Product-led growth (PLG) is now prominent across SaaS businesses at all stages, including:

- Startups launching PLG from day-one of their business,

- Scale-ups doubling down on PLG to build a moat, strengthen their audience, and increase efficiency,

- And traditionally sales-led enterprises adding a PLG motion to fend off the competition downmarket or to quickly and easily enter into new territories.

And, when you look at the data, it’s easy to see why:

- Companies with a PLG motion grew 7.2% more than others in 2021.

- The cumulative value of PLG companies in the Bessemer Cloud Index has grown more than 100x in the last 6 years.

- 83% of public SaaS firms that reached $100M ARR in their first five years had a PLG motion (Source: 645 Ventures).

The TL:DR? If you don’t have a PLG motion in your SaaS business, you risk being disrupted by the next competitor that does.

With that in mind, we looked at the data from 25k+ SaaS companies generating $30 billion ARR to look at what makes a successful PLG motion and how SaaS businesses can level up in 2023.

PLG fundamentals: PLG = Selling internationally

Whatever your business stage, there are some fundamentals that should underpin your approach to PLG.

The first is that the focus of any PLG motion is on the customer buying – not you selling. And for that to work in practice:

- The product must sell itself, this usually means starting at a low price point.

- To make money at a low price, you need to sell lots of copies.

- To sell lots of copies, you need to be global.

But building a product with a solid market fit, selling it at the right price point, and staying compliant globally is no easy task.

Let’s take a look at how to get it right.

5 ways to level up your PLG strategy

1. Optimize for acquisition with a hybrid model

While it’s called product-led, SaaS go-to-market strategies almost always include a hybrid sales motion.

That is, either a business starts product-led (with a self-serve checkout) and then hires sales teams and implements enterprise payment methods like invoicing as they sell upmarket. Or it starts with an outbound sales team and a self-serve checkout comes later to help attract more customers downmarket.

Either way, we aren’t saying goodbye to sales teams just yet.

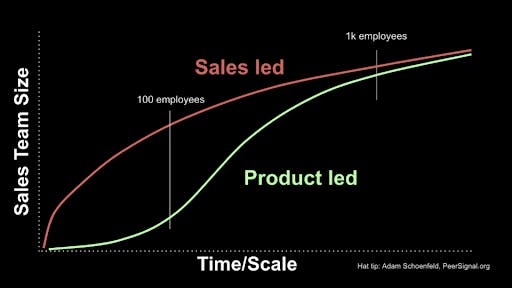

Data from Adam Schoenfeld at Peersignal shows that at sales-led companies with 100 employees sales teams are much larger but by the time you get to 1000 employees, sales teams in businesses that started out as purely product-led have almost caught up.

(Source: PeerSignal data)

This means that, however you start, you're going to need those two sales motions to work alongside each other at some point.

The problem is that when you have self-serve and sales-assisted processes, things quickly become complicated. Why? Because now you've likely got two sets of systems and processes for managing these sales and customers and two sets of user and revenue data.

With a hybrid motion an almost certainty, it’s critical to choose tools that can help you create a single source of truth for this data early on – so it doesn’t become a blocker later down the line.

2. Count payments as part of your product offering

For a product-led company, your product offering is everything. What’s often overlooked is the part that payments play in that and how - as a major part of your acquisition journey - you need dedicated people and resources to make payment processes friction-free.

Let’s take free trials as an example. If you offer a free trial and ask for credit card details to access that trial, you’re pushing people through the buyer journey. But if you don’t optimize that workflow for global payment methods, you can expect a 15% drop-off on conversions.

This might not seem like an issue at first but as we’ve said, whether intentional or not, product-led = international. As such, these complexities happen much earlier in the business lifecycle than you’d expect. So think of payments as part of your product experience, and assign a product team to it.

3. Fix the leaks in your funnel

Once you have the resource, you can get to work fixing your leaky funnel. Delinquent (or involuntary) churn makes up anywhere between 20% and 40% of your overall churn rate. That’s people who don’t actually want or mean to stop being your customer.

The biggest cause of delinquent churn? Payment failure.

Optimizing your payment and billing processes to reduce payment failure is crucial for keeping your churn rate down (and your revenue up).

There are many reasons a payment can fail, be it insufficient funds, card-not-present (CNP) transactions, or difficulties with cross-border payments. Whatever the reason, the result is the same, lost revenue. Looking at your business’ payment failures and seeing which reasons are causing the leaks in your funnel will help you find the right (or most impactful) fix.

Here are some examples and how to fix them:

Reason #1: Insufficient funds

When the customer’s account or credit card doesn’t have enough funds to cover the payment. Particularly common for payments made by credit card where there are spending limits in place.

What you can do about it:

- Retry the payments, ideally using smart technology to do so at a time when it’s more likely to be successful.

- Offer payment methods that can draw on multiple sources of funds (like PayPal) or that take payment from a bank account so that credit limits aren’t an issue (like ACH Debit).

Reason #2: Cross border transactions

Cross border payments have longer payment chains and are reliant on the relationships between banks. With no standard approach for sharing information between banks, there is more chance that these payments will fail due to different messaging standards.

What you can do about it:

- Bank locally where your customers are based (or use a payment provider that already has local banking relationships). With the acquiring bank (the bank that requests funds) and issuing bank (your customers’ bank connected to the card scheme) in the same country, payments are more likely to be successful.

Reason #3: Currency conversion

Adding the complexity of currency conversion in the payment process creates another step in the payment chain, and more potential fraud triggers.

What you can do about it:

- Sell to customers in their local currency. Paddle data shows that, depending on the market, selling in your customers local currency increases payment acceptance rates by 1% to 11%.

Read more about why SaaS payments fail and what you can do about it.

4. Deliver value through content and community

If PLG is about the customer buying, then the onus is on businesses to provide pre-sale value. That is, to help prospects understand what value you offer up front, before they sign-up, and without speaking to your team.

Here, content and community becomes the secret to success.

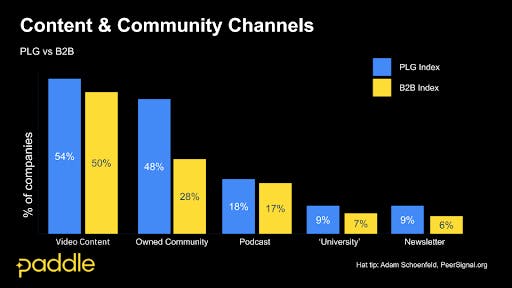

Using PeerSignal data below, you can see how PLG and B2B SaaS companies are using content and media to build up that brand awareness, engage with, and provide value for a global audience before they ever go through that product experience.

Now is a great time to build out your content and media strategy as people look for helpful content and community answers in light of the recession. Adding value and offering help now, will help you convert more customers in the short-term, and ensure you’re top of mind later for those who aren’t yet ready to buy.

5. Get your pricing right

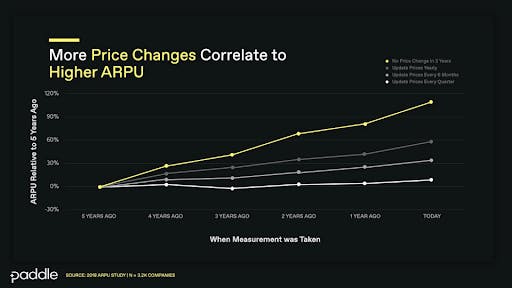

SaaS businesses on the whole aren’t good at updating their pricing regularly. Yet research shows that those who do grow more quickly and have a higher average revenue per user (ARPU).

When you’re reviewing your pricing, remember that product-led = international. Here, there are two strategies to consider:

- Cosmetic localization: Displaying prices in local currencies.

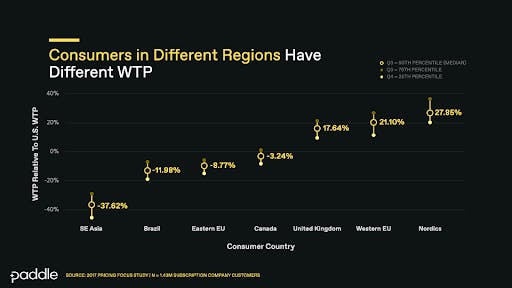

- True localization: Changing your pricing based on willingness to pay (WTP) in different markets. Here, you should research the buying conventions and competitive landscape in the markets you sell — or want to sell — into, to determine how best to price your products in each region.

Both will make a difference but true localization will yield the biggest results. The data below tells us why. How much customers are willing to pay varies greatly across different markets.

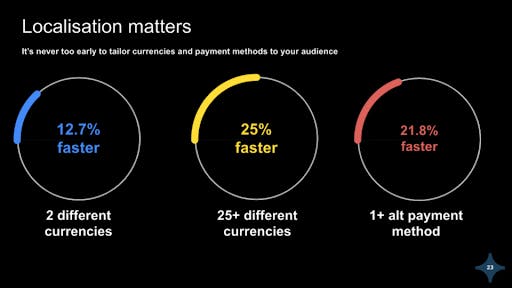

As does how they are willing to pay it. At Paddle, we see that companies allowing their customers to pay in their local currency, with a preferred payment method, grow more quickly:

How much investment you want to put into your pricing and particularly pricing localization is likely to depend on your product, customers, and business stage - we’ve got more advice on what to do when, here.