Now you understand the process for developing your pricing, let’s take a look at a few strategies you can use to determine how much you should be charging.

The most popular SaaS pricing models

There are dozens of ways to price your SaaS product, but most companies tend to follow a handful of popular pricing models. Here are seven SaaS pricing models most commonly used:

- Flat-rate pricing

- Usage-based pricing

- Tiered pricing

- Per-user pricing

- Per-active-user pricing

- Per-feature pricing

- Freemium pricing

Let’s look at each one in turn.

1. Flat-rate pricing

What is flat-rate pricing?

This model is the simplest approach to selling SaaS. You offer one product at one price, with the same set of features – and that’s it. Customers get the choice between paying monthly or paying annually, often with a discount available for annual subscriptions.

Pros of flat-rate pricing

- Easy to communicate value – flat-rate pricing is easy for potential customers to understand. They don't need to struggle to decide which option. That also makes it more comfortable for you to sell.

- More focused – with just one product, you can focus all your sales and marketing efforts on it, and build clearly-defined funnels.

Cons of flat-rate pricing

- Limits customer diversity – for example, a product priced for enterprise buyers will likely be too expensive for small businesses. Finding the sweet spot for pricing can be tricky.

- Missing out on potential revenue streams – With just one price, it’s hard to up-sell when existing customers want more services

- Lack of nuance – potential customers either want it, or they don’t. You don't have much scope for persuading them.

Who is flat-rate pricing a good fit for?

Flat-rate pricing could work for your business if you offer either a simple product with a limited feature set, or a consumer-focused subscription product.

Flat-rate pricing in action

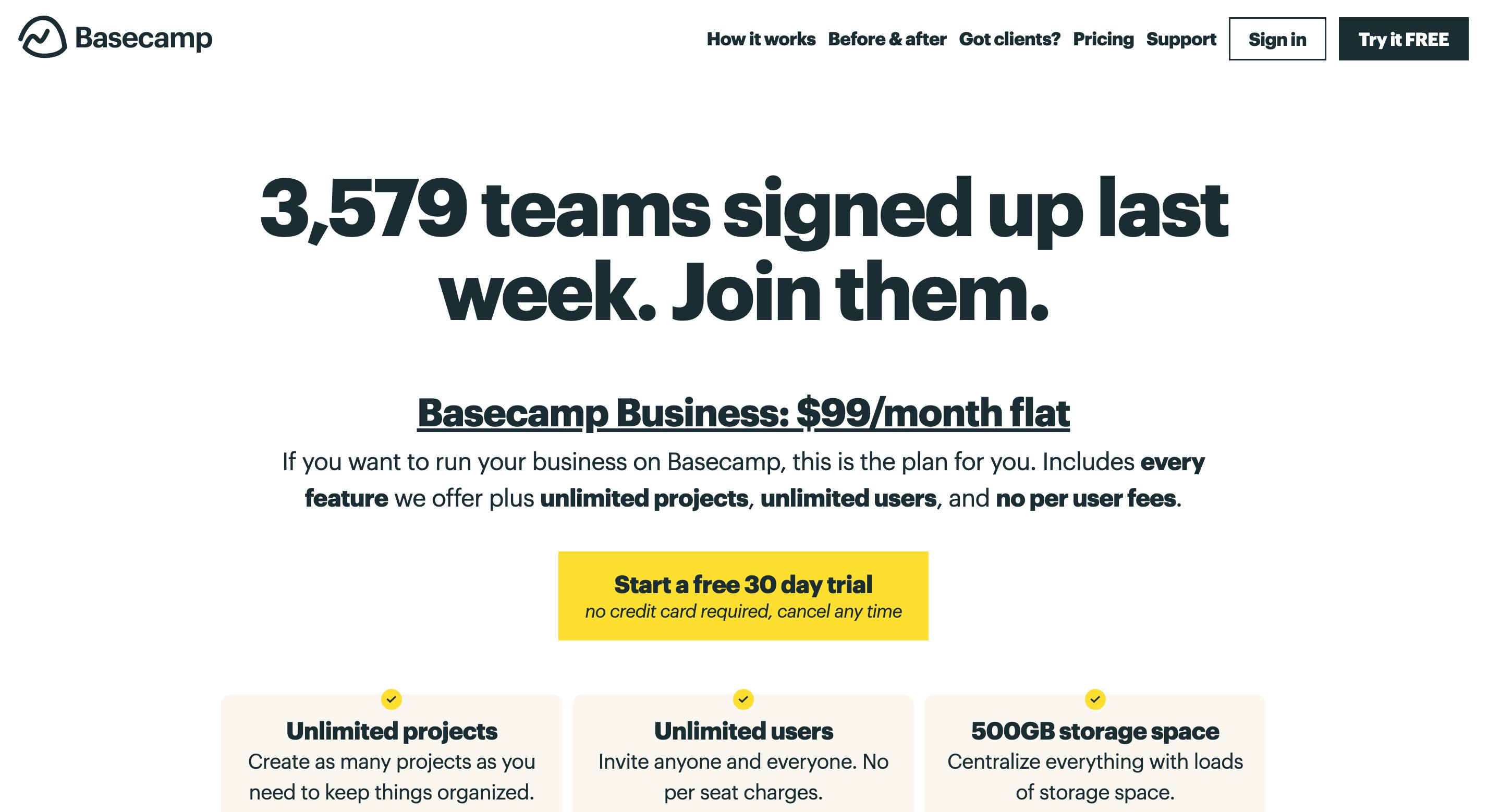

Project management software provider Basecamp offers a flat-rate pricing model targeting people working in teams online.

Basecamp charges a flat rate of $99 a month for 500 GB of storage, unlimited projects, unlimited users, and no per-user fees.

2. Usage-based pricing

What is usage-based pricing?

With this model, the cost of the product relates directly to how much a customer uses it. If they use more, the price goes up. If they use less, the price goes down.

Usage-based pricing is common among infrastructure software companies (like Amazon Web Services or Digital Ocean), which charge users based on things like the number of gigabytes of data they use, or how many API requests they make.

Pros of usage-based pricing

- Customizable – Appeals to a wide range of customers with different needs

- Transparent – The model gives the customer the responsibility for managing their usage

- Lower bar to entry – Easier to attract new clients because the price is not the main deciding factor

Cons of usage-based pricing

- Unpredictable revenue – this model tends to attract customers with volatile use patterns, making it harder for you to predict and manage your revenue from one month to the next

- Growth depends on customers – your own growth is closely tied to that of your customers. You can only scale if their businesses grow, leading to them spending more money on your service

Who is usage-based pricing a good fit for?

It's great if your customers have volatile demand in their businesses, as you can tailor your pricing to match that demand.

This is especially attractive for smaller start-ups, as it gives them the option to use the same products as enterprise companies, at an affordable price point.

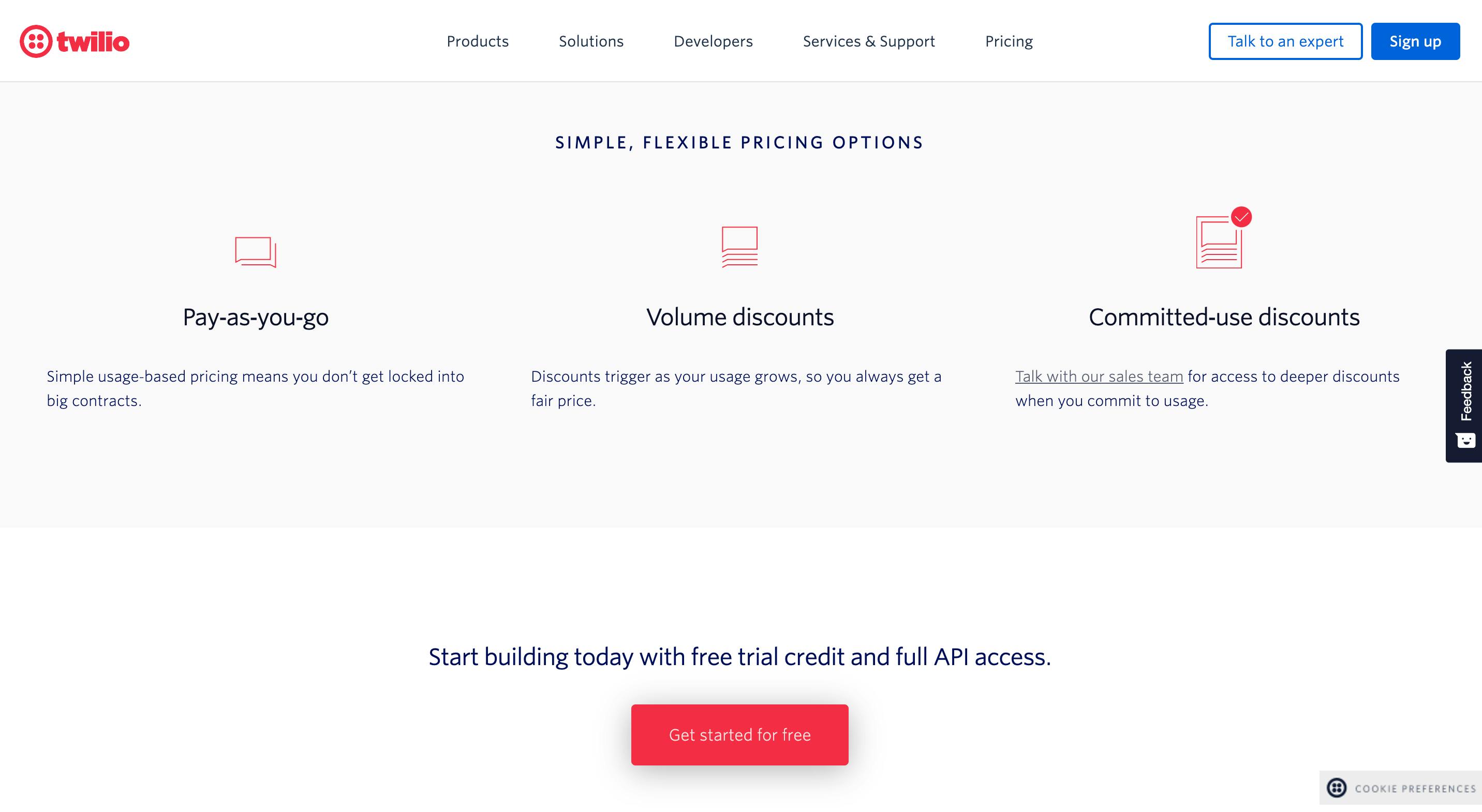

Usage-based pricing in action

Twilio is a cross-platform communication tool. It offers a choice of messaging in SMS, voice, video, WhatsApp, email, and more. Twilio offers users a small number of free credits to get started, then charges them by the number of messages they use.

3. Tiered pricing

What is tiered pricing?

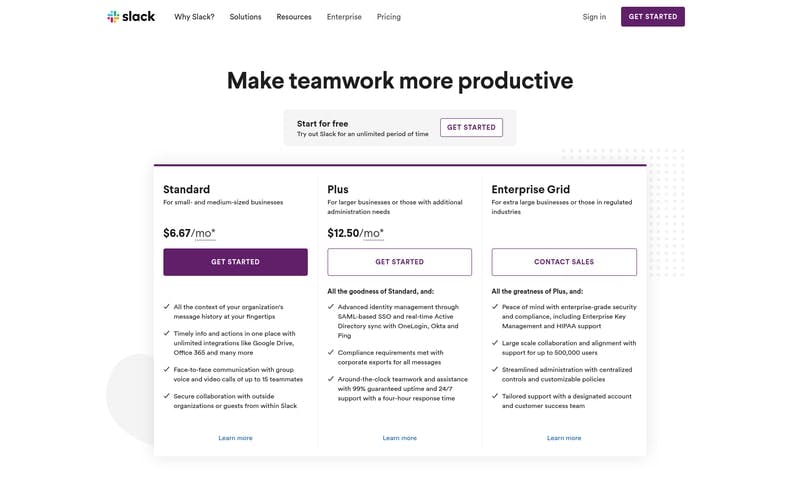

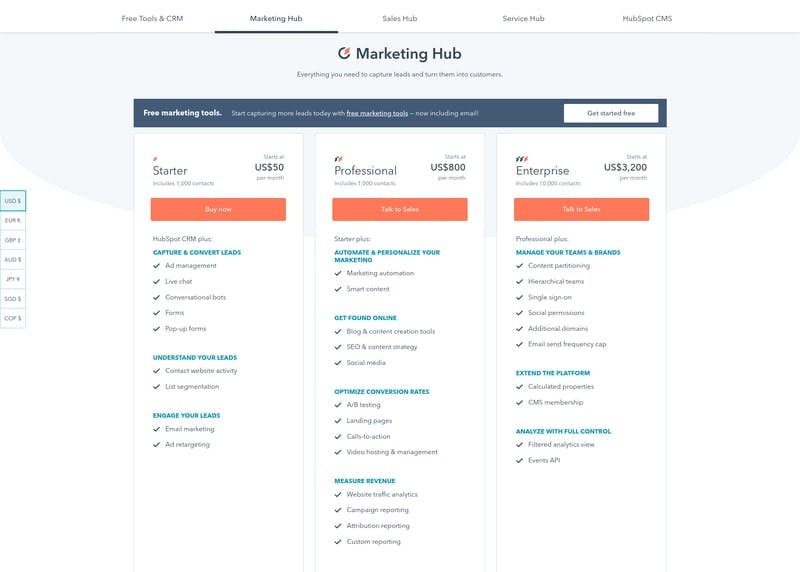

Tiered pricing tends to be the best pricing model for most SaaS companies, and the one we most often recommend. It's the model used by companies like HubSpot and Slack.

The tiered pricing model lets SaaS companies offer two or more packages or fixed sets of features for a specific price. Each tier can be tailored to meet the specific needs of a particular buyer persona—for example, beginner users versus enterprise—with tier prices increasing as you provide more value.

Pros of tiered pricing

- Maximizes revenue – better persona targeting leads to higher conversions and maximum revenue

- Broader appeal – using multiple packages lets you appeal to a wider range of potential customers – individuals, small businesses, and enterprise clients – hence boosting your revenue potential

- Easy upselling – the customer has an obvious route to the next level, once they outgrow their current tier. This helps boost your customer lifetime value and enhances customer loyalty.

Cons of tiered pricing

- Risk of overwhelm – too many options can confuse potential customers and lead to abandoned sales. It's usually best to stick with just three price tiers.

- Loss of focus – Creating too many packages with too many features can cause you to lose focus on your core target audience

- Deep audience research needed – this is key to make sure you combine the different features in the best way for the target audience. But it can consume a lot of time and effort.

Who is tiered pricing a good fit for?

If your business sells licenses, seats, or similar, then tiered pricing could be the best SaaS pricing model for you.

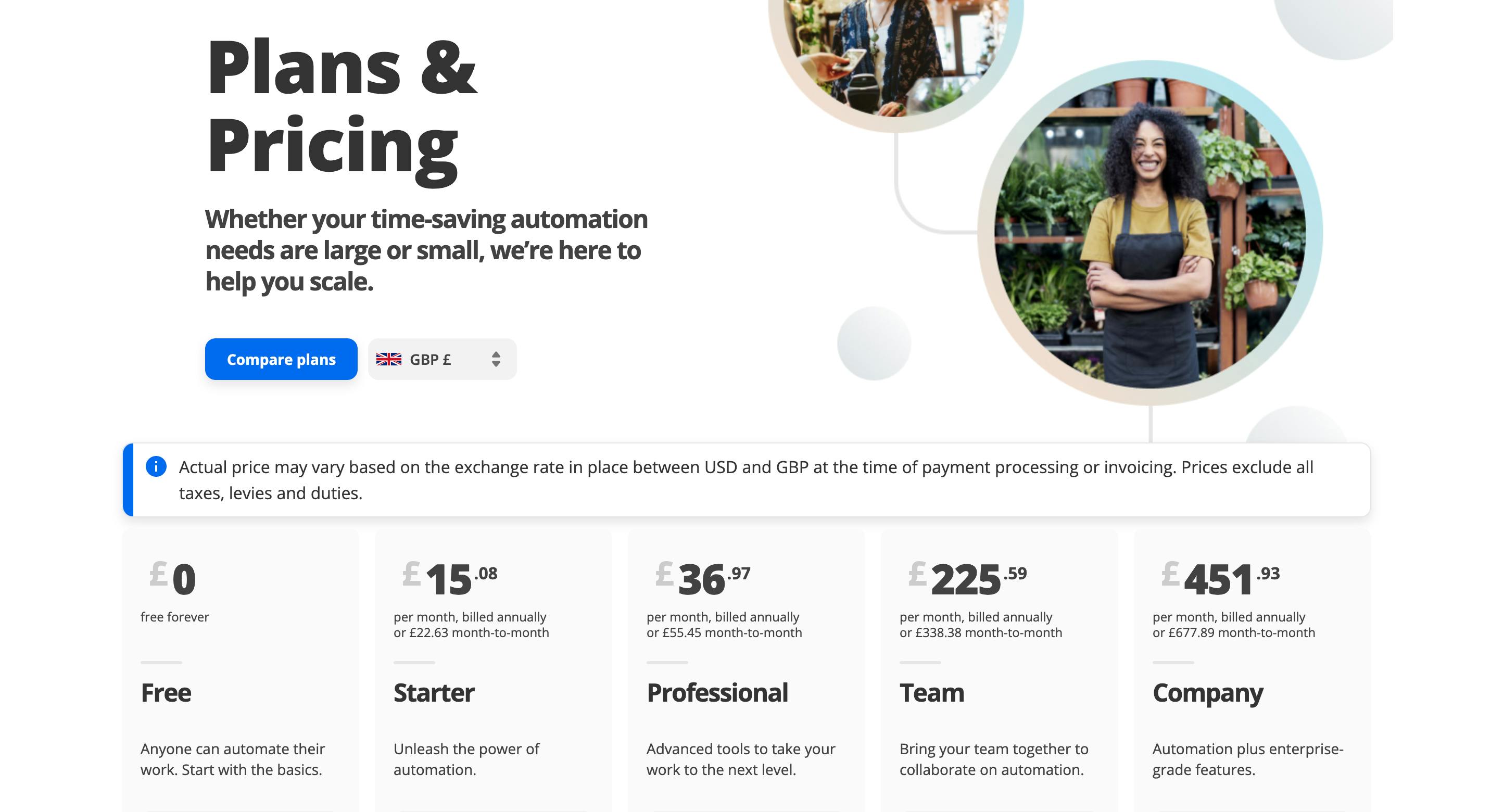

Tiered pricing in action

Zapier is a tool that helps users automate commonly repeated tasks. They use a pricing model structured around five tiers, ranging from ‘Free’ (zero cost) at the bottom to ‘Company’ (599 USD per month) at the top.

4. Per-user pricing

What is per-user pricing?

Per-user pricing is another one of the most popular pricing models currently used in the SaaS industry. It's popular because of its simplicity – a fixed monthly price for one user, double that price for a second user, and triple for a third.

Your customers can easily understand what they get for their money, and your SaaS company benefits from having predictable monthly revenue.

Pros of per-user pricing

- Simplicity – both for your customers and for your business

- Predictable revenue – with per-user pricing, you can easily forecast your revenue for each month

- Adoption is rewarded – your revenue is directly tied to user adoption, so increase your users and you'll also increase your revenue.

Cons of per-user pricing

- Users may cheat – per user pricing allows users to share logins with others, which means you lose out on additional revenue

- Limits number of users per organization – in order to save money on additional users, companies who buy your product will be careful how many licenses they buy

- Hard to communicate value – with per-user pricing, it’s harder for customers to see real value in adding another user

Who is per-user pricing a good fit for?

It's great for SaaS companies who rely heavily on a recurring revenue model because per-user pricing makes it really easy to predict your MRR.

Per-user pricing in action

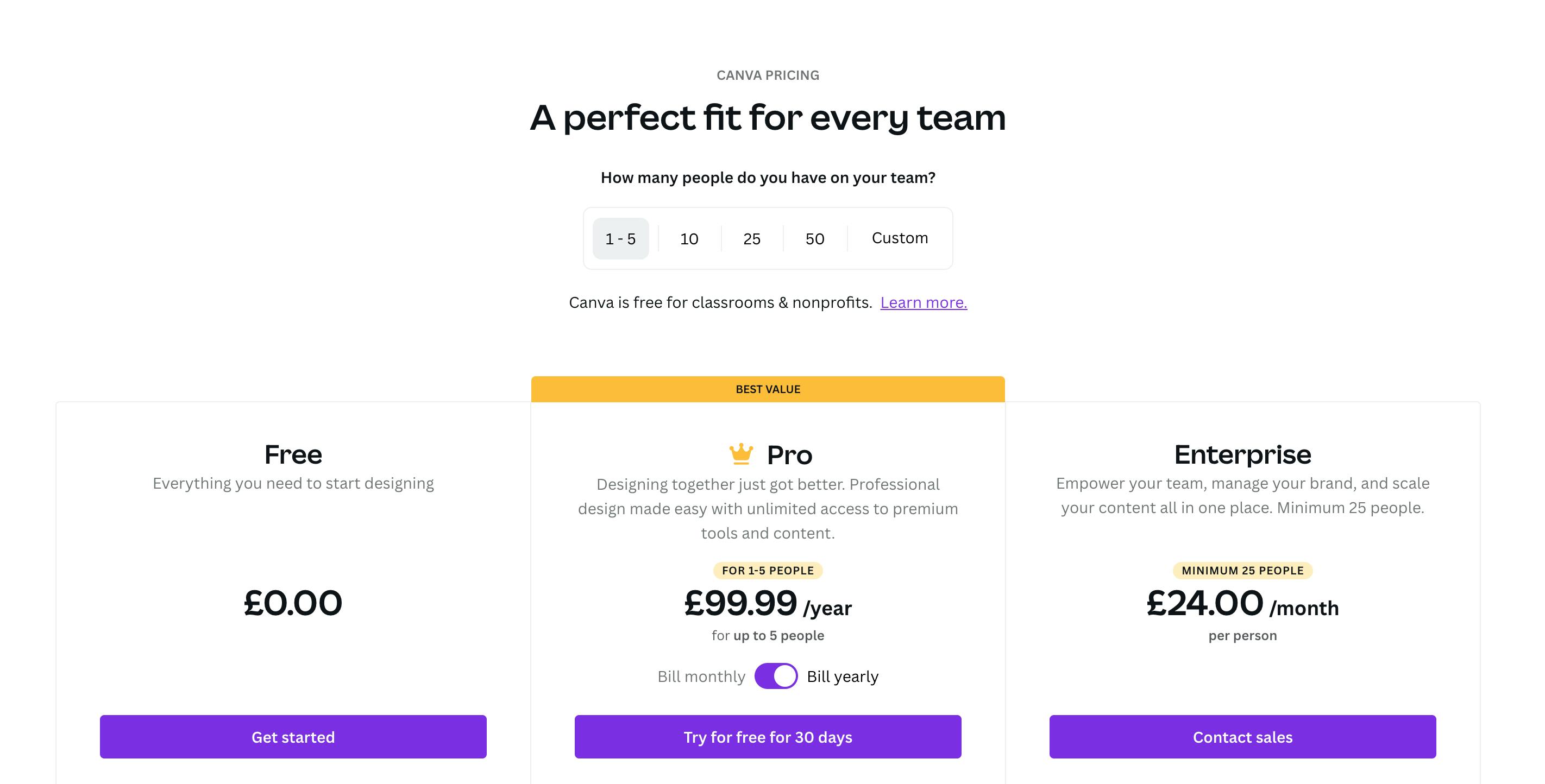

The online graphic design tool Canva offers a per-user option among its other pricing options. For $30 per user per month, this includes all features from the Pro model, with access for every user on a team.

5. Per-active-user pricing

What is per-active-user pricing?

This is where you charge customers based on how active they are. It doesn't matter how many users are enrolled, you’ll only charge the customer based on the ones who actually use your product. Typically, this means charging for users who have logged in during the last 30 days.

Pros of the per-active-user model

- Customers don't have to waste money on inactive users.

- Easier decision for enterprise companies to roll out your product company-wide – as they only pay if it works.

Cons of the per-active-user model

- Bad fit for small businesses as it doesn't give much incentive when teams are small.

- Can be more complicated when compared to per-user pricing – especially in how to define ‘active user’

- It doesn’t fit well with annual price plans, as customers can perceive it as wasteful if the service does not get much use.

Who is per-active-user pricing a good fit for?

If you’ve had problems convincing customers to onboard with your per-user model, then a shift to the less risky per-active user pricing model could spur them to take the leap.

Per-active-user pricing in action

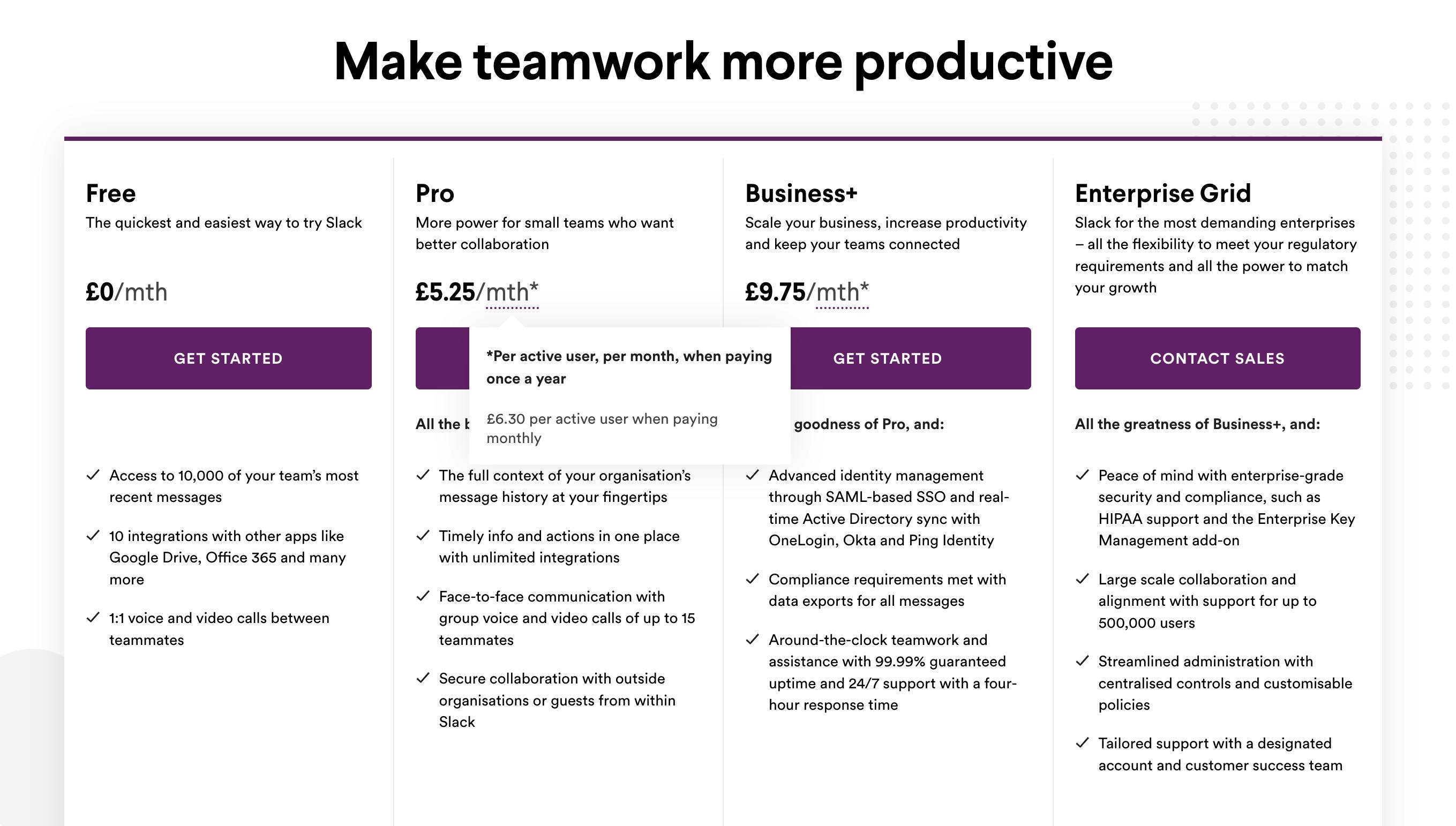

Cloud-based messaging platform Slack is a well-known example of a SaaS company succeeding with the per-active-user pricing model.

6. Per-feature pricing

What is per-feature pricing

Users aren't the only variable used to determine SaaS pricing models. As the name suggests, the per feature pricing model uses features to determine price.

Typically, this involves creating different packages and listing all the features contained in each one. Customers pay more when they need more features.

Common package names could be Standard, Pro, Advanced, or similar.

Pros of per-feature pricing

- Aids upsell – Provides a strong incentive for customers to upgrade to the next level, in order to access more features

- Clear package differentiation – Allows you to deliver high resource features as part of your top tier packages

Cons of per-feature pricing

- Customer frustration – More potential for dissatisfied customers, because they're missing out on some functionality despite paying the fee

- Research intensive to get right – Can be challenging to decide which features to include in each package – needs detailed research to know what each type of customer wants

Who is per-feature pricing a good fit for?

Per-feature pricing is a versatile model. But it works best for SaaS businesses that have taken the time to clearly map each set of features to a specific customer persona. If all your features are a great fit for all customers, you’ll lose out on the benefits of the per-feature pricing model.

Per-feature pricing in action

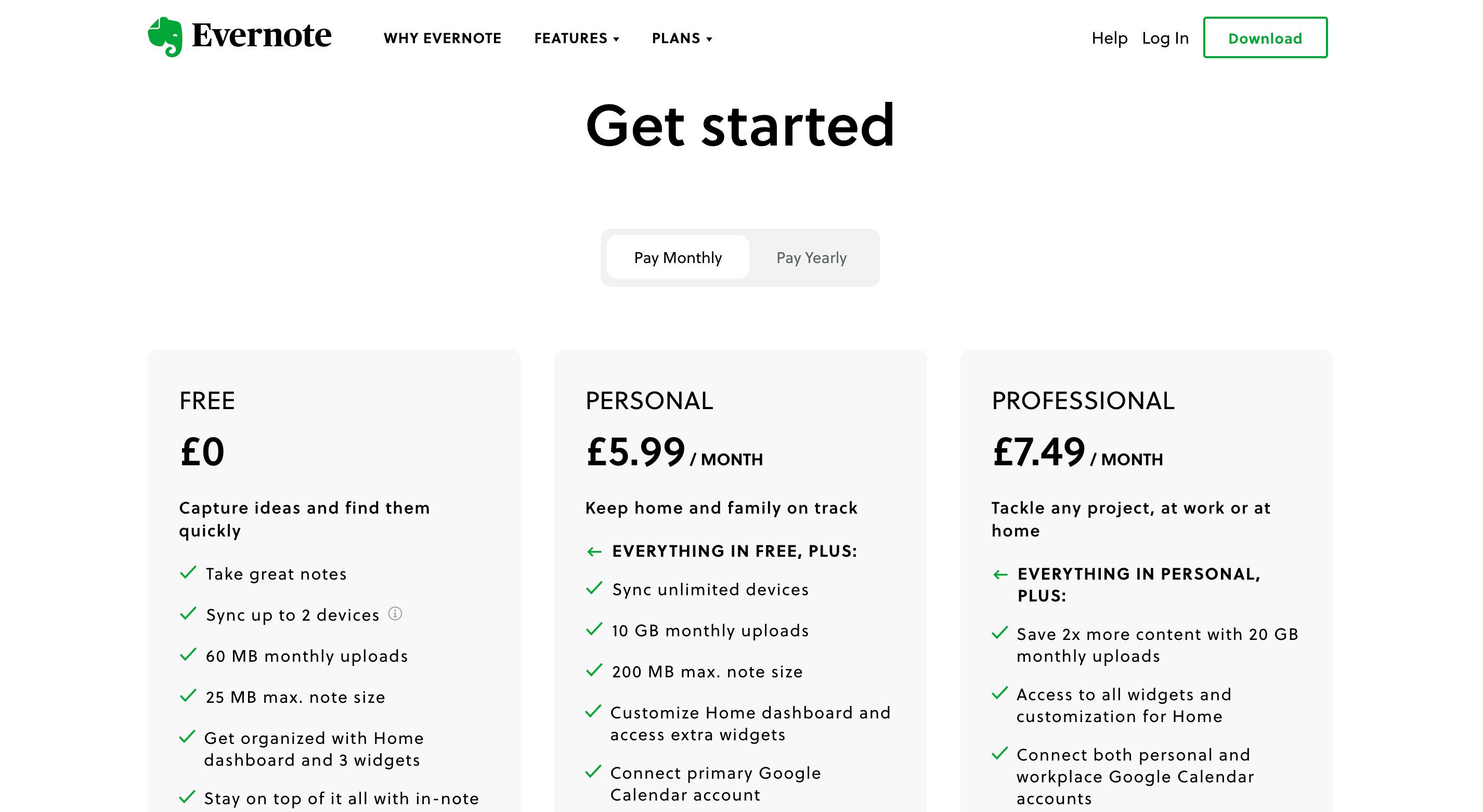

Note-taking tool Evernote offers Basic, Plus, and Premium plans, with different features unlocked at each level.

7. Freemium pricing

What is freemium pricing?

This one is normally used as a gateway to additional paid packages. The freemium tier represents the entry-level, with users regularly incentivized to upgrade to a paid tier.

For example, you might have a pop-up box when they try to use a feature that's not available in the freemium tier. Evernote uses this approach.

The free tier usually has limitations on features, capacity, or types of use cases.

Pros of the freemium pricing model

- Reduced barrier to adoption – users love to try a new service without having to first enter their credit card details.

- Build a large customer database – freemium users can be a great source of emails for your list, to help you build relationships with them going forward

- Product validation – Great way to test new features on different customer personas

Cons of the freemium pricing model

- Risk of resource drain – constantly serving freemium users can be an unnecessary drain on your resources, with no revenue to show for it.

- Difficult to establish value – people love getting free things and may sometimes prefer to stick to freemium forever.

Who is the freemium pricing model a good fit for?

It's great for new SaaS businesses that need to raise awareness of their product. An excellent free tool can quickly go viral on social media, leading to widespread buzz and more chances of paid signups.

Freemium pricing in action

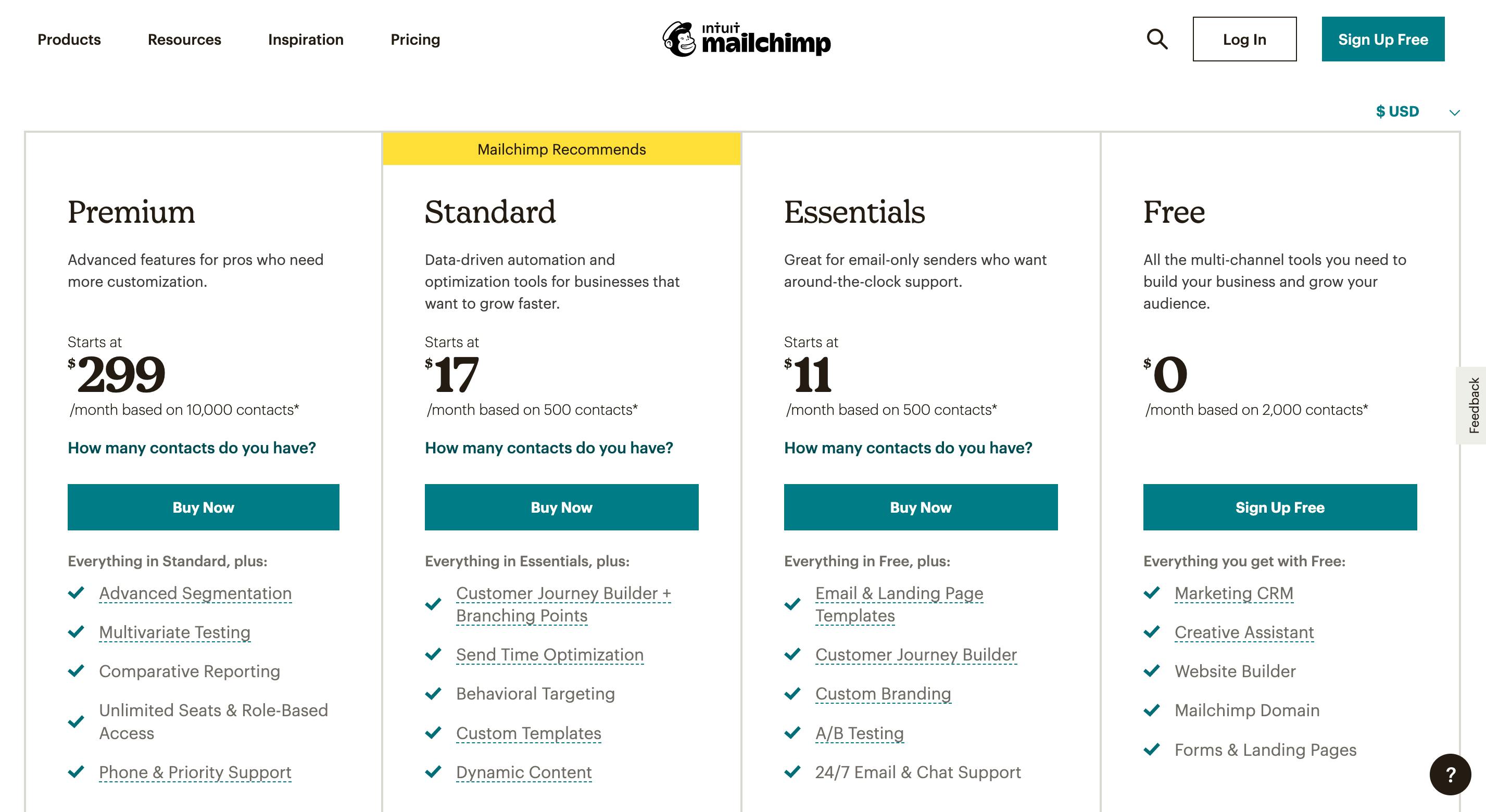

MailChimp is a popular email marketing platform with a generous freemium offering. Users can get started easily, with enough free functionality to get them up and running. Once their email list grows beyond 2000 subscribers, they can upgrade to the first paid tier to access more features.

4 successful companies that crushed their SaaS pricing strategies

You might be tempted to ask which pricing model is the best, but there’s no silver bullet here. Different pricing models work best for different companies and different customer types—it’s only through following your pricing process and analyzing customer data that you can uncover the best pricing model for your company.

To help you out, let’s take a look at four different companies that are crushing it with their pricing strategies—you’ll no doubt find some inspiration you can apply to your own pricing.

Slack

Now, Slack combines two different pricing models, charging per seat but also giving customers multiple tiers to choose from. New buyers have a choice of three tiers, and each tier unlocks additional functionality:

- The Free plan includes unlimited seats but restricts message history and the number of integrations.

- The Standard plan lifts the restrictions on message history and integrations but excludes enterprise services like single sign-on.

- The Plus plan gives enterprise customers the whole shebang for the highest price.

Likewise, Slack also knows that for larger teams—say, 50 to 100 people—enterprise features like single sign-on and compliance reports become essential, which Slack provides through their Plus tier.

You can read more about Slack’s “holy grail” of SaaS pricing in our Pricing Page Teardown—it’s one of the strongest pricing strategies we've come across.

Hubspot

Aligning your pricing tiers with your value metric isn’t the only thing to consider when setting your pricing—you should also try to align your pricing tiers with buyer personas, something HubSpot nails with their pricing strategy.

Check out more on HubSpot's pricing strategy in our Pricing Page Teardown.

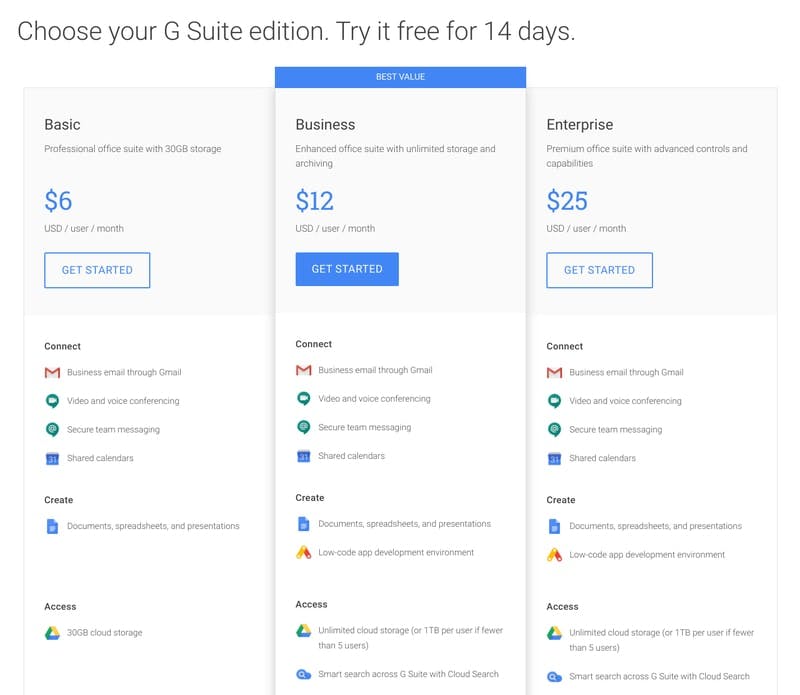

G Suite

Like Slack, Google's G Suite product intentionally keeps its pricing straightforward and easy to digest.

Google’s tandem approach of per-seat pricing and value-based tiers makes sense, given their target market. Keeping prices affordable helps boost acquisition and lock in customers, with plenty of options for expansion as companies (and their business needs) continue to grow.

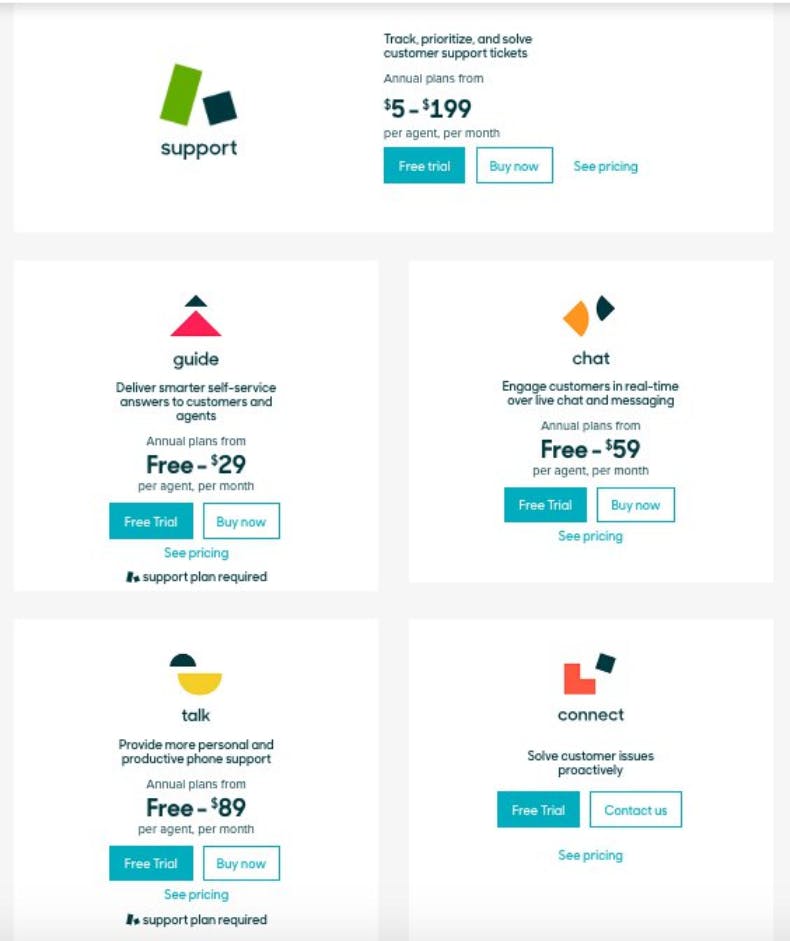

Zendesk

Sitting at the opposite end of the spectrum from Google, Zendesk’s suite of customer experience products offers up a range of challenges around pricing.

Check out our Pricing Page Teardown for more info on Zendesk’s pricing strategy.

How to change your SaaS pricing model

In a fast-changing space like SaaS, customer needs, competitor offerings, and technology itself are constantly evolving. Customers switch easily from one product to another. Your pricing approach needs to reflect the speed of these changes. You need to regularly re-evaluate your pricing approach and make changes, ideally every six months.

Here are some signs it's time to shake it up:

- It's been a while. This one goes without saying – if you haven't changed your prices since you launched, then you’ll probably need to catch up with your competition.

- Customers don't negotiate. If customers happily pay your prices without a murmur, you should probably raise those prices. If customers keep telling you what a great bargain they're getting, even more so.

- You’ve added new features. If you’ve added new features to your offering, it's time to update the price to reflect that. Otherwise, you risk wasting the time and energy involved in developing those features.

- You can prove you give great ROI. If your offering provides an especially high level of value to your customers, then make sure you price it with that in mind.

Be gentle with existing customers when it comes to big price increases. Instead, consider offering legacy rates for a time in recognition of their early adoption, or raising your new rates gradually over time.

There will always be some customers who won't be happy about a price hike. To handle this, prepare a clear and honest response explaining the decision from the perspective of the value your products bring.

If you're feeling extra cautious, you could try testing new pricing models with a smaller segment of your existing customers, rather than everyone at the same time.

No matter which pricing approach you decide to take, always keep in mind your unique relationship with your customers and be guided by what makes the most sense for them.

Your pricing is too important to neglect

Whether you’re a large or small SaaS business, it never hurts to take a second look at pricing. If you haven't ever optimized your product/service’s pricing for your target/current customer base, you have room to grow.

If you take only three things away from this guide, remember these key pricing points:

- Always, always charge based on value - no excuses. It’s far and away the optimum strategy for SaaS companies.

- Target the right buyers. Make sure your pricing tiers line up with your ideal customers.

- Don’t complicate things. Keep your pricing structure simple for better acquisition.

If you’re looking to get started on improving your SaaS pricing, we provide free subscription metrics to help you identify opportunities and have other tools to help you reduce churn, optimize pricing, and grow your subscription business end-to-end.