ACV and ARR can be confusing SaaS subscription metrics. We explain how they compare and what SaaS subscription businesses can use them for.

There are so many SaaS acronyms used daily—LTV, CAC, MRR, ARR, ROI, ARPU— it can be difficult to keep them all straight.

Annual recurring revenue, or ARR, is a commonly-used SaaS term, and for good reason. It’s a momentum metric. There’s also ACV, which stands for “annual contract value.” With dozens of SaaS acronyms, ACV tends to get lost in the mix.

Looking to supercharge your growth? Watch our webinar on revenue metrics in 2023

ACV and ARR seem similar, but they have some big differences. Below we explain the differences, how to calculate them, and some other metrics you should also be tracking.

ACV vs ARR, what’s the difference?

ARR reveals how much recurring revenue you can expect based on yearly subscriptions. ACV, on the other hand, is the value of subscription revenue from each contracted customer, normalized across a year.

Your company should track ARR to measure overall growth and how much revenue you can expect in a year. It’s common to examine ARR on a company basis to gauge size. While ARR measures the value of recurring revenue at a single point in time, ACV normalizes that revenue across one or more years.

ACV looks at one customer in particular and sees what the expected payout over a year is. For example, if a customer signs a multi-year contract, e.g. a five-year deal with you for $50,000, then your ACV for a single year would be $10,000.

Comparing ACV and ARR in action

Now you know what ACV and ARR track, let’s break them down with an example.

Let’s say you have three customers

- Customer A pays $500/year for 1 year

- Customer B pays $400/year for 2 years

- Customer C pays $300/year for 3 years

Calculating ACV

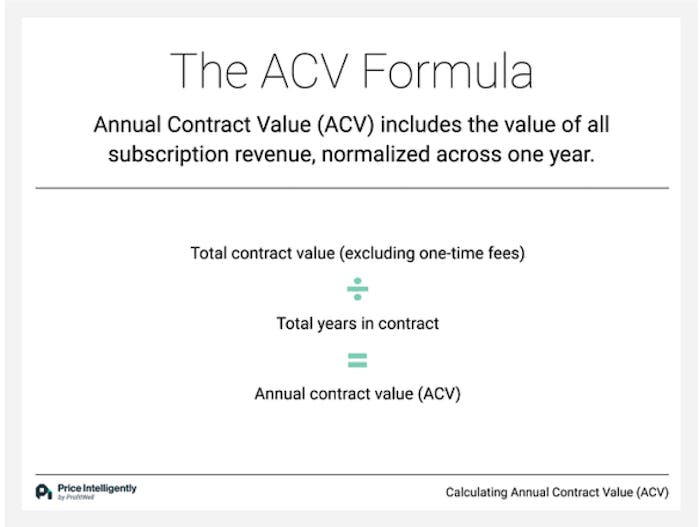

The basic formula for ACV is fairly simple. It’s the total contract value (excluding one-time fees) divided by the total years in the contract).

Let’s break it down year-by-year.

All three customers are paying you in this first year. Your ACV for year one is $400. Here’s how I got that number:

Year 1: ($500 + $400 + $300) / 3 = $400

Your ACV for year two goes down to $350 because you have fewer customers. Here’s the calculation:

Year 2: ($400 + $300) / 2 = $350

Your ACV is even lower by the third year because you only have one customer left on the contract. Here are the numbers:

Year 3: $300 / 1 = $300

Calculating ARR

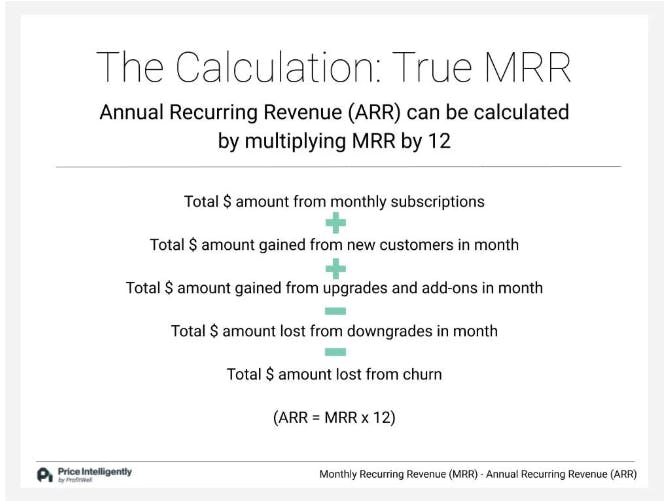

The formula for ARR is equally simple.

ARR = (overall subscription cost per year + recurring revenue from add-ons or upgrades) - revenue lost from cancellations. Unlike ACV, no dividing is necessary when calculating ARR.

Your ARR for year one is $1,200 because it’s a summation of what each customer paid you.

Year 1: $500 + $400 + $300 = $1200

Year 2 is also a summation but is only $700 because you have one less customer this year.

Year 2: $400 + $300 = $700

Finally, there’s not much math left for year 3 because there’s only one customer to account for.

Year 3: $300 = $300

Since ARR is a momentum metric, it has to remain as pure as possible.

With that, you need to include these factors when calculating ARR:

- Customer revenue per year

- Add-on purchases

- Product upgrades

- Product downgrades

- Cancellations (churn)

When should you use ACV vs ARR?

Calculating ACV and ARR results in different numbers, so when should you use each metric? To be frank, ACV isn’t a super-useful metric on its own, but pairing it with other SaaS metrics can provide some valuable insights. ARR is something you definitely can and should track on its own. I’ll break down the nuances.

Use ARR to measure year-over-year growth

Tracking ARR provides a high-level overview of your business’ health and helps you calculate the rate at which you need to grow to keep building on your success. Especially as a subscription company, recurring revenue underpins your pricing strategy and business model. Having a solid understanding of your ARR highlights your momentum and compound growth.

With ARR, there’s also monthly recurring revenue or MRR. I’ll break down MRR on its own momentarily. Tracking both MRR and ARR allows you to plan for the short and the long term.

Companies with more than $10M in ARR focus on tracking their recurring annual revenue rather than monthly.

Use ACV over time to measure sales team and customer success performance

While ARR measures growth year-over-year, ACV is used over time to measure the performance of your sales and customer success teams.

Calculating ACV helps inform your strategy and guide how much you should be investing in sales and marketing efforts. Subscription businesses can be successful with either a high or low ACV; however, it’s important to know where your business is aiming. Lower-end ACVs are fine; it just means you’ll need more customers.

4 other subscription metrics to keep an eye on

As I alluded to earlier, there aredozensof subscription acronyms and metrics. Here are the top four that should be consistently on your radar.

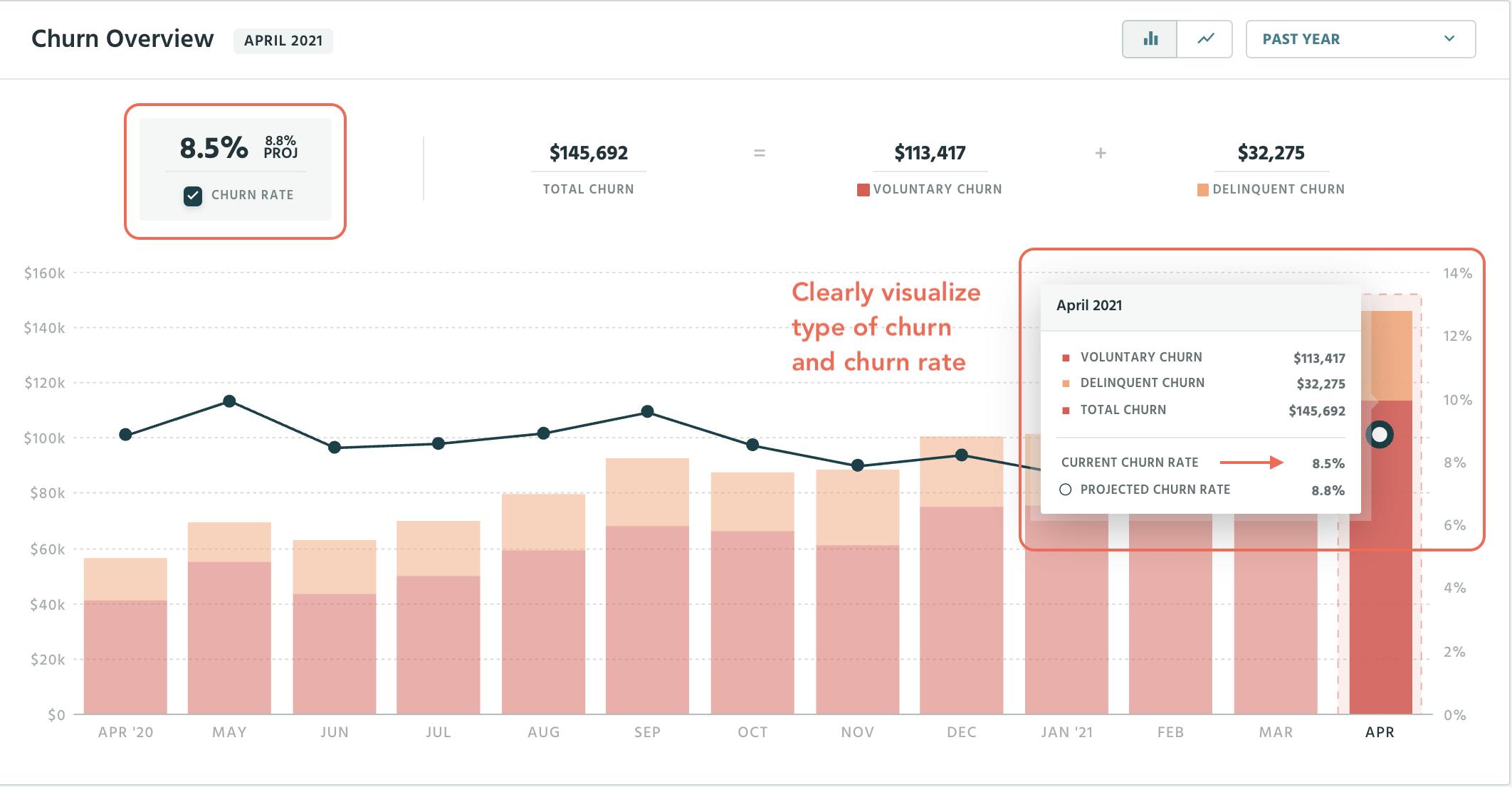

Churn rate

Knowing when churn happens is extremely crucial. Customer churn is a direct reflection of the value of the product and features you’re offering to customers—making churn rate a valuable metric to track.

Churn is the percentage of your customers who leave your service over a given period of time divided by the total remaining customers.

Churn rate = number of churned customers/total number of customers

Churn rate is a starting point, not an endpoint. Once you have your churn rate calculated, you need to deep dive into what’s causing it.

MRR

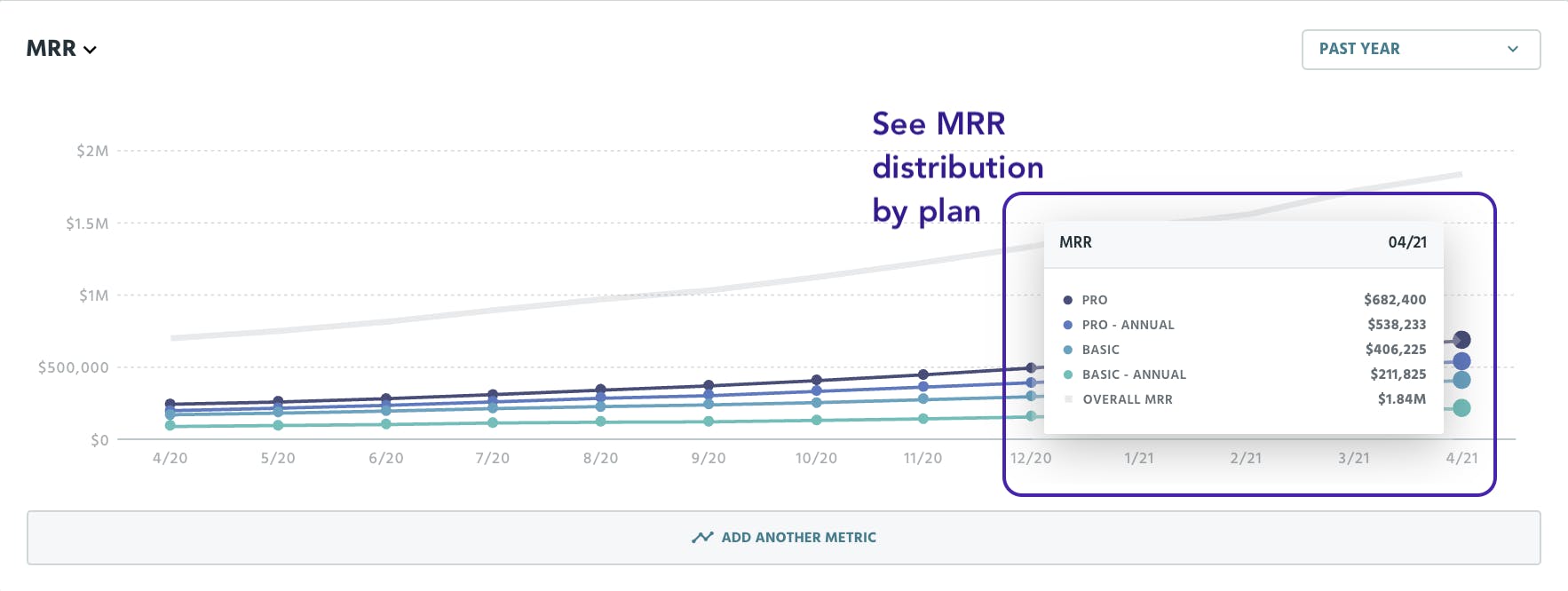

MRR is ARR just broken down on a monthly scale. Tracking MRR is crucial for financial forecasting and planning, AND measuring growth and momentum. You can make accurate financial projections in SaaS largely in part because MRR is consistent and predictable. MRR is a key indicator of the growth of a SaaS company. It’s like putting your growth under a microscope.

You can calculate MRR in four steps:

- Align your data

- Sum up MRR

- Break down by cohort

- Calculate MRR growth

With ProfitWell Metrics, you can clearly attribute MRR by a monthly subscription plan and analyze growth on a plan-by-plan basis:

CAC

CAC, or customer acquisition costs, are the total cost of sales and marketing efforts required to acquire a customer. The challenge with CAC is spending the right amount to drive new customers to your service without jeopardizing LTV (lifetime value). A successful business model means your CAC is significantly lower than LTV.

CAC = (total cost of sales and marketing)/(the number of customers acquired)

For example, if you spend $36,000 to acquire 1,000 customers, your CAC is $36 per customer.

Customer lifetime value

Finally, there’s customer lifetime value. LTV is the total dollar amount you’re likely to receive from an individual customer over the life of their account with your product.

Different LTV models can inform decisions like how much you can pay to acquire a new user, the effects of losing users, and how changes to a product affect the sum-total revenue you can expect to bring in from a user.

It’s an easy metric to look at to see the overall health of a product in terms of revenue and customer retention. A growing LTV means existing customers are happy and you will be giving you more money throughout their relationship with your company. A declining LTV indicates the company is making less from each customer and needs to make some changes.

Let ProfitWell Metrics do all the calculating for you

Operating a SaaS business requires diligence when tracking metrics like ARR, ACV, MRR, CAC, and LTV. You want to focus on retention and reduce churn, while still expanding your business and product. Paddle has a variety of tools that will help ease the confusion and give you revenue updates. With ProfitWell Metrics, by Paddle, you can spend less time calculating and more time growing your business.

ACV vs ARR FAQs

What is the difference between ACV and TCV?

ACV, or annual contract value, normalizes bookings across one year, while a TCV (total contract value) refers to all payments during the contract period.

Why do companies use ARR?

Both startups and established businesses use annual recurring revenue calculations to measure their progress and predict future performance. ARR also helps measure momentum for new contracts, upgrades/upsells, and renewals, but also metrics like churn or downgrades.

What is ARR for SaaS?

Annual recurring revenue (ARR) is a crucial metric for SaaS businesses with term subscription agreements with their customers. SaaS companies calculate ARR to gain insight into their term contracts and how well they are performing annually.