Any subscription business has some sort of Revenue backlog which affects deferred revenue. How do modern SaaS subscription companies treat this backlog?

One thing that can make operating a SaaS company tricky is the number of different revenue types you have to keep track of. And one of the types that a lot of companies miss is revenue backlog: the total unrecognized revenue across the term of a given subscription agreement.

It’s not a glamour statistic—it doesn’t show up on financial statements. In fact, it’s not recorded in any meaningful way that’s comparable to other revenue statistics (particularly deferred revenue, which it’s often confused with).

That’s no reason to sleep on it, though. Revenue backlog is beloved by investors for the picture it paints of your business’ future, and it can be a useful way of providing commentary on your company’s commercial trajectory.

What is revenue backlog?

Revenue backlog is unrecognized revenue from a subscription business. For SaaS businesses, the revenue backlog often comes predominantly from recurring revenue but can also include revenue from other sources (including investment) or one-time product sales.

Revenue backlog is commonly confused with deferred revenue. Deferred revenue refers expressly to individual periods within a contract. Revenue backlog is about total contract value, regardless of what’s been fulfilled and what hasn’t.

Revenue backlog is not a reporting number and will not appear on a company balance sheet, but many organizations include it when reporting to senior management and boards owing to the fact that, as we’ve just noted, it showcases the cumulative value of all contracts that your business model can command.

Your backlog comprises revenue totals that customers have agreed to pay but aren’t to be invoiced as such due to their long-term nature—those invoices are only sent as the separate periods of the service you provide (weeks/months/quarters) are individually fulfilled.

Why revenue backlog matters

The contents of your backlog paint a picture of how you’re winning and fulfilling new business. By monitoring the backlog, you can monitor the relationship among the quantity of new business, timelines of delivery, and the number of items in your backlog.

Let’s say Company A has an ideal backlog situation. What would that look like? Well, an ideal backlog is one that stays roughly the same in size even as the amount of new business and the rate of delivery both increase. This steadiness suggests that you’re getting a lot more new business but fulfilling a proportionately higher amount of business, too, to keep up with demand.

Company B has a smaller backlog by comparison. This may suggest that its sales team is not pulling in enough new business, or it might just suggest that it's running a real tight ship and plowing through its backlog with high prioritization.

However, your backlog should not trend upward for a prolonged period of time either, like it has with Company C. In its case, the plentiful supply of new business it's winning is starting to compound, as the company as a whole is finding it hard to deliver on time. It’s a situation that’s prone to get out of hand—resulting in resources being stretched too thin, overworked employees, and a decline in the quality of work.

This is why you should consider backlog when forming a sales strategy (including quotas and commission structures); it’s a whole-company concern, and if improperly managed can send shockwaves through the company.

How do SaaS subscription companies classify a revenue backlog?

Keeping tabs on any metric requires that it be classified in the correct way. Your revenue backlog should be classified like so:

It’s not recorded

When we say “not recorded,” we mean that revenue backlogs are not classified or recorded in the same way as other metrics related to revenue, mainly because a public company doesn’t need to record a revenue backlog in a balance sheet. Revenue backlog bears no imprint on your bottom line, so the way in which you choose to keep track of it can be entirely informal.

It’s not invoiced

Revenue backlog has only internal significance for your company and signifies the value of a contract irrespective of the time frame of use. At no point during the lifecycle of a customer’s contract will you be sharing any details of revenue backlog with them, so there’s no need to include a revenue backlog in invoicing documents.

It’s not fulfilled, yet

We’ll go into more detail on the notorious backlog/deferred revenue beef in just a moment, but one thing that the two terms do have in common is that they both refer to unearned revenue—the revenue they make note of is a liability to be fulfilled at a later date upon the provision of the service/product in question.

If there is revenue in your backlog, it means that you haven’t delivered on your goods yet. All revenue backlog counts as unfulfilled.

Why not just use deferred revenue?

One more time: Revenue backlog is not the same thing as deferred revenue. To treat your backlog and your deferred revenue as one and the same undercuts the possible extent of your company’s future value.

What’s the difference exactly?

Deferred revenue can go up and down

- Deferred revenue is dynamic and can either increase or decrease depending on how and when you invoice your customers.

- A revenue backlog, on the other hand, only counts down. As no invoices are involved, your backlog simply and straightforwardly declines over time as the revenue is recognized.

Deferred revenue starts once the invoice is received

- Deferred revenue starts once your customer receives their invoice.

- A revenue backlog, on the other hand, starts the moment in which a contract is agreed on, which is often sometime before the beginning of the invoicing period.

Revenue backlogs are more for commentary

- Deferred revenue is an official metric that features heavily on a balance sheet and is central to financial reporting.

- Revenue backlogs are meant more for commentary on a financial document, with particular respect to things like revenue forecasting and financial predictions for coming years. (This is why senior management and stakeholders are such fans of this ‘unofficial’ statistic).

How revenue backlog helps with your business valuation

All this can make revenue backlog seem like an interesting, if fairly minor, statistic, not really worth the time of an overworked data team. However, revenue backlog can really make all the difference when it comes to SaaS valuation.

Having a firm handle on your backlog can make the key difference between a good and a bad valuation. When valuating your business, one of the first things buyers are going to be looking at is your ability to fulfill the value of the contracts you’re signing, compared to your stated aims. The easiest way to do this is to observe the difference between your revenue target and your backlog.

Still, you could just use deferred revenue for this, right? Wrong. Because revenue backlog does not fluctuate in the way that deferred revenue does, buyers often prefer to use it to evaluate the performance thus far of your business and gauge the amount of risk in your revenue forecast. It gives a far more total overview of your approach to new business, financial management, and even your philosophy on managing customer relationships across a lifetime.

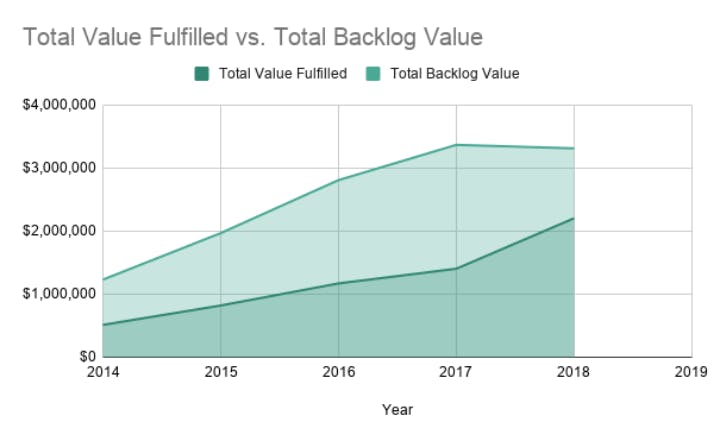

This graph paints a positive picture of the company in question to stakeholders and investors. They have managed their fulfilled revenue (i.e., their actual provision of service) against their backlog (i.e., the total value of yet-to-be-provided service) well enough that the two figures have remained in mostly the same proportion, even while plenty of new business has come in and the company has grown. The numbers have grown closer at the end of year four—perhaps there were few customers churning at the end of this time or slightly fewer customers being brought on board.

In the words of Jeff Brown:

“A comprehensive understanding of the backlog sends the right messages about your financial management of the business. Portraying backlog in accurate detail supports significantly stronger valuations.”

Conclusion

The lesson in your revenue backlog concerns the value of seemingly small things—how that one unfancied statistic can, if treated right, really show off where your company’s going. It’s understandable if it’s not right at the top of your revenue recognition priorities list, but as a way of getting a broader view of what’s up ahead, it has its usefulness. Just make sure you don’t mix it up with deferred revenue.